Question

The financial statements of the Town of Fordville consist of a statement of cash receipts and a statement of cash disbursements prepared by the town

The financial statements of the Town of Fordville consist of a statement of cash receipts and a statement of cash disbursements prepared by the town treasurer for each of its three funds: the General Fund, the Road Tax Fund (special revenue fund), and the Sewer Fund (Enterprise fund). As required by state law, the town submits its financial statements to the Office of the State Auditor; however, due to its small size, its financial statements have never had to be audited by an independent auditor. Because of its growing population (nearing 20,000) and increasing financial complexity, the town has hired Emilly Ramirez, who recently obtained her CPA license, to supervise all accounting and financial reporting operations. Having worked two years for a CPA firm in a nearby town, Ms. Ramirez gained limited experience auditing not-for-profit organizations, as well as compiling financial statements for small businesses. Although she has little knowledge of governmental accounting, she is confident that her foundation in business and not-for-profit accounting will enable her to handle the job. Using her experience with not-for-profit organizations, for the year endedd December 31, 2020, Ms. Ramirez prepared the following unaudited financial statements for the Town of Fordville. Assuming the city wants to prepare financial statements in accordance with GASB standards, study the financial statements and answer the questions that follow.

TOWN OF FORDVILLE Balance Sheet December 31, 2020 (unaudited) Assets Cash $1,740 Taxes Receivable $18,555 Investments $7,468 Due from other governments $28,766 Land, buildings, and equipment (net of accumulated depreciation of $132,640) $287,580 Total assets $344,109 Liabilities and Net Assets Accounts payable Due to other governments $3,892 Total liabilities $11,943 Net assets - without donor restrictions $15,835 Net assets - with donor restrictions $299,893 Total net assets $28,381 Total liabilities and net assets $328,274 $344,109

TOWN OF FORDVILLE Statement of Activitites Year Ended December 31, 2020 (unaudited) Revenues Property taxes $121,290 Charges for services $3,580 Sewer fees $6,859 Investment income $239 Total revenues $131,968 Expenses Governement services $115,958 Sewer services $7,227 Miscellaneous $8,462 Total expenses $131,647 Increase in net assets $321 Net assets, January 1, 2020 $327,953 Net assets, December 31, 2020 $328,274

a. What basis of accounting does it appear Ms. Ramirez has used? Explain how you arrived at your answer. b. Given what you know about the town's activities, what financial statements would the town be required to prepare using GASB standards? c. The financial statements presented appear to be most comparable to which two financial statements prepared using GASB standards? Using the information frrom the Financial Reporting Model section of the text and Illustrations A2-1 AND A2-2, explain what modifications would be needed to make the two financial statements conform to the format of the financial statements you have identified.

what other information do you need?

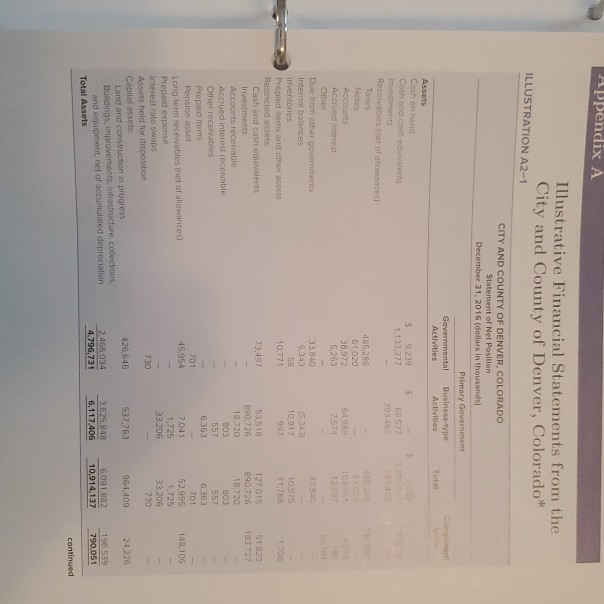

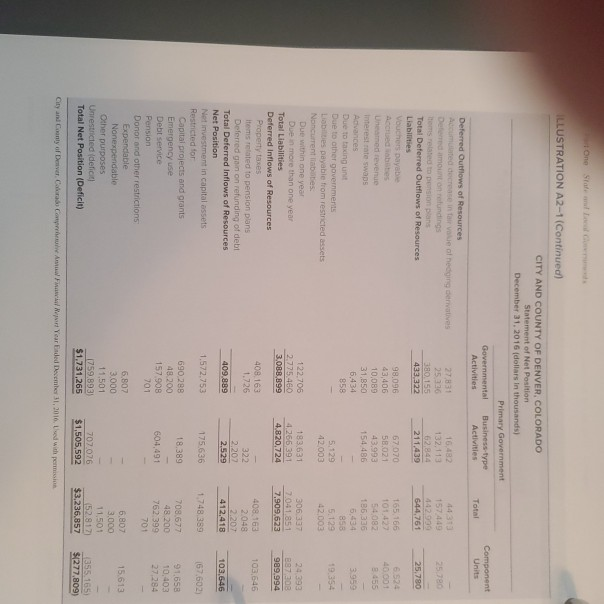

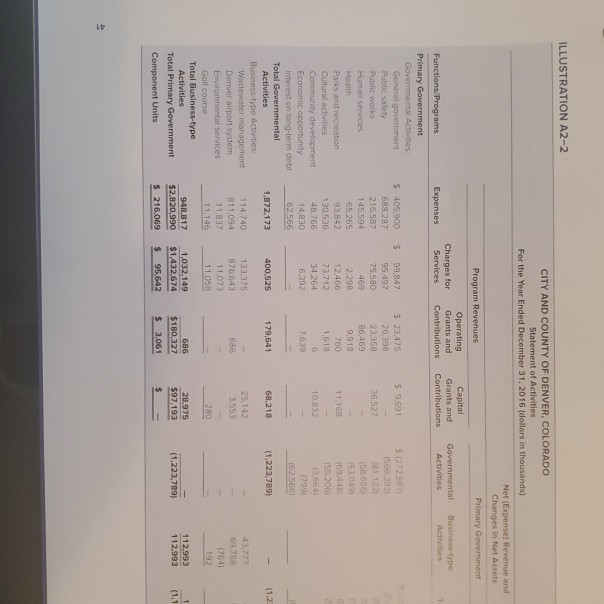

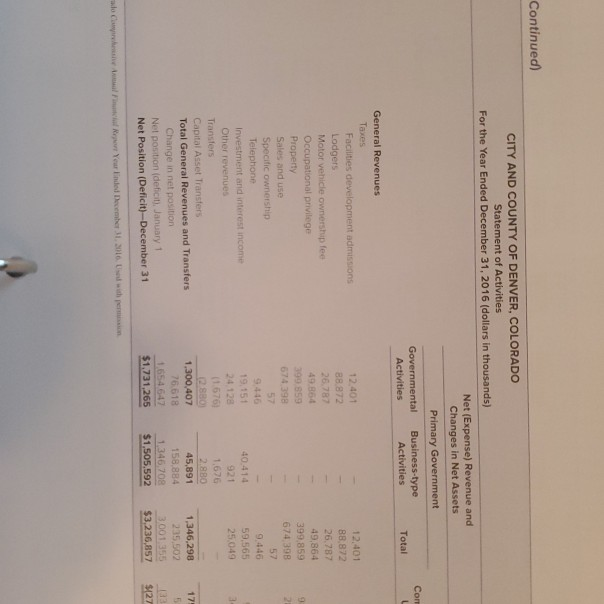

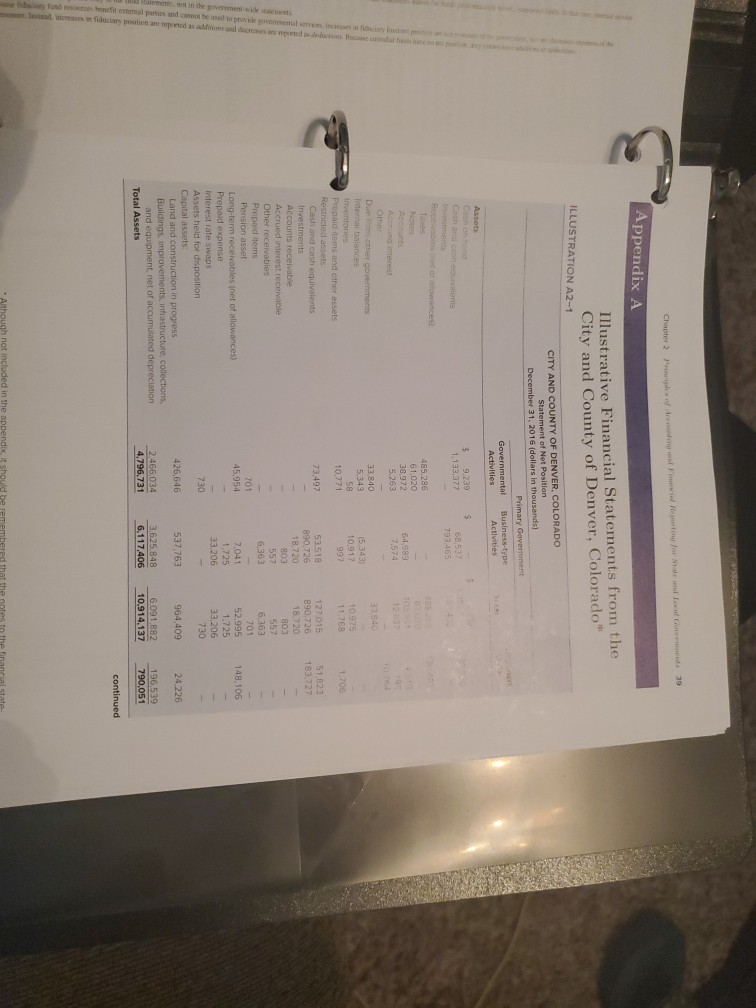

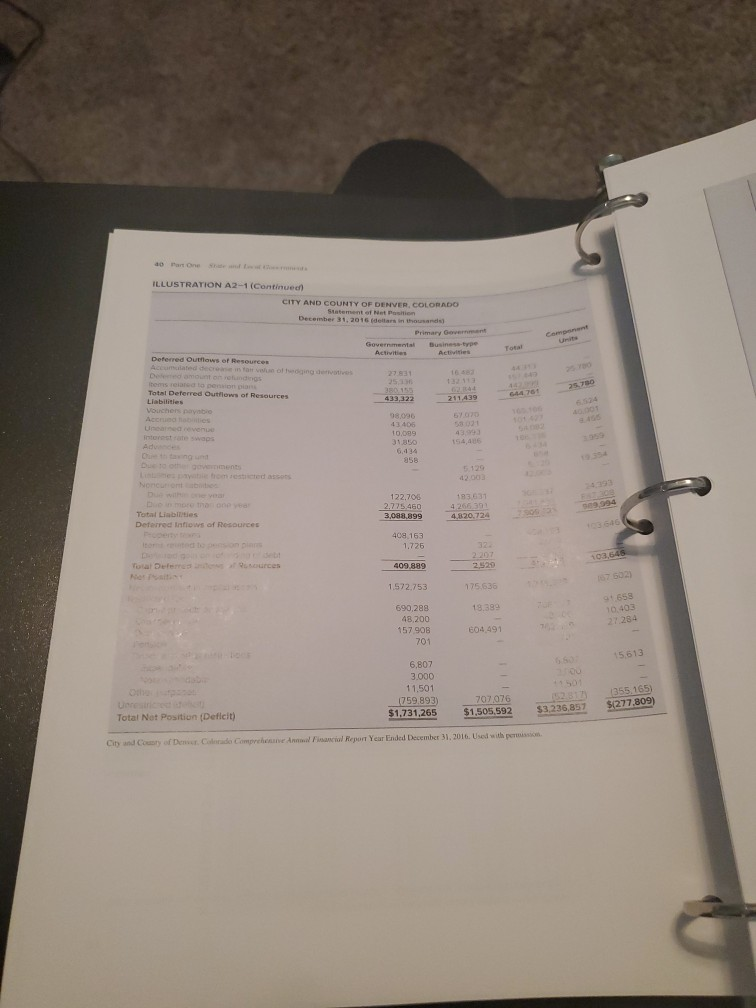

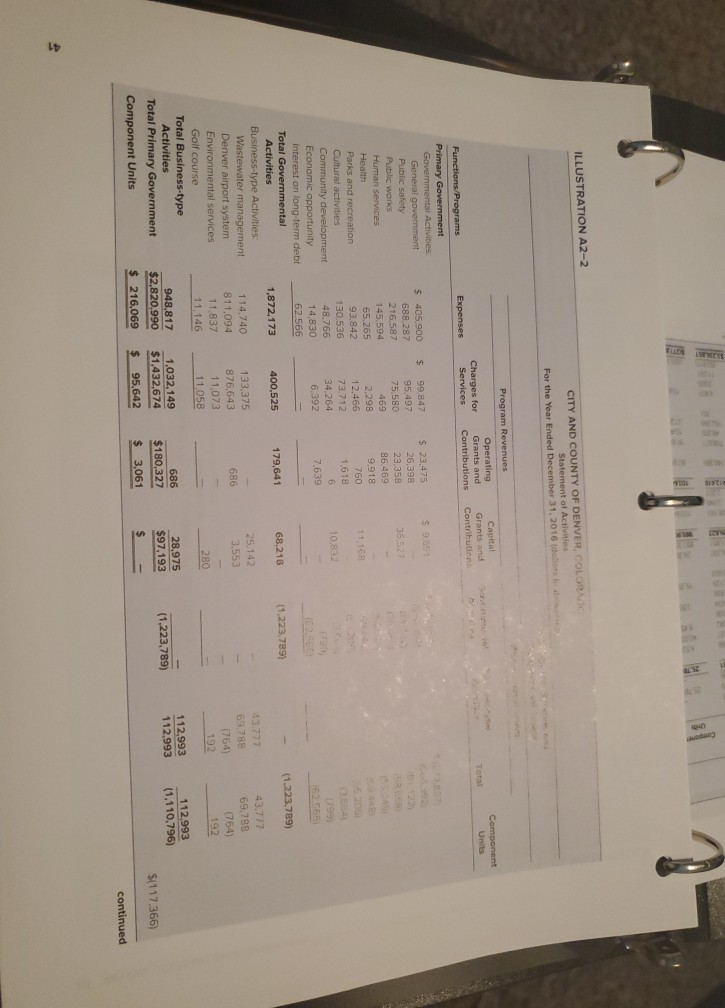

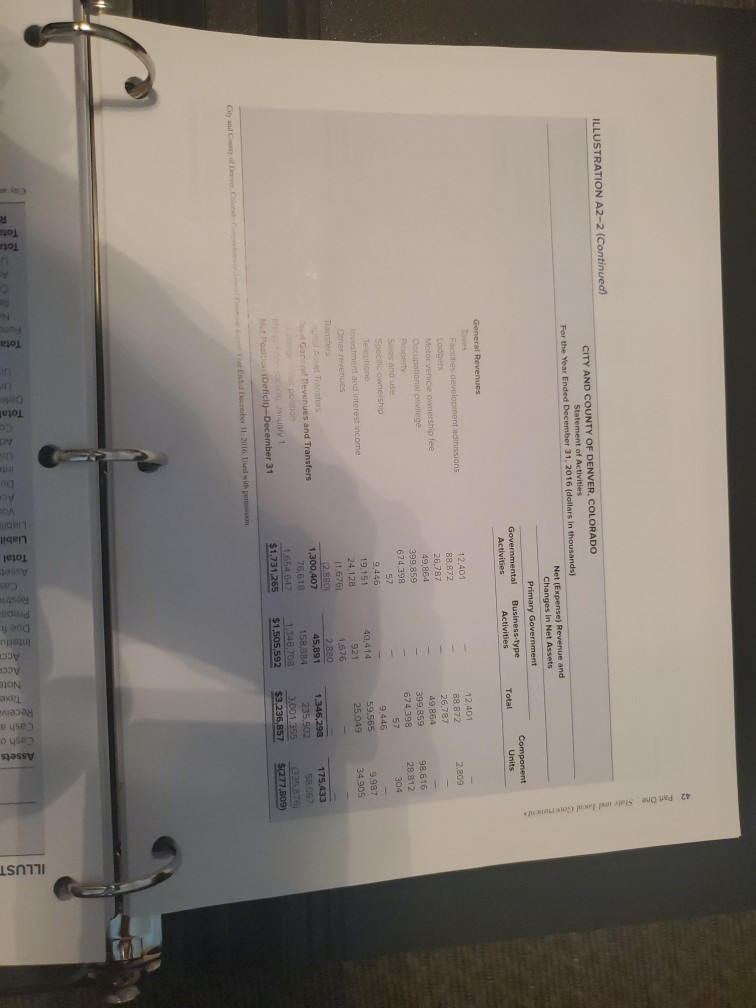

Appendix A Illustrative Financial Statements from the City and County of Denver, Colorado ILLUSTRATION A2-1 CITY AND COUNTY OF DENVER, COLORADO Statement of Net Position December 31, 2016 (dollars in thousands) Primary Government Governmental Activities Business-type Activities Total $ S 9.239 1 132 377 68.53 485,285 61020 38.972 5.263 64999 7.574 003 103 123 313 340 33,840 5.343 58 10,771 5,343 10 917 997 195 11.768 700 Assets Cash on hand Cash and cash equivalents Investment Receivables et of allowances) Taxes Notes Account Accrued interest Othe Due from other governments Internal balances Inventories Prepaid lems and other assets Restricted assets Cash and cash equivalents Investments Accounts receivable Accrued interest receivable Other receivables Prepaid items Pension asset Long-term receivables (net of allowances) Prepaid expense Interest rate swaps Assets held for disposition Capital assets Land and construction in progress Buildings, improvements. Infrastructure, collections, and equipment net of accumulated depreciation Total Assets 73,497 51.82 183727 53,518 390.726 18,720 803 557 6,363 127015 890.726 18,720 803 557 6,363 701 52.995 1.725 33,206 730 701 45.954 148,106 7.041 1.725 33.206 739 426 646 537.763 964,409 24.226 2.466,034 4.796,731 3,625,848 6,117.406 6.091.882 10,914,137 196.539 790.051 continued tone slate milloral Clermont Component Units Total 25.780 14313 157 449 4429 644,761 25,790 6.524 40.00 3.45 165 166 101.427 54082 18633 6,434 855 5.129 42003 3.959 ILLUSTRATION A2-1 (Continued) CITY AND COUNTY OF DENVER, COLORADO Statement of Net Position December 31, 2016 dollars in thousands Primary Government Governmental Business-type Activities Activities Deferred Outflows of Resources Accumulated decrease in fair ve of hedging derivatives 27,831 16432 Del amount on elundings 25 226 132.11 os related to Dension plans 380.155 62,844 Total Deferred Outflows of Resources 433,322 211,439 Liabilities Vouchers payable 98.096 67070 43,406 58,021 Uhamed revenue 10,089 43.993 Interest rate swaps 31.850 154 486 Advances 6,434 Due to taking und 858 Due to other governments 5.129 Liabiles payable from restricted assets 42003 Noncurrent abates Due within one year 122.706 183.631 Duen more than one year 2.775.460 4.266 391 Total Liabilities 3,088.899 4.820,724 Deferred Inflows of Resources Property taxes 408.163 Items related to pension plans 1.726 Deferred gain on refunding of debt 2.202 Total Deferred Inflows of Resources 409 889 2.529 Net Position Net investment in capital assets 1.572,753 175 636 Restricted for Capital projects and grants 690 288 18.389 Emergency use 48.200 Debt service 157.908 604.491 Pension 701 Donor and other restrictions Expendable 6,807 Nonexpendable 3.000 Other purposes 11.501 Unrestricted (deficit 1759.893) 707.076 Total Net Position (Deficit) $1,731,265 $1,505,592 19.354 306337 7.041.851 7,909.623 24393 387 308 989.994 103,646 322 408.163 2048 2.207 412,418 103.646 1.748.389 167.602) 708.677 48 200 762 399 701 91.658 10,403 27.284 15.613 6,807 3.000 11.501 52817 $3,236,857 355 165 $/277,809 City and County of Deswer. Colorado Con Amart Year Ended December 31, 2016. Used with permission ILLUSTRATION A2-2 CITY AND COUNTY OF DENVER, COLORADO Statement of Activities For the Year Ended December 31, 2016 (dollars in thousands) Net (Expense) Revenue and Changes in Net Assets Program Revenues Primary Government Operating Capital Charges for Grants and Grants and Governmental Business-type Services Contributions Contributions Activities Activities Expenses Functions/Programs Primary Government Governmental Activities General government Public Safety Public warks Human Services 5 $ 9,691 36,527 $ 405.900 688 287 216.587 145.594 65.265 93,842 130,536 48.766 14,830 62.566 99,847 95 497 75.580 469 2.298 12.466 73,712 34,264 6,392 $ 23.475 26,398 23.358 86,469 9,918 760 1,618 6 7.639 $ 272.88 1566,393 181122 58.656 153.049 (69.448 155 206 13.664 (799 152,566 11.169 10.832 1,872.173 400,525 179,641 68,218 (1,223,789) Paris and recreation Cultural activities Community development Economic opportunity Interest on long-term debt Total Governmental Activities Business-type Activities Wastewater management Denver airport system Environmental Services Golf course Total Business-type Activities Total Primary Government Component Units 25.142 3,553 686 114,740 811,094 11,837 11,146 133,375 876.643 11073 11 058 43.777 69.788 17641 192 280 1 948,817 $2.820,990 $ 216,069 1,032,149 $1,432,674 $ 95.642 686 $180,327 28.975 $97,193 $ 112,993 112.993 (1,223,789) (1.1 $ 3,061 41 Continued) Com CITY AND COUNTY OF DENVER, COLORADO Statement of Activities For the Year Ended December 31, 2016 dollars in thousands) Net (Expense) Revenue and Changes in Net Assets Primary Government Governmental Business-type Activities Activities Total General Revenues Taxes Facilities development admissions 12.401 12,401 Lodgers 88.872 88.872 Motor vehicle ownership fee 26.787 26,787 Occupational privilege 49,864 Property 399.859 Sales and use 674.398 674,398 Specific ownership 57 57 Telephone Investment and interest income 19.151 40.414 59,565 Other revenues 921 25.049 Transfers (1676 1.676 Capital Asset Transfers (2880 2.880 Total General Revenues and Transfers 1,300,407 45,891 1,346,298 Change in net position 76.618 158,884 235 502 Nel position deficit) January 1 1.654647 1.346,709 3001 355 Net Position (Deficit)-December 31 $1,731,265 $1,505,592 $3,236,857 17 $127 wowerport Year Ended December 2016 Uhr Chapter willen for state of Great 39 Appendix A Illustrative Financial Statements from the City and County of Denver, Colorado* ILLUSTRATION A2-1 CITY AND COUNTY OF DENVER, COLORADO Statement of Net Position December 31, 2016 dollars in thousands) Primary Government Governmental Business-type Activities Activities Assets 5 9.239 1.133,377 68.53 793.46 then Note 485,286 61,020 38,973 5.263 64.98 7.574 33.84 33,840 5.343 58 10,771 15.3431 10,912 992 1097 11.768 1.700 73,497 51823 183 727 53 515 890,726 18,720 803 557 6.363 Duerom other governments Internal balance Inventores Propaid items and other assets Resincted assets Cash and cash equivalents Investments Accounts receivable Accrued interest receivable Other receivables Prepaid tems Pension asset Long-term receivables (net of allowances) Prepaid expense Interest rate swaps Assets held for disposition Capital assets Land and construction in progress Buildings, improvements, infrastructure, collections and equipment, net of accumulated depreciation Total Assets 127015 890.726 18.720 303 55 6,363 701 52.995 1,725 33,206 730 701 45 954 148,106 7041 1.725 33.206 730 426,646 537.763 964,409 24.226 2.465,034 3,625,848 6,117,406 4.796.731 6,091,882 10.914,137 196,539 790,051 continued h not included in the appendi 0 Part One ILLUSTRATION A2-1 (Continued CITY AND COUNTY OF DENVER, COLORADO Statement of Net Position December 31, 2016 dear in thousands Primary Cover comonnant Governmental Activities Total Deferred Outlaws of Resources 27831 25.70 3801 433,323 211.439 Total Deferred Outflows of Resources Liabilities Vouchers Day Accrued abilities Unaven 43 98,096 13 405 10.009 3185 6,434 358 Adu 5.129 Nonton 183.63 122.700 2.725460 3,083.899 9994 4.820.724 Total Liabilities Deferred Intlows of Resources 408.163 1,725 32 De 103,645 409889 2520 1.572.753 175.63 18.339 690,288 48.200 157 908 701 + 659 10403 27284 604.491 15613 6,807 3.000 11.501 759.893) $1,731,265 707076 $1,505,592 355.165 ${277.809) $3.236,857 Total Net Position (Deficit) City and County of Denver, Canada Compre Amancial Report Year Ended December 31, 2016. Used with ILLUSTRATION A2-2 CITY AND COUNTY OF DENVER, COLOR Statement of Activities For the Year Ended December 31, 2016 dollar Capital Grants and Contribution Component Units S 965 11.168 10.83 Program Revenues Operating Charges for Grants and Functions/Programs Expenses Services Contributions Primary Government Governmental Activities General government $ 405.900 $ 99 847 $ 23,475 Public safety 688 287 95,497 26,398 Public works 216.587 75.580 23.358 Human Services 145 594 469 86.469 Health 65.265 2,298 9,918 Parks and recreation 93,842 12.466 760 Cultural activities 130.536 73.712 1.618 Community development 48.766 34 264 6 Economic opportunity 14,830 6,392 7,639 Interest on long-term debt 62.566 Total Governmental Activities 1,872,173 400,525 179,641 Business-type Activities. Wastewater management 114,740 133,375 Denver airport system 811,094 876,643 686 Environmental services 11,837 11,073 Golf course 11.146 11058 Total Business-type Activities 948.817 1,032,149 686 Total Primary Government $2,820,990 $1,432,674 $180,327 Component Units $ 216.069 $ 95,642 $ 3,061 62565 (1.223.789) (1.223,789) 68,218 25.142 3.553 69785 (754) 192 43.777 69.788 (754) 192 280 28,975 $97,193 112,993 112.993 112,993 (1.110,796) (1,223,789) $1117.366) $ continued ILLUSTRATION A2-2 (Continued) CITY AND COUNTY OF DENVER, COLORADO Statement of Activities For the Year Ended December 31, 2016 dollars in thousands) Net (Expense) Revenue and Changes in Net Assets Primary Government Governmental Business-type Activities Activities General Revenues Component Units Total 2009 Facilities development admissions Lodgers Motor vehicle ownership fee Occupational privilege Property Sards and use Specific Ownership Telephone vestment and interest income Other revenues 12,401 B8 872 26,787 49.864 399.859 674 398 57 9.446 19.151 12,401 88.872 26,787 49.864 399.859 674 398 57 9.446 59.565 25.049 98,615 28.812 304 9.987 34 905 24 128 et Transfers Grevenues and Transfers 175,433 40,414 921 1.676 2.880 45,891 158.884 1346.708 $1,505,592 11 676) 2.880 1,300,407 76,618 1654647 $1,731,265 1.346,298 235,502 3.001.355 $3,236,857 335.876 $[277,809 Deficit)-December 31 City and of Directed December 11, 2016. Lyed with person ILLUSTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started