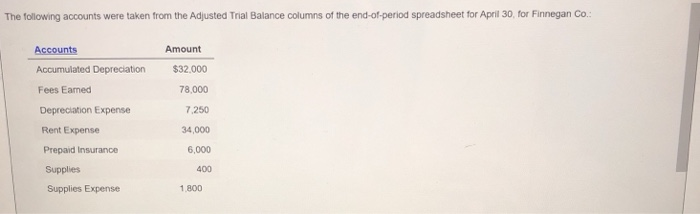

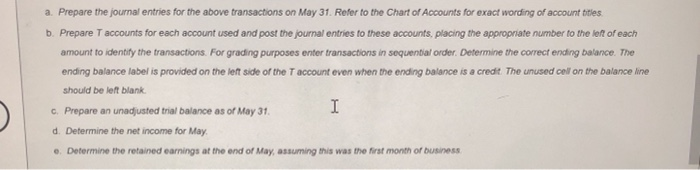

The following accounts were taken from the Adjusted Trial Balance columns of the end-of-period spreadsheet for April 30, for Finnegan Co.: Accounts Amount $32,000 Accumulated Depreciation 78,000 Fees Eamed Depreciation Expense 7.250 Rent Expense 34,000 Prepaid Insurance 6,000 Supplies 400 Supplies Expense 1.800 a. Prepare the journal entries for the above transactions on May 31. Refer to the Chart of Accounts for exact wording of account titles b. Prepare Taccounts for each account used and post the journal entries to these accounts, placing the appropriate number to the left of each amount to identify the transactions. For grading purposes enter transactions in sequential order. Determine the correct ending balance. The ending balance label is provided on the left side of the T account even when the ending balance is a credit The unused cell on the balance ine should be left blank c. Prepare an unadjusted trial balance as of May 31, I d. Determine the net income for May e. Determine the retained earnings at the end of May, assuming this was the first month of business The following accounts were taken from the Adjusted Trial Balance columns of the end-of-period spreadsheet for April 30, for Finnegan Co.: Accounts Amount $32,000 Accumulated Depreciation 78,000 Fees Eamed Depreciation Expense 7.250 Rent Expense 34,000 Prepaid Insurance 6,000 Supplies 400 Supplies Expense 1.800 a. Prepare the journal entries for the above transactions on May 31. Refer to the Chart of Accounts for exact wording of account titles b. Prepare Taccounts for each account used and post the journal entries to these accounts, placing the appropriate number to the left of each amount to identify the transactions. For grading purposes enter transactions in sequential order. Determine the correct ending balance. The ending balance label is provided on the left side of the T account even when the ending balance is a credit The unused cell on the balance ine should be left blank c. Prepare an unadjusted trial balance as of May 31, I d. Determine the net income for May e. Determine the retained earnings at the end of May, assuming this was the first month of business