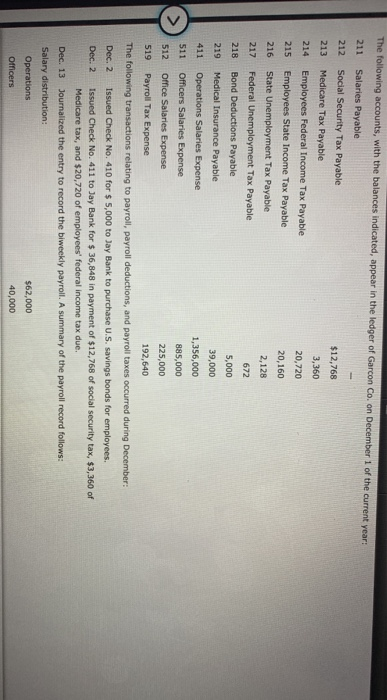

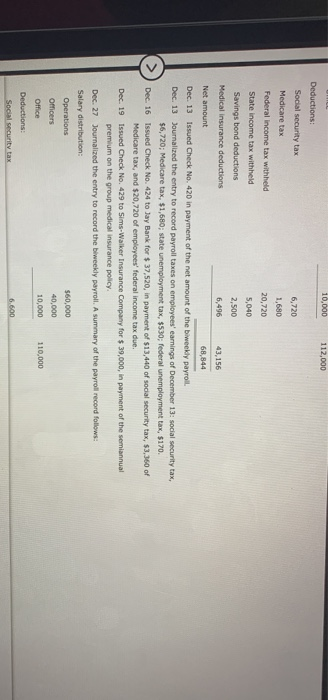

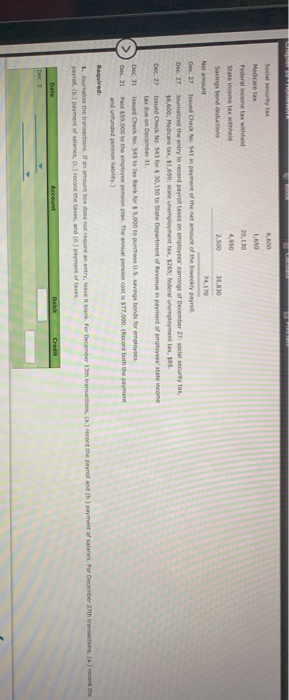

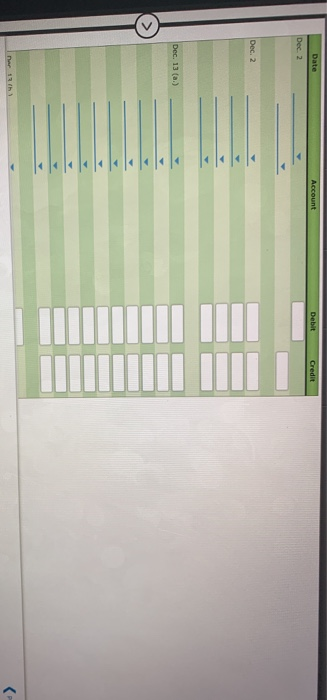

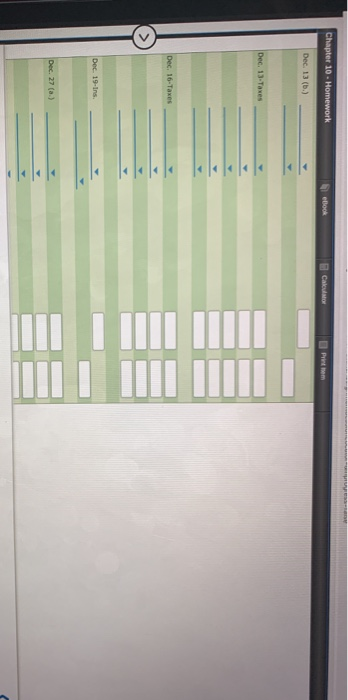

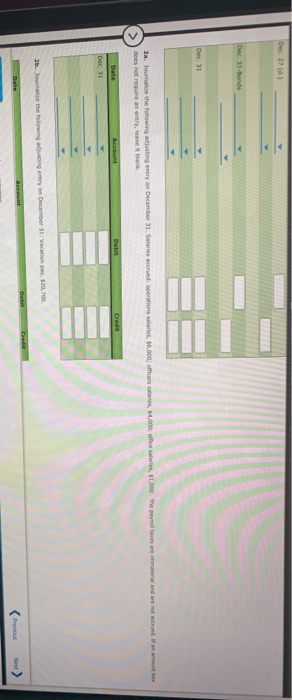

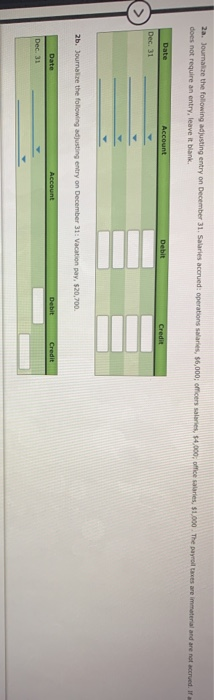

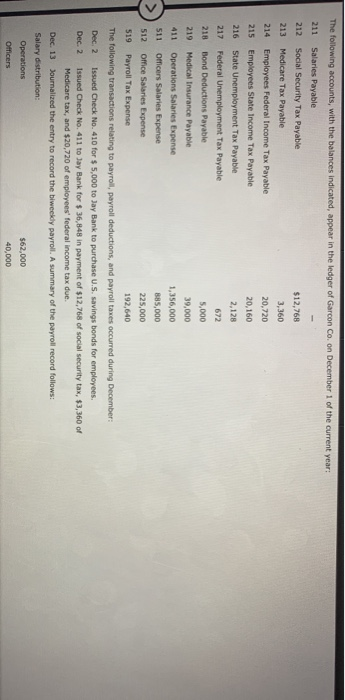

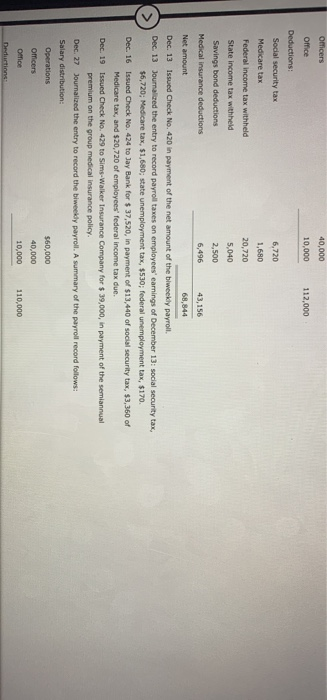

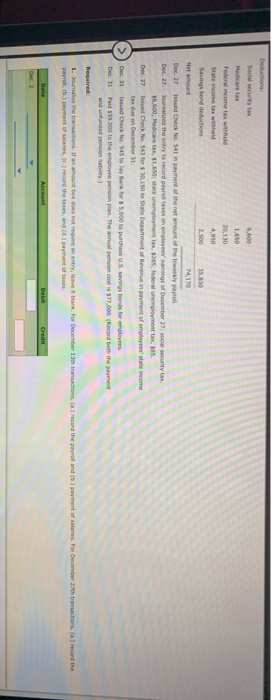

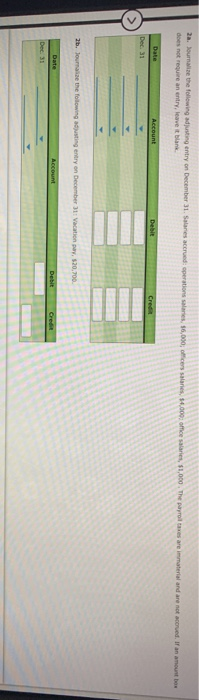

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: 211 Salaries Payable 212 Social Security Tax Payable $12,768 213 Medicare Tax Payable 3,360 214 Employees Federal Income Tax Payable 20,720 215 Employees State Income Tax Payable 20,160 216 State Unemployment Tax Payable 2,128 217 Federal Unemployment Tax Payable 672 218 Bond Deductions Payable 5,000 219 Medical Insurance Payable 39,000 Operations Salaries Expense 1,356,000 511 Officers Salaries Expense 885,000 512 Office Salaries Expense 225,000 519 Payroll Tax Expense 192,640 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2 Issued Check No. 410 for $ 5,000 to Jay Bank to purchase U.S. savings bonds for employees. Dec. 2 Issued Check No. 411 to Jay Bank for $ 36,848 in payment of $12,768 of social security tax, $3,360 of Medicare tax, and $20,720 of employees' federal income tax due. Dec. 13 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Salary distribution: Operations $62,000 Officers 40,000 10,000 112,000 Deductions: Social security tax 6,720 Medicare tax 1,680 Federal income tax withheld 20,720 State income tax withheld 5,040 Savings bond deductions 2,500 Medical insurance deductions 6,496 43, 156 Net amount 68,844 Dec. 13 Issued Check No. 420 in payment of the net amount of the biweekly payroll Dec. 13 Journalized the entry to record payroll taxes on employees' earnings of December 13: social security tax, $6,720; Medicare tax, $1,680; state unemployment tax, $530; federal unemployment tax, $170. Dec. 16 Issued Check No. 424 to Jay Bank for $ 37,520, in payment of $13,440 of social security tax, $3,360 of Medicare tax, and $20,720 of employees' federal income tax due Dec. 19 Issued Check No. 429 to Sims-Walker Insurance Company for $ 39,000, in payment of the semiannual premium on the group medical insurance policy. Dec. 27 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Salary distribution: Operations $60,000 Officers 40,000 Office 10,000 110,000 Deductions: Social security tax 6.600 Social security tax Medicare te 1,650 Federal income tax with 20130 State income tax wehed 4,950 Savings bond deductions 2.500 35,830 Net amount 74.170 Dec. 27 Issued Check No. 541 in payment of the net amount of the pro Dec 27 Journalized the entry to record payroll taxes on employees' earings of December 27 social security tax, 16,600: Medicare tax, 51.650 state unemployment tax, 5265; federal unemployment tax, $85. Dec. 27 Issued Check No. 543 for $30,150 to State Department of Revenue in payment of employees' state income tax due on December 31 Dec 31 Issued Check No: 545 to Say Bank for $5.000 to purchase U.S. savings bords for employees Dec. 31 Paid $59,000 to the employee pension plan. The annual pension cost is $77,000 (Record both the payment and unfunded pension abit) Required 1. Journal the transactions. If an amount box does not require an entry leave it for December 13th transactions, (a) record the payroll and (b) payment of sales For December 27thansactions, a) record the payroll, (b) payment of salaries, (c) record thes, and (d) payment of tas Date Account Debit Credit Dec. 2 Date Account Debit Credit Dec. 2 Dec. 13 (a.) narah Chapter 10 - Homework eBook Caku Printem Dec 13 (6) Dec. 13-Taxes Dec. 16-Taxes Dec 19-ins. Dec. 27 (a.) Dec. 27 (a.) Dec. 27 (1) Dec. 27 (c) Dec. 27 (d.) Dec. 270 Dec 31-Bonds Dec 31 2a. Journalce the following adjusting entry on December 31. Stories scored operations are $6.000 oers salaries, 34,000 offices, 1,000. The payroll taxes e material and are not credit box does not require an entry leave it bank Date Debit Crede Dec 31 2b. Journalize the following adjusting entry on December 31: Vacation pov. 20,700 Date Previous Most 2a. Journalize the following adjusting entry on December 31. Salaries accrued operations salaries, $6,000; officers salaries, 14.000, offeries, $1,000. The payroll taxes are immaterial and are not cred. If does not require an entry, leave it blank. Date Account Debit Credit Dec. 31 2b. Journalize the following adjusting entry on December 31: Vacation pay $20,700. Date Account Debit Credit Dec. 31 The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: 211 Salaries Payable 212 Social Security Tax Payable $12,768 213 Medicare Tax Payable 3,360 214 Employees Federal Income Tax Payable 20,720 215 Employees State Income Tax Payable 20,160 216 State Unemployment Tax Payable 2,128 217 Federal Unemployment Tax Payable 672 218 Bond Deductions Payable 5,000 219 Medical Insurance Payable 39,000 411 Operations Salaries Expense 1,356,000 511 Officers Salaries Expense 885,000 512 Office Salaries Expense 225,000 519 Payroll Tax Expense 192,640 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2 Issued Check No. 410 for $5,000 to Jay Bank to purchase U.S. savings bonds for employees Dec. 2 Issued Check No. 411 to Jay Bank for $ 36,848 in payment of $12,768 of social security tax, $3,360 of Medicare tax, and $20,720 of employees' federal income tax due. Dec. 13 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Salary distribution: Operations $62,000 Officers 40,000 Officers 40,000 Office 10,000 112,000 Deductions 2.50D Social security tax 6,720 Medicare tax 1,680 Federal income tax withheld 20,720 State income tax withheld 5,040 Savings bond deductions Medical insurance deductions 6,496 43,156 Net amount 68,844 Dec. 13 Issued Check No. 420 in payment of the net amount of the biweekly payroll Dec. 13 Journalised the entry to record payroll taxes on employees' earnings of December 13: social security tax, $6,720; Medicare tax, $1,680; state unemployment tax, $530; federal unemployment tax, $170. Dec. 16 Issued Check No. 424 to Jay Bank for $ 37,520, in payment of $13,440 of social security tax, $3,360 of Medicare tax, and $20,720 of employees' federal income tax due. Dec. 19 Issued Check No. 429 to Sims-Walker Insurance Company for $ 39,000, in payment of the semiannual premium on the group medical insurance policy. Dec. 27 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Salary distribution: Operations $60,000 Omcers 40,000 Otice 10,000 110,000 Deductions Die 6.800 Media 1,650 Federal income tax withheld 20,130 State income tax with 4,950 Savings bond deductions 2.500 35.30 Net amount 74,170 Dec. 27 Issued Check No 541 in payment of the name of the weekly payroll Dec. 27 Journaled the entry to record payroll taxes on employees' earings of December 27 unity tax, $6,600; Medicaretas, $1,650 state unemployment tax, 265:federalnemployment tax, 85 Dec. 27 Issued Check 543 for $30,150 to State Department of Revenue in payment of employees' state income tax due on December 31 Dec. 31 Issued Check No. 45 to lay Bank for $5,000 to purchase 5. savings bords for employees Dec. 31 Paid 559,000 to the employee pension plan. The annual pension costis 177,000 (Record both the payment and unfunded pensionat) Required 1. Sourate the transactions. If an amount to does not require an entry leave it bank. For December 13th transactions, a) record the payrol and (b) payment of sale For December transactions, (a) record the payroll, tb.) payment of salaries, (c) record the taxes, and (d) payment of the Date Account Credit D2 Dec 13 (1) Dec 13 (1) Dec. 13-Taxes Dec. 19-Ins. Dec. 27 (a) Dec. 27 (1) Dec. 27 (b.) Dec. 27 (c.) Dec. 27 (d.) Dec. 31-Bonds Dec. 31 2a. Jumalize the following adjusting entry on December 31. Salaries accrued operations salaries, 16,000 officers salaries, 14.000: office salaries, $1,000. The payroll taxes are immaterial and are not acord. If an amount om does not require an entry leave it bank Date Account Debt Cred Dec 31 2b. Journaise the following adjusting entry on December 31: Vacation pav. 520.700. Account Date Dec. 31 Det Credit