Question

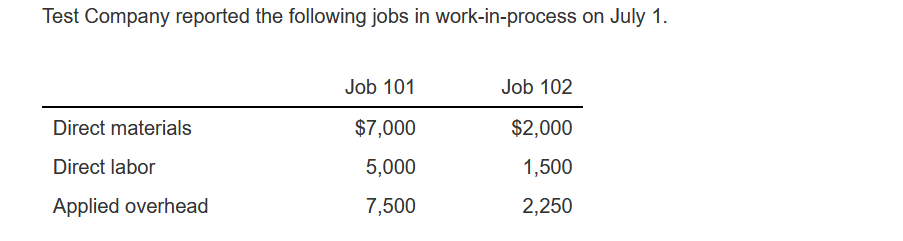

The following activity occurred during July. Purchased raw materials on account for $30,000 Started Job 103 into production Requisitioned materials: $2,000 for Job 101, $8,000

The following activity occurred during July.

| Purchased raw materials on account for $30,000 |

| Started Job 103 into production |

| Requisitioned materials: $2,000 for Job 101, $8,000 for Job 102, $4,000 for Job 103 |

| Recorded job time tickets: 100 hours for Job 101, 600 hours for Job 102, 300 hours for Job 103 |

| The direct labor wage rate was $10 per hour |

| Incurred overhead costs of $12,000 |

| Overhead is applied at a rate of $15 per direct labor hour |

| Completed Jobs 101 and 102 |

| Delivered Job 101 and billed the customer for cost plus 20% |

The journal entry to issue of direct materials to production would include

| A debit to cost of goods manufactured for $14,000 | ||||||||||||||||||||||||||

| A debit to raw materials inventory for $14,000 | ||||||||||||||||||||||||||

| A credit to work-in-process inventory - Job 101 for $2,000 | ||||||||||||||||||||||||||

| A credit to raw materials inventory for $14,000 he journal entry to record actual overhead costs would include

The entry to record the completion of Job 101 would include

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started