Answered step by step

Verified Expert Solution

Question

1 Approved Answer

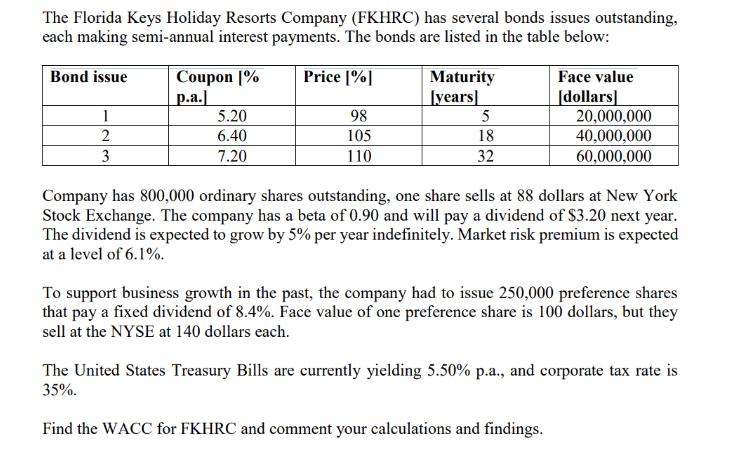

The Florida Keys Holiday Resorts Company (FKHRC) has several bonds issues outstanding, each making semi-annual interest payments. The bonds are listed in the table

The Florida Keys Holiday Resorts Company (FKHRC) has several bonds issues outstanding, each making semi-annual interest payments. The bonds are listed in the table below: Price [%] Bond issue 1 2 3 Coupon [% p.a.] 5.20 6.40 7.20 98 105 110 Maturity [years] 5 18 32 Face value [dollars] 20,000,000 40,000,000 60,000,000 Company has 800,000 ordinary shares outstanding, one share sells at 88 dollars at New York Stock Exchange. The company has a beta of 0.90 and will pay a dividend of $3.20 next year. The dividend is expected to grow by 5% per year indefinitely. Market risk premium is expected at a level of 6.1%. To support business growth in the past, the company had to issue 250,000 preference shares that pay a fixed dividend of 8.4%. Face value of one preference share is 100 dollars, but they sell at the NYSE at 140 dollars each. The United States Treasury Bills are currently yielding 5.50% p.a., and corporate tax rate is 35%. Find the WACC for FKHRC and comment your calculations and findings.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to calculate the WACC for FKHRC 1 Cost of debt Bond 1 Coupon rate 64 Current price 105 of face value Yield to maturity Coupon Price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started