The first financial statement is Coca Cola and the second one is for Pepsi . The question for the assignment is the last two pictures. Please and thank you!!

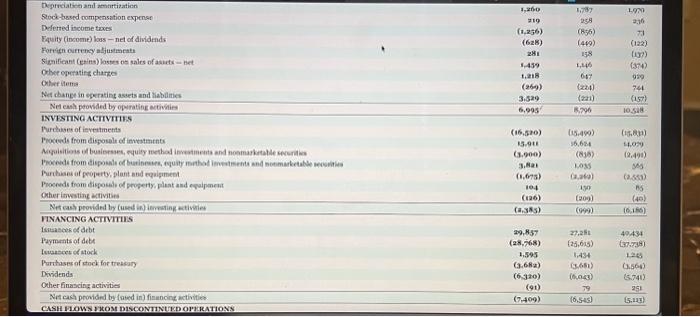

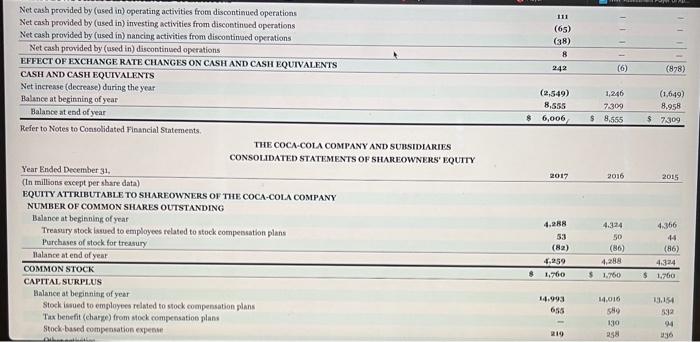

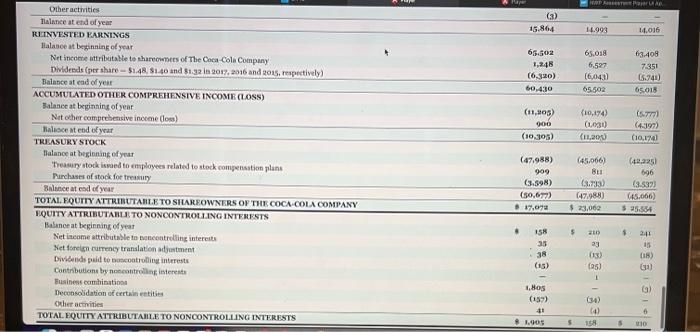

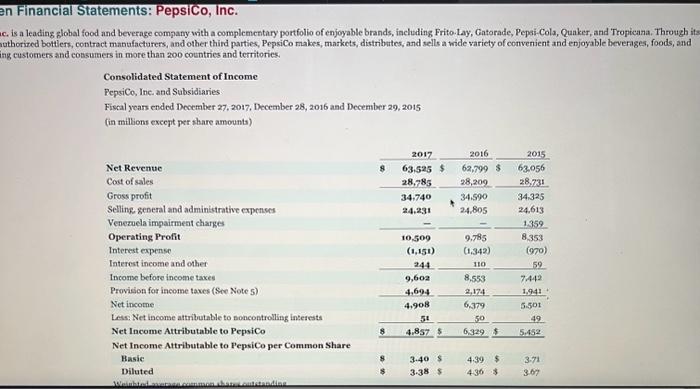

pepsi

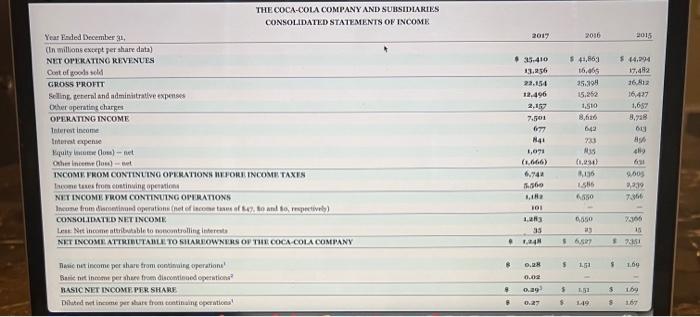

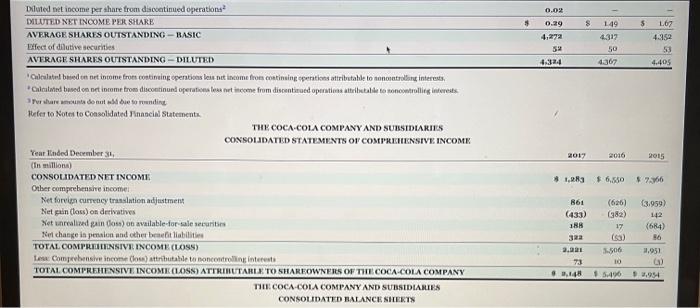

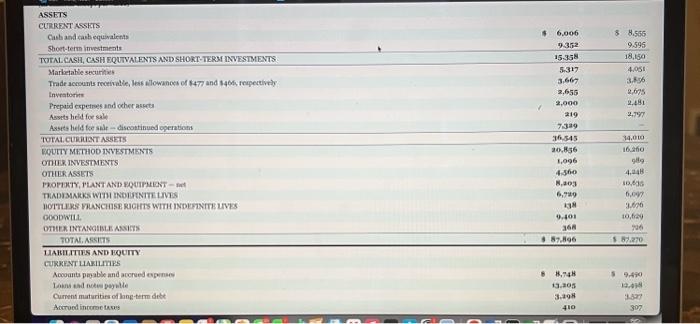

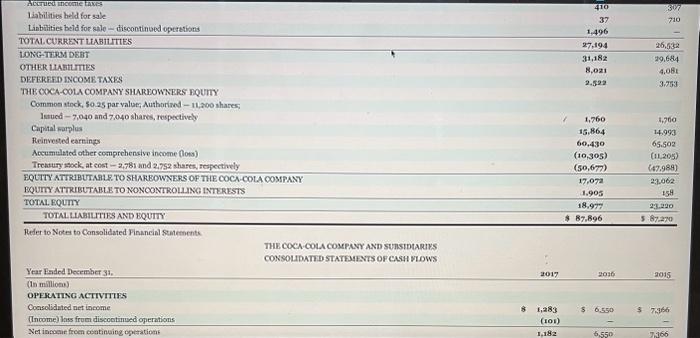

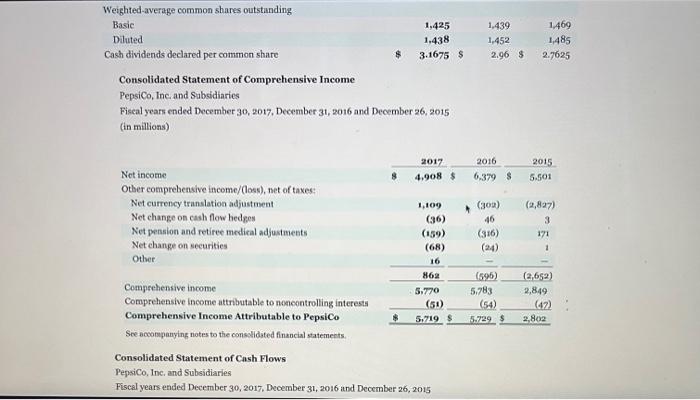

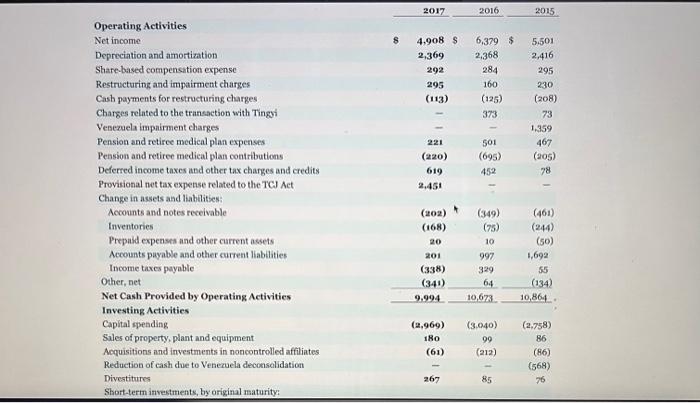

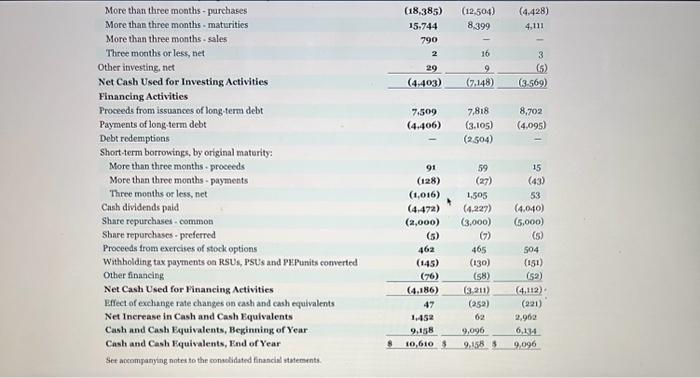

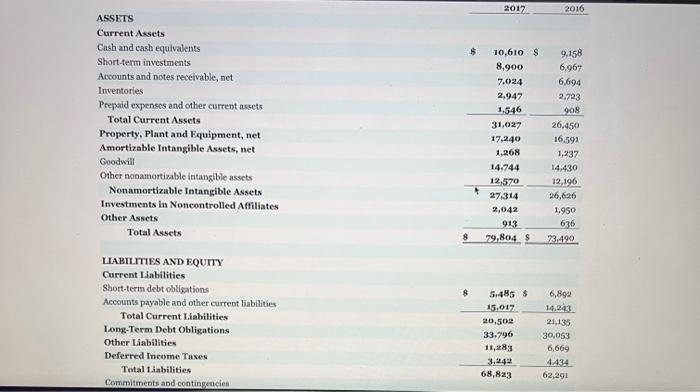

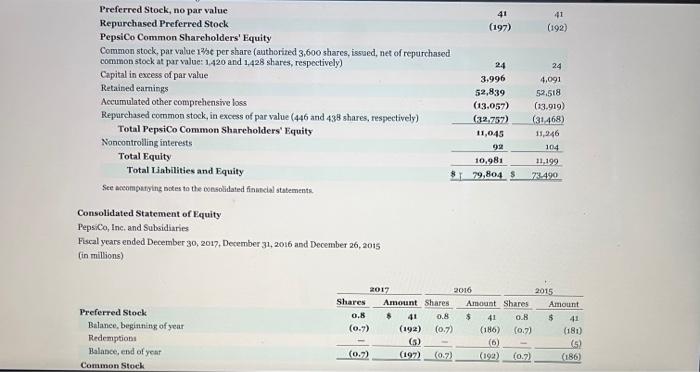

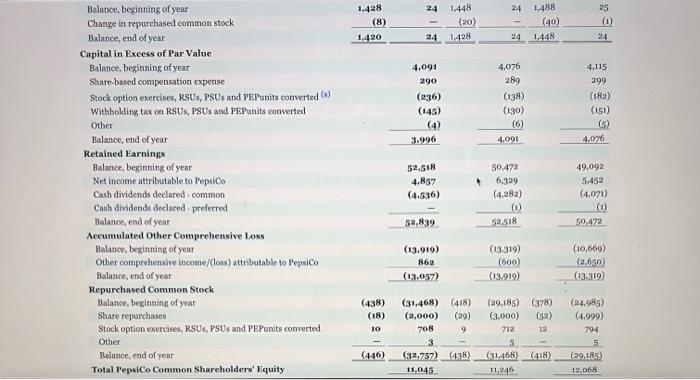

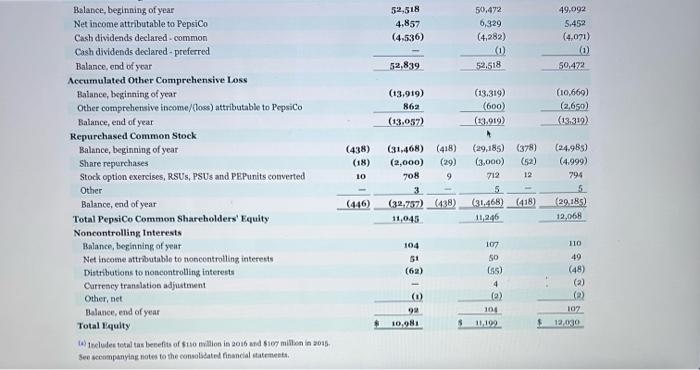

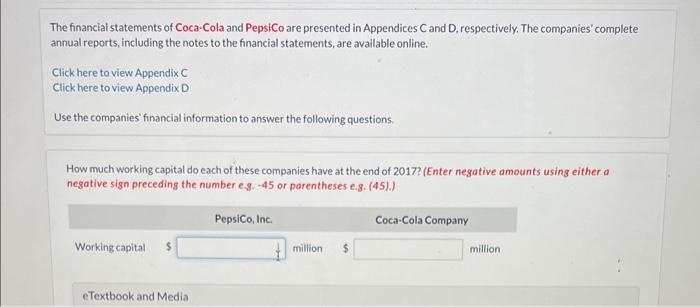

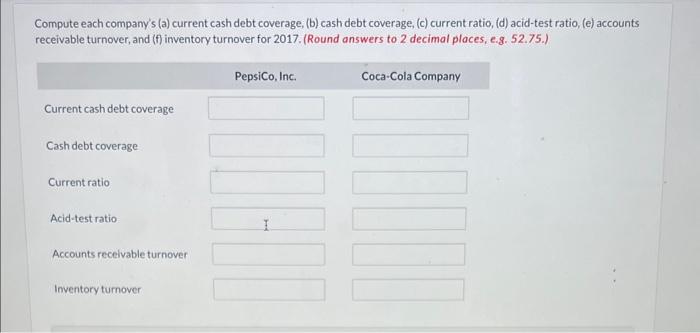

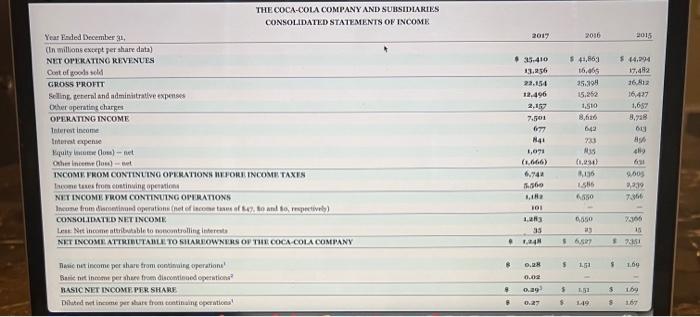

THE COCA-COLA COMPANY AND SUISIDIARIES CONSOLIDATED STATEMENTS OF INCOME Year Feded December 31 , (Un millons extept jer share data) Nit O1'LATNG REVINUES Cont ef gooula tel Gros5 ProFIT Eelline, terernal and adminitratlye expenses Deher opentint charges OPRHATTNG INCOME Inierest income Interat ropenie Kyuity iniuise (lons) - net. oshie incense (loee) - eet laxeme temes from costinsing operations NUIT INCOMIE HROM CONTINUTNG OPIDATIONS CONsot.1Dk7id NHTINCOste. Lrat Nrt inceme ateributable to mebentrollinc internta Neac nut income per share tram centimairy operations! Falie nit inceau per aher from disoumienod eperntions? ILSICNET INCOMR. PIK SHAME Phised met incume per shars treat continaing eprrations? Diluted set income per thare from dacontimed operations 2 DILUTE NET ENCOME PEE SHARE AVRRAGE SHARES OUTSLANDING - BASIC Dfect of dillutive securities AVERACE SHARES OUTSTANDING - DILUTED 3 Ter share ancains do aut wald bie so rumiting Hefer to Notea to Consolidated Jnancial Statements. THE COCA-COLA COMPAVY AND SUSTDLHS COSSOLJDATU STATEMENTS OI COSTHUIHLNSRVE INCOME Vear linded December 31 ; (fin millions) CONSOLDATED NIT INCOME. 4.283 \& 1,5650&7,36 Onler comprehensite incomel Net forvign curracy trassintion acjustment Niet gan (loss) on deivatives Ket unrralined gein (osn) ob aveilable-for-ale seraribes Rie change is penaicn and cther braefit liabilitien teac Comjerbensire incont (oos) attributalile te Boncontroling interets TOTA. COMPREHENSTVI. INCOMTL (LOSS) ATHRIHTART. TO SHAREOWNEIE OF THE COCA-COLA COMPANY TIL COCA-COLA COMPANY AND SUBSTDLAMES CONSOUDATED BALANCE SILEETS ASSETS CURRFNT ASFES UAEIITHS AND BQUIT CUXRENT HEIHM Acoountr proable and acered exprnse: Lakns and note peyntle Curnent maturities of hang term debe Actrued inturo taves Acorued income takes Liabilities held for sale THE COCA-COLA COMPANY SHAREOWNERS FQUTY Common stock, 50.25 par valuer, Autharised - 11,200 shares; Isaned 7,040 and 7,040 shares, respectivaly Cipital marplus fleinvested earnings Accumulated other comprehensive income (loss) Treatury sock, at cost 2,781 und 2.752 ahares, respectively FQLTT ATTRIBUTASL.TO SHARBOWNERS OF THE COCA-COLA COSFRANY BQUTY ATTKIEUTABLE TO NONOONTROLING INTERESTS TOTNL. EQUII TOTAL LIABHLTIRS AND BQUITY Peder to Note to Consolidated Finuncial Statements. THE COCA COLA COMPANY AND SUASIDTARUY CONSOLDATBDSTATEARTS OF CASH vLOWS Year fided December 31, (1in milliones) OPERUING ACTIVITFS Consolidited net income (Income) lass frum discootinued operations Net ismene freen coetinuing operationt Deprrciateen and amntization Sock-besed compensation expense Delerted iscome trese Equity (income) loss - net of dividends Forvich ouftency ajjusteacak sigrificant (epins) lastes oe talis of asuets = bet. Orber oberaties chates Oxtice ulema Net chanee in egerating asdets and tiablitics Ned eask peoviled by opvrating ectivities INVHSIINQ.ACTVItHs Thechaise of ieventments Pockede from dileposalr of imvnamente Turthase at peoperby, plant and equigrnent Phocends from difpokelo of preperty. pleat and eyuipment Oxher imwatine activities IINACING ACTIVITIIS Istasece od drbt Payments of dets luuaseces ef atock Parthases of stock for treasary Divitends Oher finasing activities Nest cast provided by (awed in) fiemang activitice. Net eash provided by (used in) operating activities from discontinued operations Net cash provided by (used in) investing activities from discontinoed operations Net cash provided by (used in) nancing activities from discontinued operations Net cash provided by (used in) discontinued operations: EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS CASH AND CASH EQUTVALENTS Net inerease (decrease) during the year Balance at beginning of year Balance at end of year Refer to Notes to Consolidated Financial Statements. THE COCA.COLA COMPANY AND SUESIDIARIES CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUTT Year Ended December 31, (In millions except per share data) EQUTTY ATTRIEUTABLE TO SHLAROWNERS OF THE COCA-COLA COMFANY NUMBER OF COMMON SHLRES OUTSTANDING Balnce at begiening of year Treasury stock iasued to employess related to stock eompensation plans Purchases of stock for treasury Halance at end of year COMMON STOCK CAPTTAL SURPLUS Balance at beginnitus of year Stock issued to employees related to stock compensation plans Tax benefit (charge) from sock compensation plans Stock based compensation expense , is a leading elobal food and beverage company with a complementary portfolio of enjoyable brands, including Frito.Lay, Gatorade, Pepai-Cola, Quaker, and Tropieana, Through its thorired bottiers, contract manufacturers, and other third parties, PepsiCo makes, matkets, distribates, and sells a wide variety of convenient and enjoyable beverages, foods, and * customers and cossumers in more than 200 countries and territories, Consolidated Statement of Income PepsiCo, Inc, and Subsidiaries. Fiscal years ended December 27, 2017, December 28, 2016 and December 29, 2015 (in millions except per share amounts) Consolidated Statement of Comprehensive Income PepsiCo, Inc and Sabcidiaries Fiseal years ended December 30, 2017, December 31, 2016 and December 26, 2015 (in millions) Consolidated Statement of Cash Flows PepsiCo, Inc, and Subsiciaries Fiscal years ended December 30,2017 , December 31,2016 and December 26, 2015 Operating Activities Net income Depreciation and amortimation Share-based compensation expense Restructuring and impairment charges Cash payments for restructuring charges Charges related to the transaction with Tingy Venecuela impairment charges Pension and retiree medical plan expenses Pension and retiree medieal plan contributions Deferred income taxes and other tax charges and credits Provisional net tax expense related to the TCJ Act Change in assets and liabilitien: Short-term investments, by original maturity: More than three months-purchases More than three months - maturities More than three months - sales Three months or less; net Other itsvesting, net Net Cash Used for Investing Activities Financing Activities Proceeds from issuances of long-term debt Payments of long-term debt Debt rodemptions Short-term borrowings, by original materity: Ses acenmpanying notes to the moodidated financial statemants. 20172016 ASSETS Current Assets Cash and cash equivalents Short-term investments Acoounts and notes receivable, net Inventories Prepaid expenses and other current assets Total Current Assets Property, Plant and Equipment, net Amortizable Intangible Assets, net Goodwill Oaher nonamortizable intangible assets Nonamortizable Intangible Assets Investments in Noncontrolled Affiliates Other Assets Total Assets LABIIITTES AND EQUTY Current Liabilities Sbort-term debt obligations Accounts payable and other current liabilities Total Current Liabilities Long-Term Debt Obligations Other Liabilities Deferred Income Tuxes Total tiabilities Commitments and contingencies \begin{tabular}{rrr} 5,485 & 8 & 6,892 \\ 15,017 & 14,293 \\ \hline 20,502 & 21,135 \\ 33,796 & 30,053 \\ 11,283 & 6,669 \\ 3,242 & 4,434 \\ \hline 68,823 & 62,291 \end{tabular} Consolidated Statement of Equity PepsiCo, Inc, and Subsidiaries Fiscal years ended December 30, 2017, December 31, 2016 and December 26, 2015 (in millions) Balance, beginning of year Change in repurchased common stock Balance, end of year \begin{tabular}{rrrrrr} 1,428 & 24 & 1,448 & 24 & 1,488 & 25 \\ (8) & - & (20) & - & (40) & (1) \\ \hline 1,420 & 24 & 1,428 & 24 & 1,448 & 24 \\ \hline \end{tabular} Capital in Exeess of Par Value Balance, beginning of year Share-based compensation expense Siock option exercises, RSUs, PSUs and PEPunits converted (a) Withbolding tax oe RSUs, PSUs and PEPunits converted Otber Balance, end of year Retained karnings Balance, beginning of year Net incame attributable to Pepsico Cash dividends declared - common Cash dividends declared - preferred Halance, end of year Accumulated Other Comprehensive Loss Balance, beginning of year Other compeeliensive income/(loss) attribatable to PepsiCo Balance, end of year Repurchased Common Stock Balance, besinning of year Share repurchases Stock option exercises, RSUs, PSUs and PEPunits converted Other filance, end of year Total PepsiCo Common Shareholders' Equity \begin{tabular}{rrrrrr} (438) & (31,468) & (418) & (29,185) & (378) & (24,985) \\ (188) & (2,000) & (29) & (3,000) & (52) & (4,999) \\ 10 & 708 & 9 & 712 & 12 & 794 \\ - & 3 & - & 5 & - & 5 \\ \hline(446) & (32,757) & (4,38) & (31,468) & (418) & (29,185) \\ \hline & 11,045 & & 11,246 & & 12,068 \\ \hline \end{tabular} 14) 1reludec total tas bebefits of 5150 trimion is 2036 sta s107 mumen in zo35 See sceompenyiag notes to the censobdated financial taterneste. The financiai statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies' complete annual reports, including the notes to the financial statements, are available online. Click here to view Appendix C Click here to view Appendix D Use the companies' financial information to answer the following questions. How much working capital do each of these companies have at the end of 2017? (Enter negative amounts using either a negative sign preceding the number e.g. -45 or porentheses e.g. (45).) Compute each company's (a) current cash debt coverage; (b) cash debt coverage, (c) current ratio, (d) acid-test ratio, (e) accounts receivable turnover, and (f) inventory turnover for 2017. (Round answers to 2 decimal places, e.g. 52.75.) THE COCA-COLA COMPANY AND SUISIDIARIES CONSOLIDATED STATEMENTS OF INCOME Year Feded December 31 , (Un millons extept jer share data) Nit O1'LATNG REVINUES Cont ef gooula tel Gros5 ProFIT Eelline, terernal and adminitratlye expenses Deher opentint charges OPRHATTNG INCOME Inierest income Interat ropenie Kyuity iniuise (lons) - net. oshie incense (loee) - eet laxeme temes from costinsing operations NUIT INCOMIE HROM CONTINUTNG OPIDATIONS CONsot.1Dk7id NHTINCOste. Lrat Nrt inceme ateributable to mebentrollinc internta Neac nut income per share tram centimairy operations! Falie nit inceau per aher from disoumienod eperntions? ILSICNET INCOMR. PIK SHAME Phised met incume per shars treat continaing eprrations? Diluted set income per thare from dacontimed operations 2 DILUTE NET ENCOME PEE SHARE AVRRAGE SHARES OUTSLANDING - BASIC Dfect of dillutive securities AVERACE SHARES OUTSTANDING - DILUTED 3 Ter share ancains do aut wald bie so rumiting Hefer to Notea to Consolidated Jnancial Statements. THE COCA-COLA COMPAVY AND SUSTDLHS COSSOLJDATU STATEMENTS OI COSTHUIHLNSRVE INCOME Vear linded December 31 ; (fin millions) CONSOLDATED NIT INCOME. 4.283 \& 1,5650&7,36 Onler comprehensite incomel Net forvign curracy trassintion acjustment Niet gan (loss) on deivatives Ket unrralined gein (osn) ob aveilable-for-ale seraribes Rie change is penaicn and cther braefit liabilitien teac Comjerbensire incont (oos) attributalile te Boncontroling interets TOTA. COMPREHENSTVI. INCOMTL (LOSS) ATHRIHTART. TO SHAREOWNEIE OF THE COCA-COLA COMPANY TIL COCA-COLA COMPANY AND SUBSTDLAMES CONSOUDATED BALANCE SILEETS ASSETS CURRFNT ASFES UAEIITHS AND BQUIT CUXRENT HEIHM Acoountr proable and acered exprnse: Lakns and note peyntle Curnent maturities of hang term debe Actrued inturo taves Acorued income takes Liabilities held for sale THE COCA-COLA COMPANY SHAREOWNERS FQUTY Common stock, 50.25 par valuer, Autharised - 11,200 shares; Isaned 7,040 and 7,040 shares, respectivaly Cipital marplus fleinvested earnings Accumulated other comprehensive income (loss) Treatury sock, at cost 2,781 und 2.752 ahares, respectively FQLTT ATTRIBUTASL.TO SHARBOWNERS OF THE COCA-COLA COSFRANY BQUTY ATTKIEUTABLE TO NONOONTROLING INTERESTS TOTNL. EQUII TOTAL LIABHLTIRS AND BQUITY Peder to Note to Consolidated Finuncial Statements. THE COCA COLA COMPANY AND SUASIDTARUY CONSOLDATBDSTATEARTS OF CASH vLOWS Year fided December 31, (1in milliones) OPERUING ACTIVITFS Consolidited net income (Income) lass frum discootinued operations Net ismene freen coetinuing operationt Deprrciateen and amntization Sock-besed compensation expense Delerted iscome trese Equity (income) loss - net of dividends Forvich ouftency ajjusteacak sigrificant (epins) lastes oe talis of asuets = bet. Orber oberaties chates Oxtice ulema Net chanee in egerating asdets and tiablitics Ned eask peoviled by opvrating ectivities INVHSIINQ.ACTVItHs Thechaise of ieventments Pockede from dileposalr of imvnamente Turthase at peoperby, plant and equigrnent Phocends from difpokelo of preperty. pleat and eyuipment Oxher imwatine activities IINACING ACTIVITIIS Istasece od drbt Payments of dets luuaseces ef atock Parthases of stock for treasary Divitends Oher finasing activities Nest cast provided by (awed in) fiemang activitice. Net eash provided by (used in) operating activities from discontinued operations Net cash provided by (used in) investing activities from discontinoed operations Net cash provided by (used in) nancing activities from discontinued operations Net cash provided by (used in) discontinued operations: EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS CASH AND CASH EQUTVALENTS Net inerease (decrease) during the year Balance at beginning of year Balance at end of year Refer to Notes to Consolidated Financial Statements. THE COCA.COLA COMPANY AND SUESIDIARIES CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUTT Year Ended December 31, (In millions except per share data) EQUTTY ATTRIEUTABLE TO SHLAROWNERS OF THE COCA-COLA COMFANY NUMBER OF COMMON SHLRES OUTSTANDING Balnce at begiening of year Treasury stock iasued to employess related to stock eompensation plans Purchases of stock for treasury Halance at end of year COMMON STOCK CAPTTAL SURPLUS Balance at beginnitus of year Stock issued to employees related to stock compensation plans Tax benefit (charge) from sock compensation plans Stock based compensation expense , is a leading elobal food and beverage company with a complementary portfolio of enjoyable brands, including Frito.Lay, Gatorade, Pepai-Cola, Quaker, and Tropieana, Through its thorired bottiers, contract manufacturers, and other third parties, PepsiCo makes, matkets, distribates, and sells a wide variety of convenient and enjoyable beverages, foods, and * customers and cossumers in more than 200 countries and territories, Consolidated Statement of Income PepsiCo, Inc, and Subsidiaries. Fiscal years ended December 27, 2017, December 28, 2016 and December 29, 2015 (in millions except per share amounts) Consolidated Statement of Comprehensive Income PepsiCo, Inc and Sabcidiaries Fiseal years ended December 30, 2017, December 31, 2016 and December 26, 2015 (in millions) Consolidated Statement of Cash Flows PepsiCo, Inc, and Subsiciaries Fiscal years ended December 30,2017 , December 31,2016 and December 26, 2015 Operating Activities Net income Depreciation and amortimation Share-based compensation expense Restructuring and impairment charges Cash payments for restructuring charges Charges related to the transaction with Tingy Venecuela impairment charges Pension and retiree medical plan expenses Pension and retiree medieal plan contributions Deferred income taxes and other tax charges and credits Provisional net tax expense related to the TCJ Act Change in assets and liabilitien: Short-term investments, by original maturity: More than three months-purchases More than three months - maturities More than three months - sales Three months or less; net Other itsvesting, net Net Cash Used for Investing Activities Financing Activities Proceeds from issuances of long-term debt Payments of long-term debt Debt rodemptions Short-term borrowings, by original materity: Ses acenmpanying notes to the moodidated financial statemants. 20172016 ASSETS Current Assets Cash and cash equivalents Short-term investments Acoounts and notes receivable, net Inventories Prepaid expenses and other current assets Total Current Assets Property, Plant and Equipment, net Amortizable Intangible Assets, net Goodwill Oaher nonamortizable intangible assets Nonamortizable Intangible Assets Investments in Noncontrolled Affiliates Other Assets Total Assets LABIIITTES AND EQUTY Current Liabilities Sbort-term debt obligations Accounts payable and other current liabilities Total Current Liabilities Long-Term Debt Obligations Other Liabilities Deferred Income Tuxes Total tiabilities Commitments and contingencies \begin{tabular}{rrr} 5,485 & 8 & 6,892 \\ 15,017 & 14,293 \\ \hline 20,502 & 21,135 \\ 33,796 & 30,053 \\ 11,283 & 6,669 \\ 3,242 & 4,434 \\ \hline 68,823 & 62,291 \end{tabular} Consolidated Statement of Equity PepsiCo, Inc, and Subsidiaries Fiscal years ended December 30, 2017, December 31, 2016 and December 26, 2015 (in millions) Balance, beginning of year Change in repurchased common stock Balance, end of year \begin{tabular}{rrrrrr} 1,428 & 24 & 1,448 & 24 & 1,488 & 25 \\ (8) & - & (20) & - & (40) & (1) \\ \hline 1,420 & 24 & 1,428 & 24 & 1,448 & 24 \\ \hline \end{tabular} Capital in Exeess of Par Value Balance, beginning of year Share-based compensation expense Siock option exercises, RSUs, PSUs and PEPunits converted (a) Withbolding tax oe RSUs, PSUs and PEPunits converted Otber Balance, end of year Retained karnings Balance, beginning of year Net incame attributable to Pepsico Cash dividends declared - common Cash dividends declared - preferred Halance, end of year Accumulated Other Comprehensive Loss Balance, beginning of year Other compeeliensive income/(loss) attribatable to PepsiCo Balance, end of year Repurchased Common Stock Balance, besinning of year Share repurchases Stock option exercises, RSUs, PSUs and PEPunits converted Other filance, end of year Total PepsiCo Common Shareholders' Equity \begin{tabular}{rrrrrr} (438) & (31,468) & (418) & (29,185) & (378) & (24,985) \\ (188) & (2,000) & (29) & (3,000) & (52) & (4,999) \\ 10 & 708 & 9 & 712 & 12 & 794 \\ - & 3 & - & 5 & - & 5 \\ \hline(446) & (32,757) & (4,38) & (31,468) & (418) & (29,185) \\ \hline & 11,045 & & 11,246 & & 12,068 \\ \hline \end{tabular} 14) 1reludec total tas bebefits of 5150 trimion is 2036 sta s107 mumen in zo35 See sceompenyiag notes to the censobdated financial taterneste. The financiai statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies' complete annual reports, including the notes to the financial statements, are available online. Click here to view Appendix C Click here to view Appendix D Use the companies' financial information to answer the following questions. How much working capital do each of these companies have at the end of 2017? (Enter negative amounts using either a negative sign preceding the number e.g. -45 or porentheses e.g. (45).) Compute each company's (a) current cash debt coverage; (b) cash debt coverage, (c) current ratio, (d) acid-test ratio, (e) accounts receivable turnover, and (f) inventory turnover for 2017. (Round answers to 2 decimal places, e.g. 52.75.)