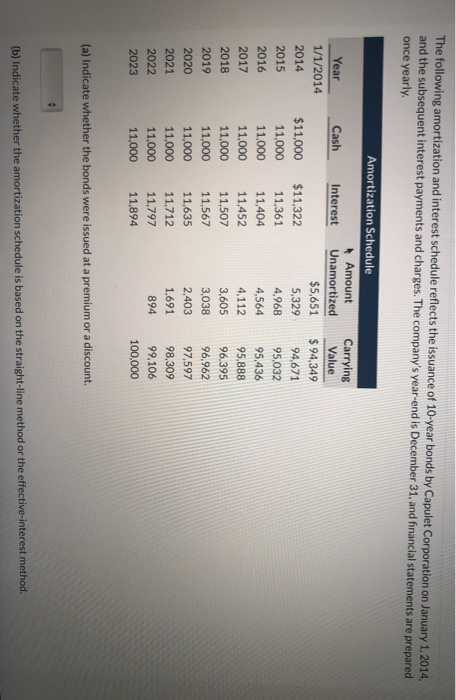

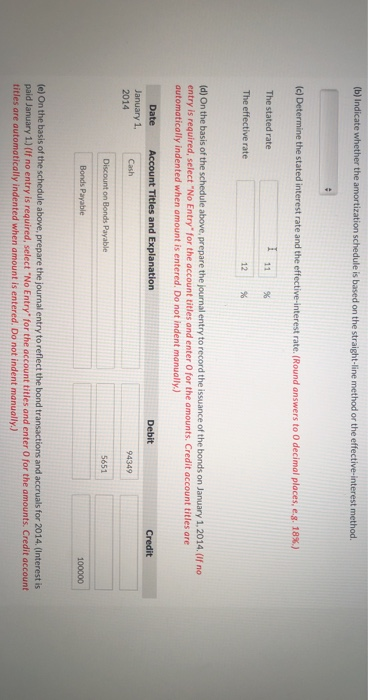

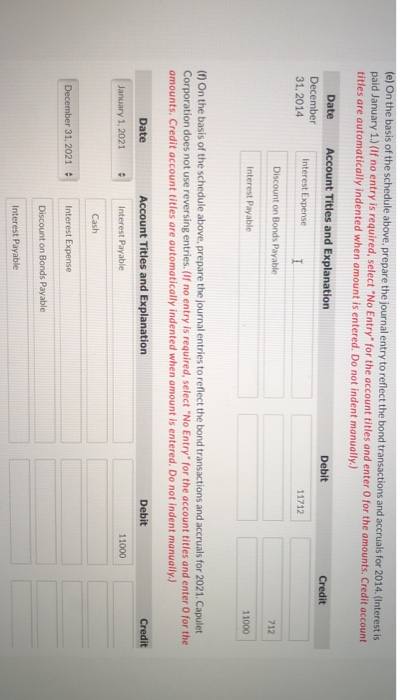

The following amortization and interest schedule reflects the issuance of 10-year bonds by Capulet Corporation on January 1, 2014, and the subsequent interest payments and charges. The company's year-end is December 31, and financial statements are prepared once yearly Year 1/1/2014 2014 2015 2016 2017 Amortization Schedule Amount Cash Interest Unamortized $5,651 $11,000 $11,322 5,329 11,000 11,361 4,968 11,000 11,404 4,564 11,000 11,452 4,112 11,000 11,507 3,605 11,000 11,567 3,038 11,000 11,635 2,403 11,000 11,712 1,691 11,000 11,797 894 11,000 11,894 Carrying Value $ 94,349 94,671 95,032 95,436 95,888 96,395 96,962 97,597 98,309 99,106 100,000 2018 2019 2020 2021 2022 2023 (a) Indicate whether the bonds were issued at a premium or a discount. (b) Indicate whether the amortization schedule is based on the straight-line method or the effective-interest method. (b) Indicate whether the amortization schedule is based on the straight-line method or the effective-interest method. (c) Determine the stated interest rate and the effective interest rate. (Round answers to O decimal places, c.8. 18%.) The stated rate I 11 % The effective rate 12 % (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2014. (If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit January 1 Cash 94349 2014 Discount on Bonds Payable 5651 Bonds Payable 100000 (e) On the basis of the schedule above, prepare the journal entry to reflect the bond transactions and accruals for 2014. (Interest is paid January 1.) (If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date (e) On the basis of the schedule above, prepare the journal entry to reflect the bond transactions and accruals for 2014. (Interestis paid January 1.) (if no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation December 31, 2014 Interest Expense 1 Discount on Bonds Payable Interest Payable Debit Credit 11712 712 11000 (1) On the basis of the schedule above, prepare the journal entries to reflect the bond transactions and accruals for 2021. Capulet Corporation does not use reversing entries. (If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Credit January 1, 2021 Interest Payable Debit 11000 Cash December 31, 2021 Interest Expense Discount on Bonds Payable Interest Payable