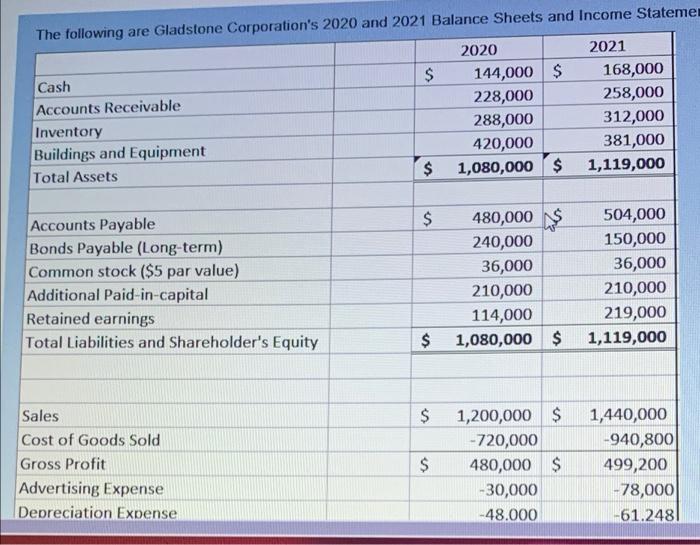

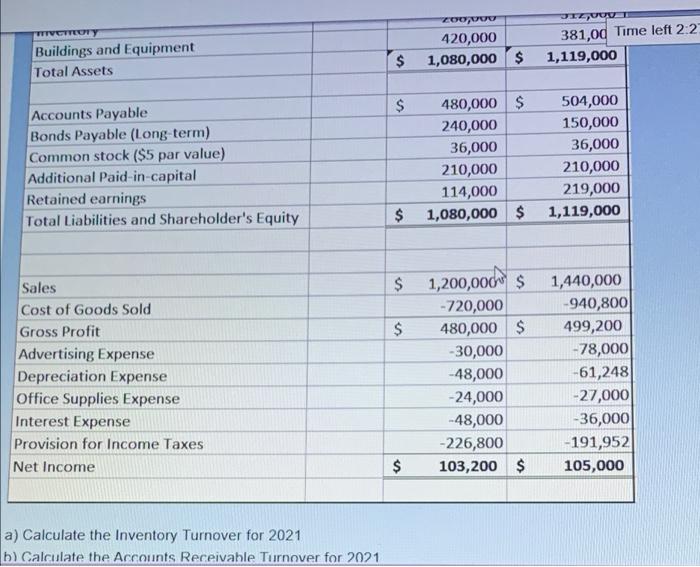

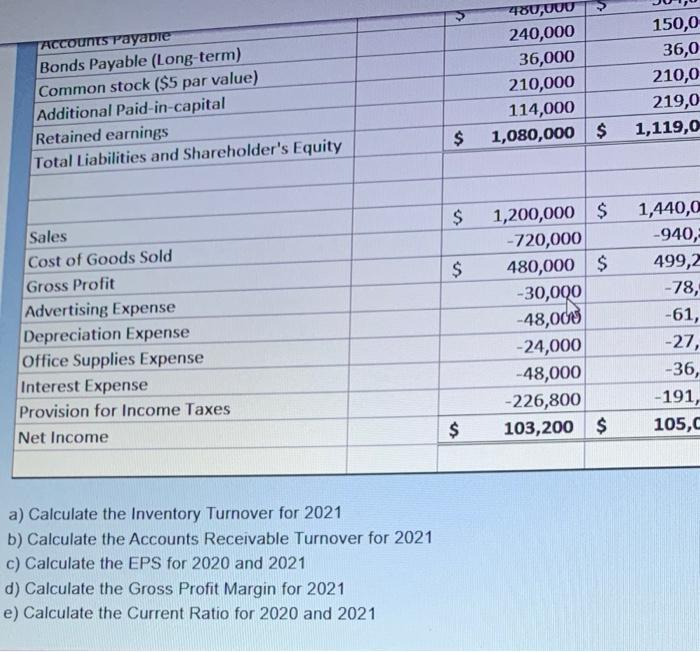

The following are Gladstone Corporation's 2020 and 2021 Balance Sheets and Income Stateme $ Cash Accounts Receivable Inventory Buildings and Equipment Total Assets 2020 144,000 $ 228,000 288,000 420,000 1,080,000 $ 2021 168,000 258,000 312,000 381,000 1,119,000 $ $ A Accounts Payable Bonds Payable (Long-term) Common stock ($5 par value) Additional Paid-in-capital Retained earnings Total Liabilities and Shareholder's Equity 480,000 $ 240,000 36,000 210,000 114,000 $ 1,080,000 $ 504,000 150,000 36,000 210,000 219,000 1,119,000 $ Sales Cost of Goods Sold Gross Profit Advertising Expense Depreciation Expense $ 1,200,000 $ -720,000 480,000 $ -30,000 -48.000 1,440,000 -940,800 499,200 -78,000 -61.248 TUVETTURY 700 420,000 1,080,000 $ DIEU 381,00 Time left 2:2 1,119,000 Buildings and Equipment Total Assets $ $ Accounts Payable Bonds Payable (Long-term) Common stock ($5 par value) Additional Paid-in-capital Retained earnings Total Liabilities and Shareholder's Equity 480,000 $ 240,000 36,000 210,000 114,000 1,080,000 $ 504,000 150,000 36,000 210,000 219,000 1,119,000 $ Sales Cost of Goods Sold Gross Profit Advertising Expense Depreciation Expense Office Supplies Expense Interest Expense Provision for Income Taxes Net Income $ 1,200,000 $ $ -720,000 $ 480,000 $ -30,000 -48,000 -24,000 -48,000 -226,800 $ 103,200 $ 1,440,000 -940,800 499,200 -78,000 -61,248 -27,000 -36,000 -191,952 105,000 a) Calculate the Inventory Turnover for 2021 b) Calculate the Accounts Receivable Turnover for 2021 ACCOUNts Payable Bonds Payable (Long-term) Common stock ($5 par value) Additional Paid-in-capital Retained earnings Total Liabilities and Shareholder's Equity 480,000 240,000 36,000 210,000 114,000 1,080,000 $ 150,0 36,0 210,0 219,0 1,119,0 $ $ $ Sales Cost of Goods Sold Gross Profit Advertising Expense Depreciation Expense Office Supplies Expense Interest Expense Provision for Income Taxes Net Income 1,200,000 $ -720,000 480,000 $ -30,000 -48,000 -24,000 -48,000 -226,800 103,200 $ 1,440,0 -940, 499,2 -78, -61, -27, -36, -191, 105, $ a) Calculate the Inventory Turnover for 2021 b) Calculate the Accounts Receivable Turnover for 2021 c) Calculate the EPS for 2020 and 2021 d) Calculate the Gross Profit Margin for 2021 e) Calculate the Current Ratio for 2020 and 2021