Question

the first part of the question is, Suppose today the spot wheat price is $2.43 per bushel. The continuous interest rate is 6%. Storage costs

the first part of the question is,

the first part of the question is,

Suppose today the spot wheat price is $2.43 per bushel. The continuous interest rate is 6%. Storage costs are 6 cents per bushel per month, payable at the end of each month.

If the convenience value is 0, what is the fair futures price for a 90-day futures contract?"

I have found the SC to be .1782. My question is this question says that since the spot price is greater than the fair futures price, then it is implied that there is convenience value from holding wheat. so what if the fair value price was greater than the spot price? would there be no convenience value? or is it calculated a different way?

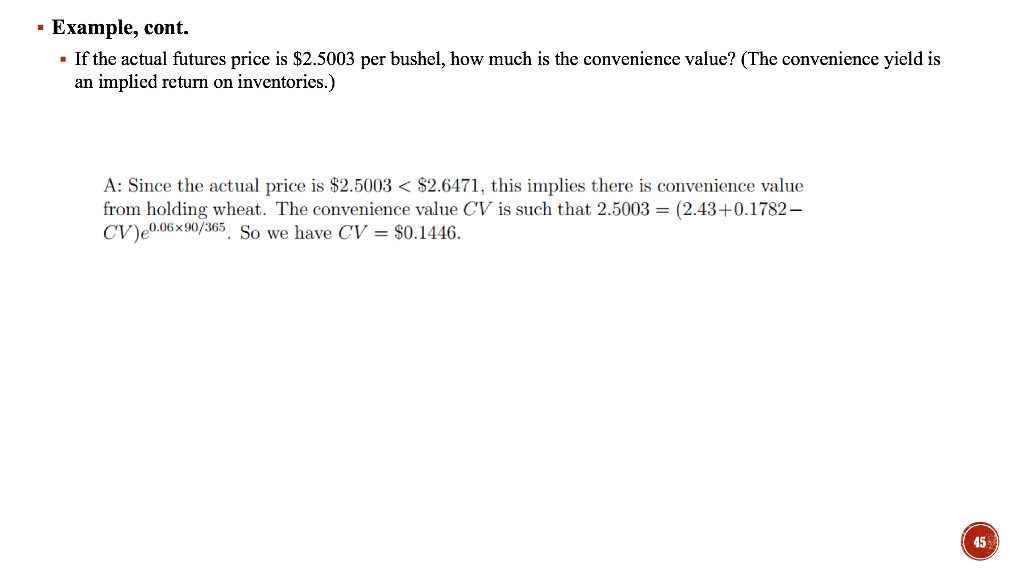

Example, cont. If the actual futures price is $2.5003 per bushel, how much is the convenience value? (The convenience yield is an implied return on inventories.) A: Since the actual price is $2.5003 $2.6471, this implies there is convenience value from holding wheat. The convenience value CV is such that 2.5003 (2.43+0.1782 CV) 365. So we have CV = $0.1446. 0.06 90/ 45Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started