Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following (2) questions are based on the following data: Year Rp Rm Rf 2000 18.1832 -24.9088 5.112 2001 -3.454 -15.1017 5.051 2002 47.5573 20.784

The following (2) questions are based on the following data:

| Year | Rp | Rm | Rf |

| 2000 | 18.1832 | -24.9088 | 5.112 |

| 2001 | -3.454 | -15.1017 | 5.051 |

| 2002 | 47.5573 | 20.784 | 3.816 |

| 2003 | 28.7035 | 9.4163 | 4.2455 |

| 2004 | 29.8613 | 8.7169 | 4.2182 |

| 2005 | 11.2167 | 16.3272 | 4.3911 |

| 2006 | 32.2799 | 14.5445 | 4.7022 |

| 2007 | -41.0392 | -36.0483 | 4.0232 |

| 2008 | 17.6082 | 9.7932 | 2.2123 |

| 2009 | 14.1058 | 16.5089 | 3.8368 |

| 2010 | 16.1978 | 8.0818 | 3.2935 |

| 2011 | 11.558 | 15.1984 | 1.8762 |

| 2012 | 42.993 | 27.1685 | 1.7574 |

| 2013 | 18.8682 | 17.2589 | 3.0282 |

| 2014 | -1.4678 | 5.1932 | 2.1712 |

| 2015 | 9.2757 | 4.4993 | 2.2694 |

| 2016 | 8.5985 | 23.624 | 2.4443 |

When performing calculations in the following problems, use the numbers in the table as-is. I.e., do NOT convert 8.5985 to 8.5985% (or 0.085985). Just use plain 8.5985.

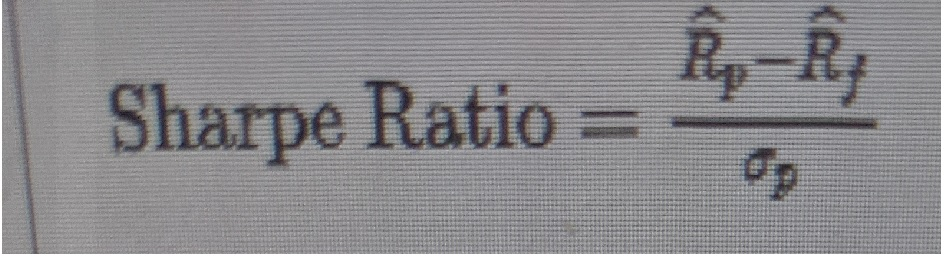

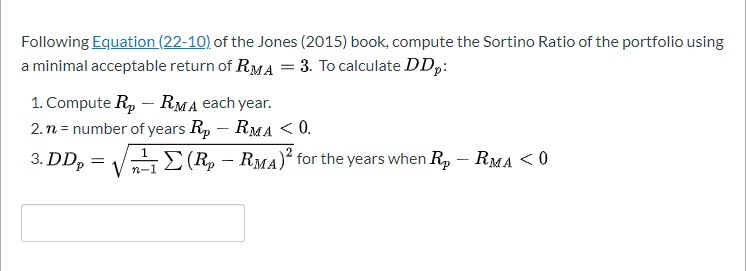

5. What is the Sharpe Ratio of the portfolio using the following equation:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started