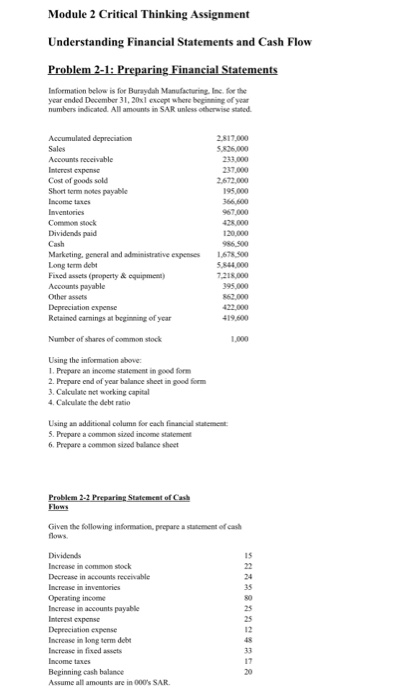

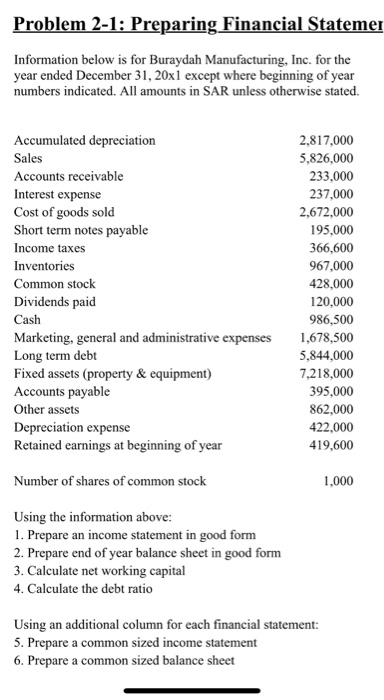

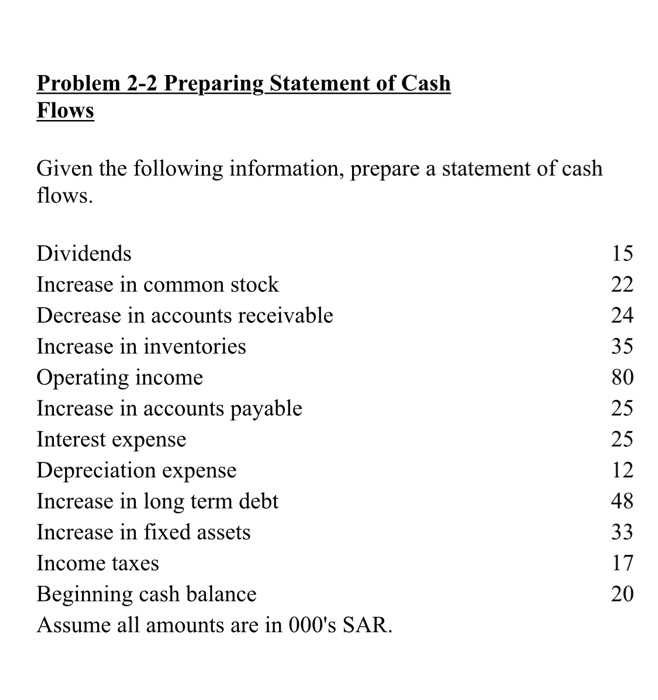

Module 2 Critical Thinking Assignment Understanding Financial Statements and Cash Flow Problem 2-1: Preparing Financial Statements Information below is for Buraydah Manufacturing, Inc. for the year ended December 31, 20x1 except where beginning of year numbers indicated. All amounts in SAR unless otherwise stated Accumulated depreciation Sales Accounts receivable Interest expense Cost of goods sold Short term notes payable Income taxes Inventories Common stock Dividends paid Cash Marketing, general and administrative expenses Long term debet Fixed assets (property & equipment) Accounts payable Other assets Depreciation expense Retained camnings at beginning of your Number of shares of common stock Using the information above 1. Prepare an income statement in good form 2. Prepare end of year balance sheet in good form 3. Calculate networking capital 4. Calculate the debt ratio 2.817.000 5.806.000 233.000 237.000 2.672.000 195.000 366.600 967.000 428.000 120.000 986 500 1.678.500 5.544.000 7210.000 395.000 862.000 422.000 1.000 Using an additional column for each financial statement: 5. Prepare a common sized income statement 6. Prepare a common sized balance sheet Problem 2-2 Preparing Statement of Cash Given the following information, prepare a statement of cash flows. Dividends 15 Increase in common stock Decrease in accounts receivable 24 Increase in inventories Operating income 30 Increase in accounts payable Interest expense 25 Depreciation expense Increase in long term debt Increase in fixed Income taxes Beginning cash balance Assume all amounts are in 000's SAR. 33 17 20 Problem 2-1: Preparing Financial Statemer Information below is for Buraydah Manufacturing, Inc. for the year ended December 31, 20x1 except where beginning of year numbers indicated. All amounts in SAR unless otherwise stated. Accumulated depreciation Sales Accounts receivable Interest expense Cost of goods sold Short term notes payable Income taxes Inventories Common stock Dividends paid Cash Marketing, general and administrative expenses Long term debt Fixed assets (property & equipment) Accounts payable Other assets Depreciation expense Retained earnings at beginning of year 2,817,000 5,826,000 233,000 237,000 2,672,000 195,000 366,600 967,000 428,000 120,000 986,500 1,678,500 5,844,000 7,218,000 395,000 862,000 422,000 419,600 Number of shares of common stock 1,000 Using the information above: 1. Prepare an income statement in good form 2. Prepare end of year balance sheet in good form 3. Calculate net working capital 4. Calculate the debt ratio Using an additional column for each financial statement: 5. Prepare a common sized income statement 6. Prepare a common sized balance sheet Problem 2-2 Preparing Statement of Cash Flows Given the following information, prepare a statement of cash flows. 15 22 24 Dividends Increase in common stock Decrease in accounts receivable Increase in inventories Operating income Increase in accounts payable Interest expense Depreciation expense Increase in long term debt Increase in fixed assets Income taxes Beginning cash balance Assume all amounts are in 000's SAR. 35 80 25 25 12 48 33 17 20