Answered step by step

Verified Expert Solution

Question

1 Approved Answer

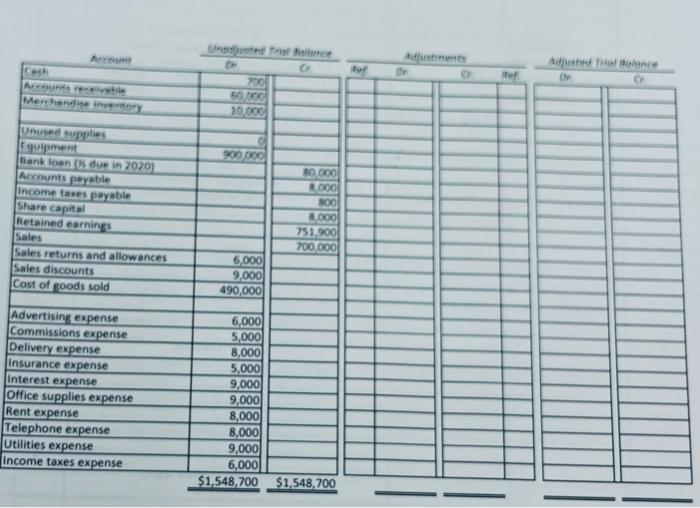

The fiscal year-end of King Storelnc. is December 31. 2019. The company uses the perpetual inventory system. Required: look at the picture and please complete

The fiscal year-end of King Storelnc. is December

31. 2019. The company uses the perpetual

inventory system.

Required: look at the picture and please complete all these 3 steps. i will leave 2 upvotes using 2 accounts if u do everything propely

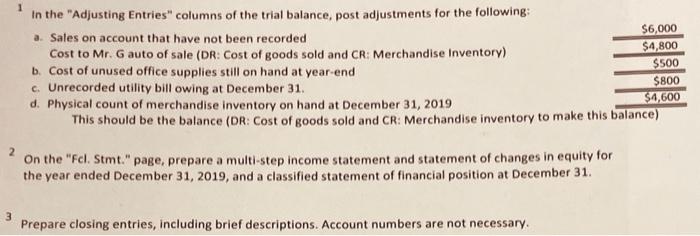

1. see the picture:In the "Adjusting Entries" columns of the trial balance, post adjustments for the following

2. On the "Fcl. Stmt." page, prepare a multi-step income statement and statement of changes in equity for

the year ended December 31, 2019, and a classified statement of financial position at December 31.

3.prepare closing entries, including brief descriptions. Account numbers are not necessary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started