Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the first photo is the question the second photo is an exapmle of how im supposed to format it, thank you for you time! 4.

the first photo is the question

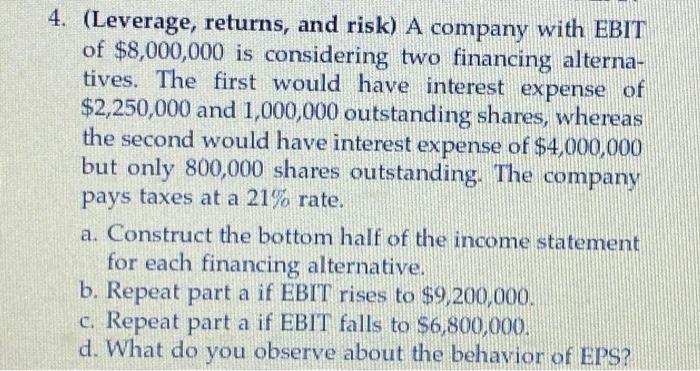

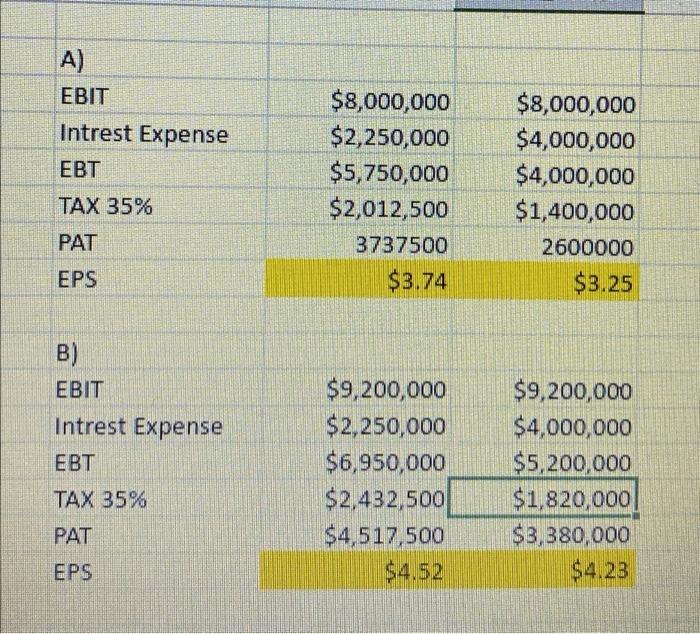

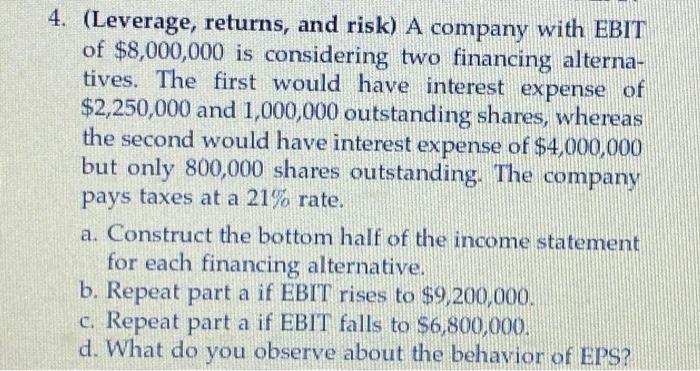

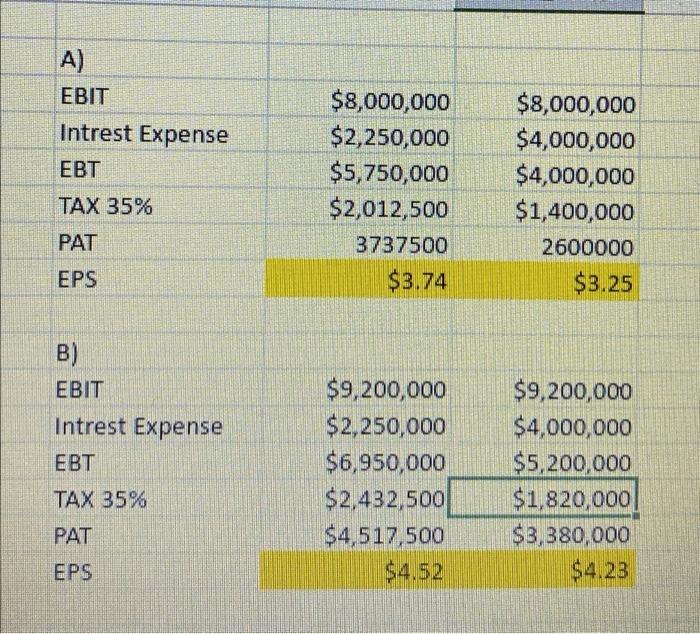

4. (Leverage, returns, and risk) A company with EBIT of $8,000,000 is considering two financing alterna- tives. The first would have interest expense of $2,250,000 and 1,000,000 outstanding shares, whereas the second would have interest expense of $4,000,000 but only 800,000 shares outstanding. The company pays taxes at a 21% rate. a. Construct the bottom half of the income statement for each financing alternative. b. Repeat part a if EBIT rises to $9,200,000. c. Repeat part a if EBIT falls to $6,800,000. d. What do you observe about the behavior of EPS? A) EBIT Intrest Expense EBT $8,000,000 $2,250,000 $5,750,000 $2,012,500 3737500 $3.74 $8,000,000 $4,000,000 $4,000,000 $1,400,000 2600000 $3.25 TAX 35% PAT EPS B) EBIT Intrest Expense EBT $9,200,000 $2,250,000 $6,950,000 $2,432,500 $4,517,500 $4.52 $9,200,000 $4,000,000 $5,200,000 $1,820,000 $3,380,000 $4.23 TAX 35% PAT EPS the second photo is an exapmle of how im supposed to format it, thank you for you time!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started