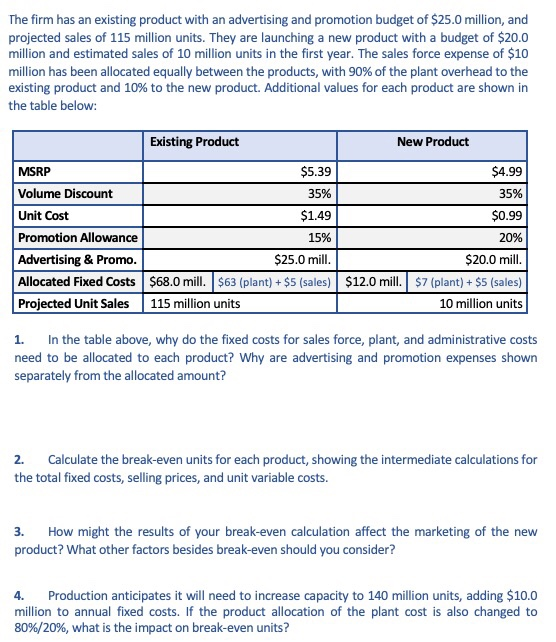

The firm has an existing product with an advertising and promotion budget of $25.0 million, and projected sales of 115 million units. They are launching a new product with a budget of $20.0 million and estimated sales of 10 million units in the first year. The sales force expense of $10 million has been allocated equally between the products, with 90% of the plant overhead to the existing product and 10% to the new product. Additional values for each product are shown in the table below: Existing Product New Product MSRP Volume Discount Unit Cost Promotion Allowance Advertising & Promo Allocated Fixed Costs $68.0 mill. $63 (plant)$5 (sales) $12.0 mil Projected Unit Sales115 milion units $5.39 35% $1.49 15% $25.0 mill $4.99 35% $0.99 20% $20.0 mill $7 (plant)+$5 (sales) 10 million units 1. In the table above, why do the fixed costs for sales force, plant, and administrative costs need to be allocated to each product? Why are advertising and promotion expenses shown separately from the allocated amount? 2. Calculate the break-even units for each product, showing the intermediate calculations for the total fixed costs, selling prices, and unit variable costs. 3. How might the results of your break-even calculation affect the marketing of the new product? What other factors besides break-even should you consideri? 4. Production anticipates it will need to increase capacity to 140 million units, adding $10.0 million to annual fixed costs. If the product allocation of the plant cost is also changed to 80%/20%, what is the impact on break-even units? The firm has an existing product with an advertising and promotion budget of $25.0 million, and projected sales of 115 million units. They are launching a new product with a budget of $20.0 million and estimated sales of 10 million units in the first year. The sales force expense of $10 million has been allocated equally between the products, with 90% of the plant overhead to the existing product and 10% to the new product. Additional values for each product are shown in the table below: Existing Product New Product MSRP Volume Discount Unit Cost Promotion Allowance Advertising & Promo Allocated Fixed Costs $68.0 mill. $63 (plant)$5 (sales) $12.0 mil Projected Unit Sales115 milion units $5.39 35% $1.49 15% $25.0 mill $4.99 35% $0.99 20% $20.0 mill $7 (plant)+$5 (sales) 10 million units 1. In the table above, why do the fixed costs for sales force, plant, and administrative costs need to be allocated to each product? Why are advertising and promotion expenses shown separately from the allocated amount? 2. Calculate the break-even units for each product, showing the intermediate calculations for the total fixed costs, selling prices, and unit variable costs. 3. How might the results of your break-even calculation affect the marketing of the new product? What other factors besides break-even should you consideri? 4. Production anticipates it will need to increase capacity to 140 million units, adding $10.0 million to annual fixed costs. If the product allocation of the plant cost is also changed to 80%/20%, what is the impact on break-even units