Answered step by step

Verified Expert Solution

Question

1 Approved Answer

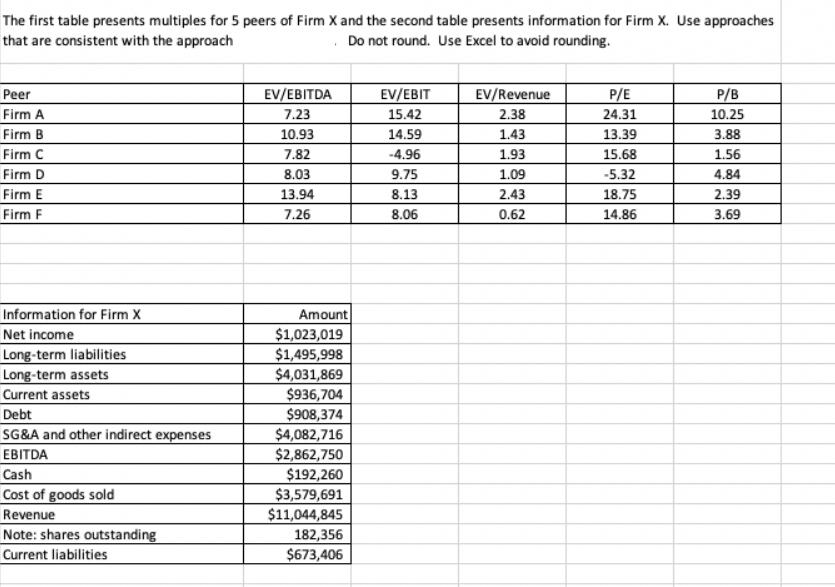

The first table presents multiples for 5 peers of Firm X and the second table presents information for Firm X. Use approaches that are

The first table presents multiples for 5 peers of Firm X and the second table presents information for Firm X. Use approaches that are consistent with the approach Do not round. Use Excel to avoid rounding. Peer Firm A Firm B Firm C Firm D Firm E Firm F Information for Firm X Net income Long-term liabilities Long-term assets Current assets Debt SG&A and other indirect expenses EBITDA Cash Cost of goods sold Revenue Note: shares outstanding Current liabilities EV/EBITDA 7.23 10.93 7.82 8.03 13.94 7.26 Amount $1,023,019 $1,495,998 $4,031,869 $936,704 $908,374 $4,082,716 $2,862,750 $192,260 $3,579,691 $11,044,845 182,356 $673,406 EV/EBIT 15.42 14.59 -4.96 9.75 8.13 8.06 EV/Revenue 2.38 1.43 1.93 1.09 2.43 0.62 P/E 24.31 13.39 15.68 -5.32 18.75 14.86 P/B 10.25 3.88 1.56 4.84 2.39 3.69 Fill in the following table. What is the estimated share price of Firm X based on the average of relevant peer multiples? What is the estimated share price of Firm X based on the median of relevant peer multiples? EV/EBITDA EV/EBIT EV/Revenue P/E P/B

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To fill in the table and calculate the estimated share price of Firm X based on the average and medi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started