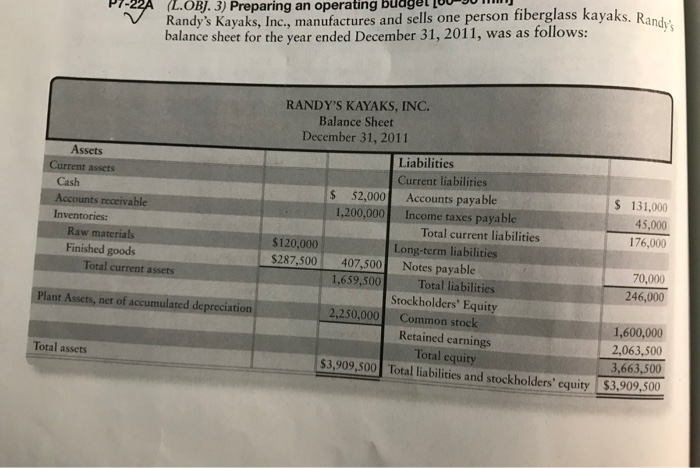

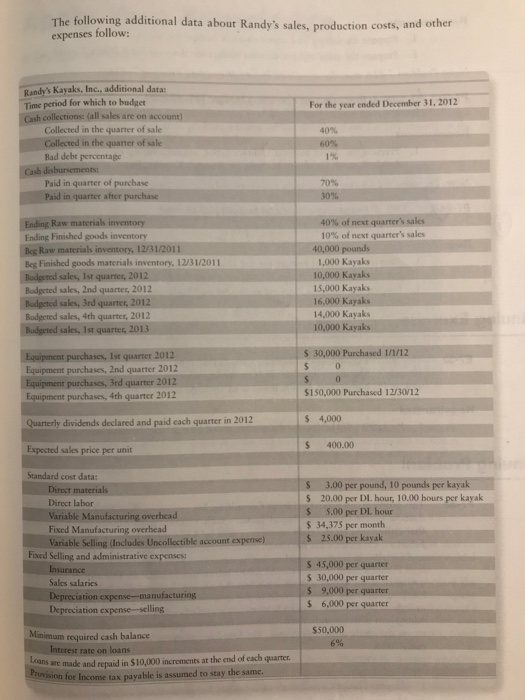

The following additional data about Randy's sales, production costs, and other expenses follow: Randy's Kayaks, Inc., additional data Cash collections: (all sales are on account) Time period for which to budget For the year ended December 31, 2012 Collected in the quarter of sale 40% 60% 1% Colleced in the quarter of sale Bad debe percentage Paid in quarter of purchase 70% 30% Paid in quarter after purchase ng Raw materials inventory Ending Finished goods inventory 40% of next quarter's sales 10% of next quarter's sales 40,000 pounds 1,000 Kayaks 10,000 Kayaks 15,000 Kayaks 16,000 Kayaks 14,000 Kayaks 10,000 Kayaks Bes Finished goods materials inventory, 12/3 1/2011 sales, 1st quarter, 2012 Bodgeted sales, 2nd quartes, 2012 Bodgeted sales, 3rd quarte, 2012 Budgeted sales, 4th quarter, 2012 sales, 1st quarter, 2013 S 30,000 Purchased 1/1/12 hases, 1st quarter 2012 0. Equipment purchases, 2nd quarter 2012 Equipment purchases, 4th quarter 2012 Quarterly dividends declared and paid cach quarter in 2012 Expected sales price per unit Standard cost data parchases, 3rd quarter 2012 $150,000 Purchased 12/3012 $ 4,000 400.00 s 3.00 per pound, 10 pounds per kayak 5 20.00 per DI. hour, 10.00 hours per kayalk Direct materials Direct labor Variable Manufacturing overhcad 5.00 per DL hour S 34,375 per month -Fixed Manufacturing overhead 25.00 per kayak Variable Sellins Inclules Uacolletibik acount expene) Fixed Selling and administrative expenses: 45,000 per quarter 30,000 per quarter 9,000 per quarter S 6.000 per quarter Sales salaries Depreciation expense-manufacturing Depreciation expense-selling $50,000 Min NInimum required cash balance terest rate on loans are made and repaid in $10,000 increments at the end of cach quartet sion for Income tax payable is Loans are to stay the same. Requirements . Prepare the selling and administrative budget for the year 2. Prepare the sales and production budget for the year for Randy's Kayaks, Inc. Note: Problem 7-22A must be completed before attempting Problem 7-23A. P7-23A L.OBJ. 3) Preparing an operating budget [35-45 min] Review your results from P7-22A. Requirement Prepard the direct materials) direct labor, manufacturing overhead, and ending finished goods inventory budgets for Randy's Kayaks, Inc. 1. Note: Problems 7-22A and 7-23A must be completed before attempting Problem 7-24A. -4 LOBJ. 4) Preparing a financial budget (35-45 min] Requirements Review your results from P7-22A and P7-23A. 1. Prepare a financial budget for the year, a schedule of cash collections from cus- tomers, cash payments for direct materials, and the cash budget. Prepare the budgeted income statement and budgeted balance sheet 2. Exercise The following additional data about Randy's sales, production costs, and other expenses follow: Randy's Kayaks, Inc., additional data Cash collections: (all sales are on account) Time period for which to budget For the year ended December 31, 2012 Collected in the quarter of sale 40% 60% 1% Colleced in the quarter of sale Bad debe percentage Paid in quarter of purchase 70% 30% Paid in quarter after purchase ng Raw materials inventory Ending Finished goods inventory 40% of next quarter's sales 10% of next quarter's sales 40,000 pounds 1,000 Kayaks 10,000 Kayaks 15,000 Kayaks 16,000 Kayaks 14,000 Kayaks 10,000 Kayaks Bes Finished goods materials inventory, 12/3 1/2011 sales, 1st quarter, 2012 Bodgeted sales, 2nd quartes, 2012 Bodgeted sales, 3rd quarte, 2012 Budgeted sales, 4th quarter, 2012 sales, 1st quarter, 2013 S 30,000 Purchased 1/1/12 hases, 1st quarter 2012 0. Equipment purchases, 2nd quarter 2012 Equipment purchases, 4th quarter 2012 Quarterly dividends declared and paid cach quarter in 2012 Expected sales price per unit Standard cost data parchases, 3rd quarter 2012 $150,000 Purchased 12/3012 $ 4,000 400.00 s 3.00 per pound, 10 pounds per kayak 5 20.00 per DI. hour, 10.00 hours per kayalk Direct materials Direct labor Variable Manufacturing overhcad 5.00 per DL hour S 34,375 per month -Fixed Manufacturing overhead 25.00 per kayak Variable Sellins Inclules Uacolletibik acount expene) Fixed Selling and administrative expenses: 45,000 per quarter 30,000 per quarter 9,000 per quarter S 6.000 per quarter Sales salaries Depreciation expense-manufacturing Depreciation expense-selling $50,000 Min NInimum required cash balance terest rate on loans are made and repaid in $10,000 increments at the end of cach quartet sion for Income tax payable is Loans are to stay the same. Requirements . Prepare the selling and administrative budget for the year 2. Prepare the sales and production budget for the year for Randy's Kayaks, Inc. Note: Problem 7-22A must be completed before attempting Problem 7-23A. P7-23A L.OBJ. 3) Preparing an operating budget [35-45 min] Review your results from P7-22A. Requirement Prepard the direct materials) direct labor, manufacturing overhead, and ending finished goods inventory budgets for Randy's Kayaks, Inc. 1. Note: Problems 7-22A and 7-23A must be completed before attempting Problem 7-24A. -4 LOBJ. 4) Preparing a financial budget (35-45 min] Requirements Review your results from P7-22A and P7-23A. 1. Prepare a financial budget for the year, a schedule of cash collections from cus- tomers, cash payments for direct materials, and the cash budget. Prepare the budgeted income statement and budgeted balance sheet 2. Exercise