Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the first picture is all 4 of the questions. But I need help filling it in. The second picture is the question, I need help

the first picture is all 4 of the questions. But I need help filling it in.

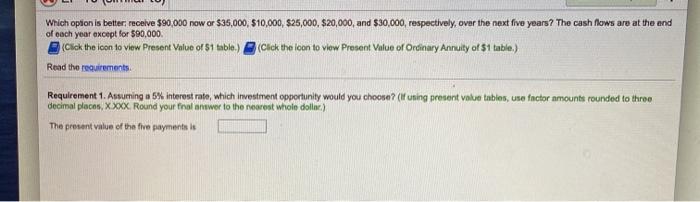

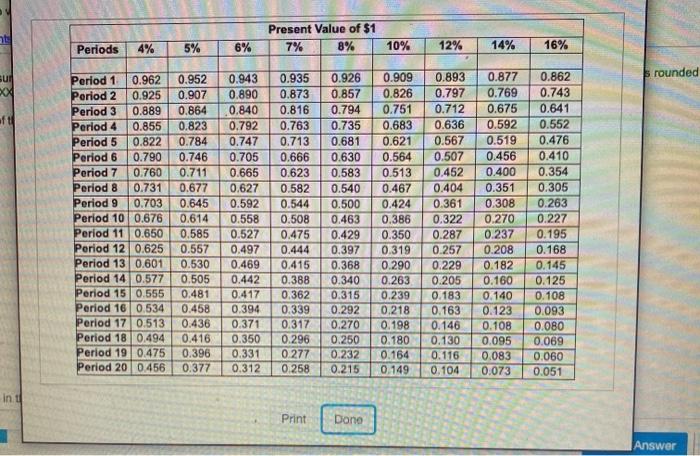

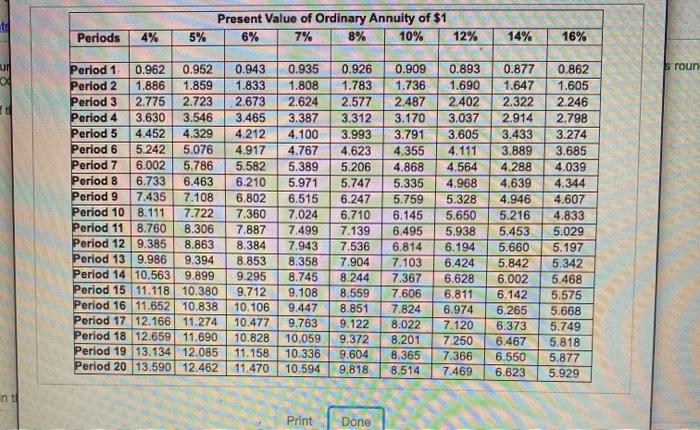

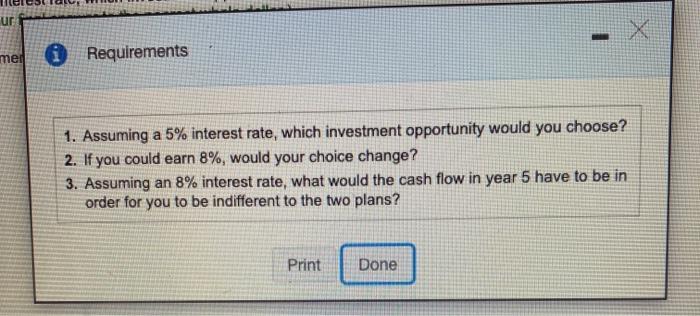

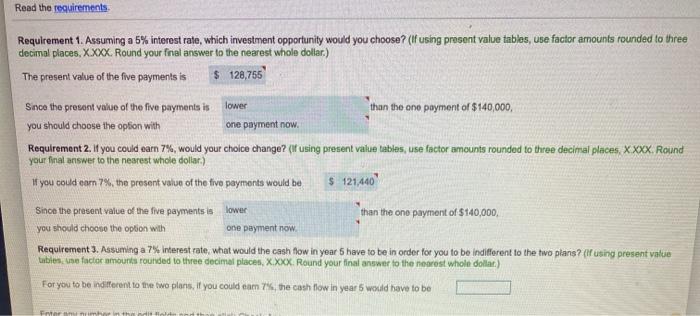

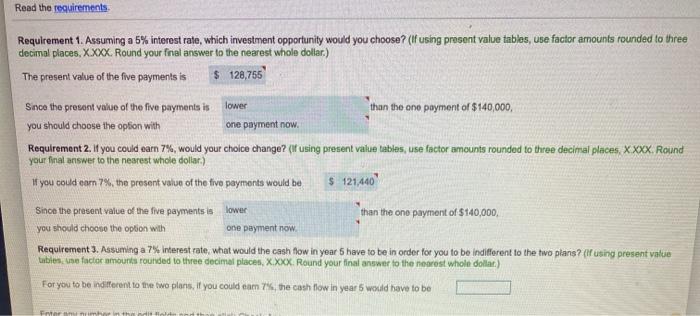

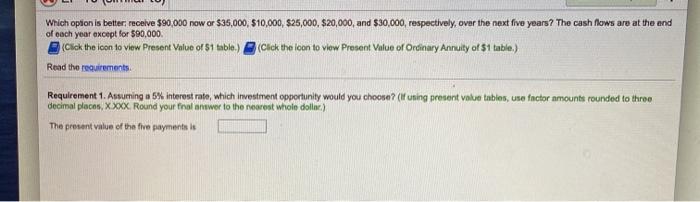

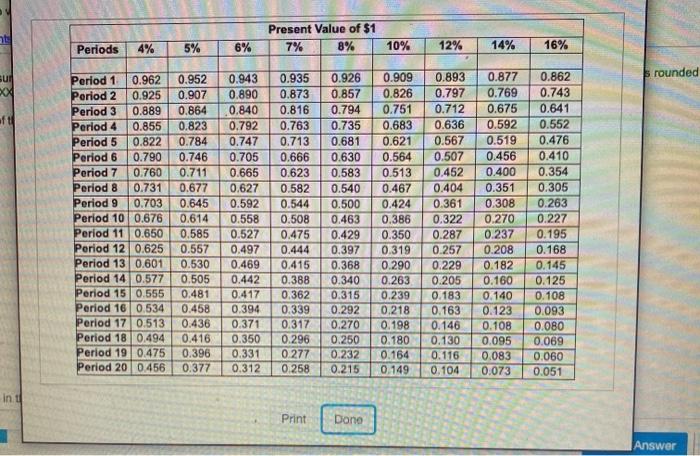

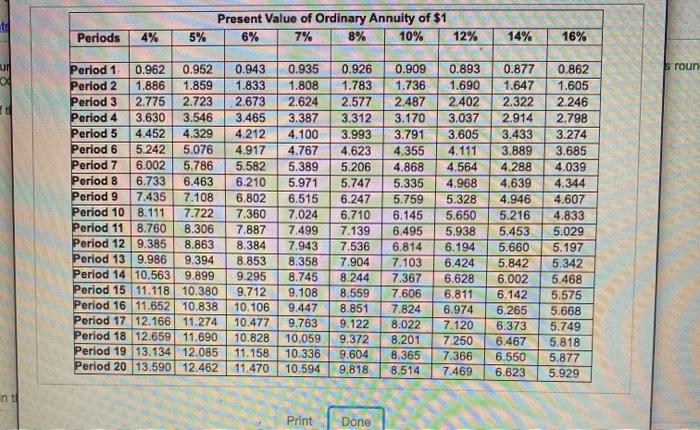

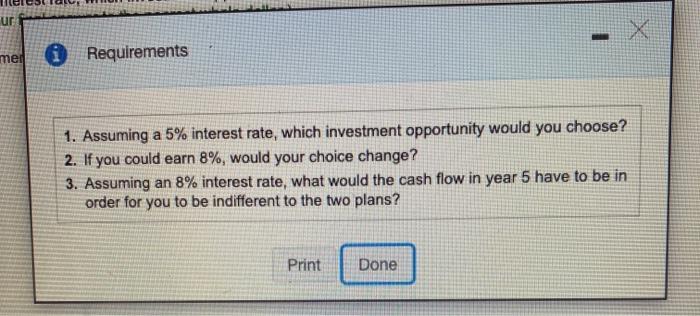

Read the requirements Requirement 1. Assuming a 5% interest rate, which investment opportunity would you choose? (if using present value tables, use factor amounts rounded to three decimal places, X.XXX. Round your final answer to the nearest whole dollar.) The present value of the five payments is $ 128,755 Since the prosent value of the five payments is lower than the ono payment of $140,000, you should choose the option with one payment now. Requirement 2. If you could earn 7%, would your choice change? (if using present value tables, use factor amounts rounded to three decimal places, X XXX. Round your final answer to the nearest whole dollar.) If you could eam 7%, the present value of the five payments would be $ 121,440 Since the present value of the five payments is than the one payment of $140,000 you should choose the option with one payment now lower Requirement 3. Assuming a 7%. Interest rate, what would the cash flow in years have to be in order for you to be indifferent to the two plans? (Ifusing present value tables un factor amounts rounded to three decimal places, X.XXX. Round your final answer to the nearest whole dollar For you to be indifferent to the two plans. If you could eam 76, the cash flow in year 5 would have to be Which option is better receive $90 000 now or $35,000, $10,000, $25,000 $20,000 and $30,000, respectively, over the next five years? The cash flows are at the end of each year except for $90,000 (Click the icon to view Present Value of $1 table.) (Click the loon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements Requirement 1. Assuming a 5% interest rate, which investment opportunity would you choose? (uning present value tables, use factor amounts rounded to three decimal places, XXX. Round your final anwer to the nearest whole dollar) The present value of the five payment is at Present Value of $1 7% 8% Periods 4% 5% 6% 10% 12% 14% 16% rounded Sur x oft Period 1 0.962 Period 2 0.925 Period 3 0.889 Period 4 0.855 Period 5 0.822 Period 6 0.790 Period 7 0.760 Period 8 0.731 Period 9 0.703 Period 100.676 Period 110.650 Period 120.625 Period 130.601 Period 14 0.577 Period 15 0.555 Period 16 0.534 Period 17 0.513 Period 18 0.494 Period 190.475 Period 20 0.456 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0.258 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.893 0.797 0.712 0.636 0.567 0.507 0,452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.093 0.080 0.069 0.060 0.051 H DU int Print Dono Answer ts Present Value of Ordinary Annuity of $1 6% 7% 8% 10% 12% Periods 4% 5% 14% 16% s roun Period 1 0.962 0.952 Period 2 1.886 1.859 Period 3 2.775 2.723 Period 4 3.630 3.546 Period 5 4.452 4.329 Period 6 5.242 5.076 Period 7 6.002 5.786 Period 8 6.733 6.463 Period 9 7.435 7.108 Period 10 8.111 7.722 Period 11 8.760 8.306 Period 129.385 8.863 Period 139.986 9.394 Period 14 10.563 9.899 Period 15 11.11810.380 Period 16 11.652 10.838 Period 17 12.166 11.274 Period 18 12.659 11.690 Period 19 13.134 12.085 Period 20 13.590 12.462 0.943 1.833 2.673 3,465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.336 10.594 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6,495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7 250 7.366 7.469 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.668 5.749 5.818 5.877 5.929 ET ntl Print Done The second picture is the question, I need help with.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started