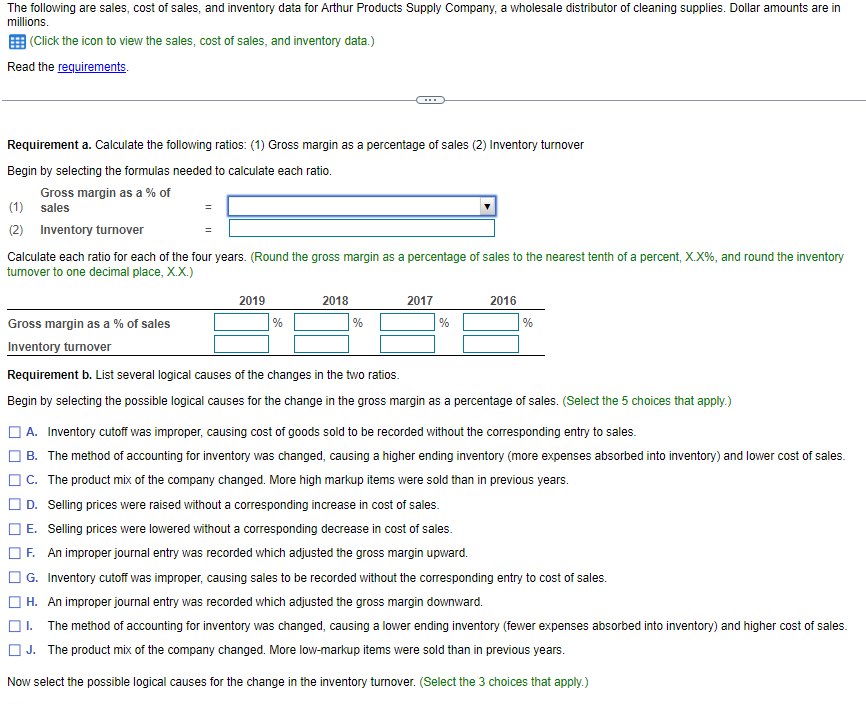

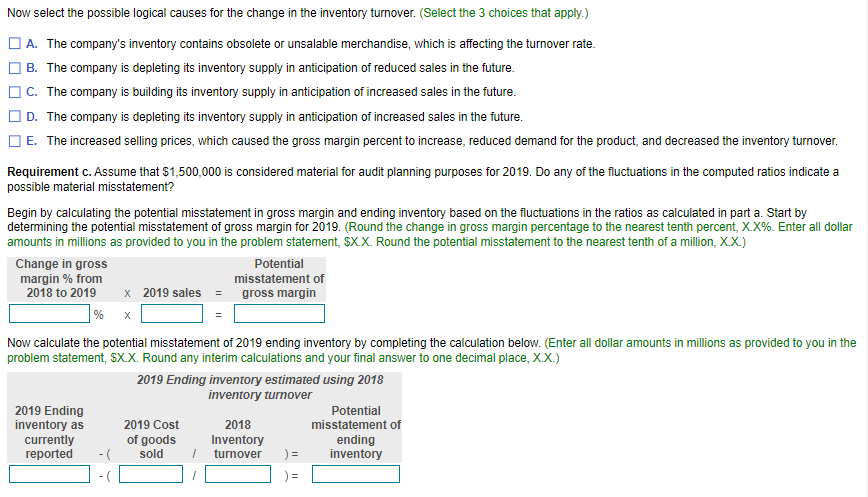

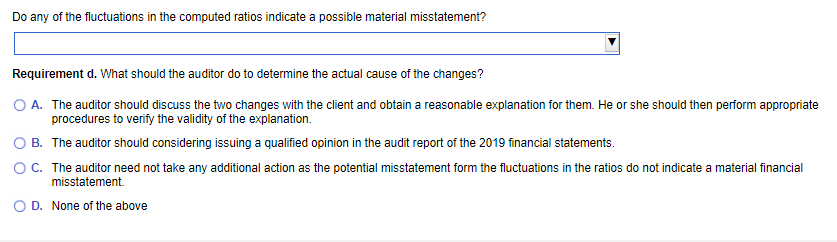

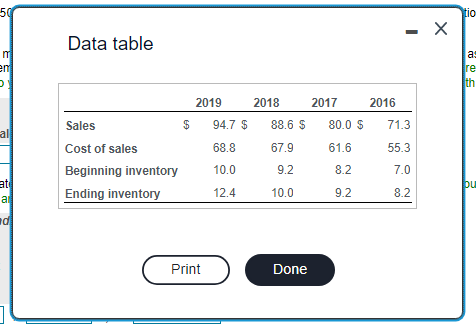

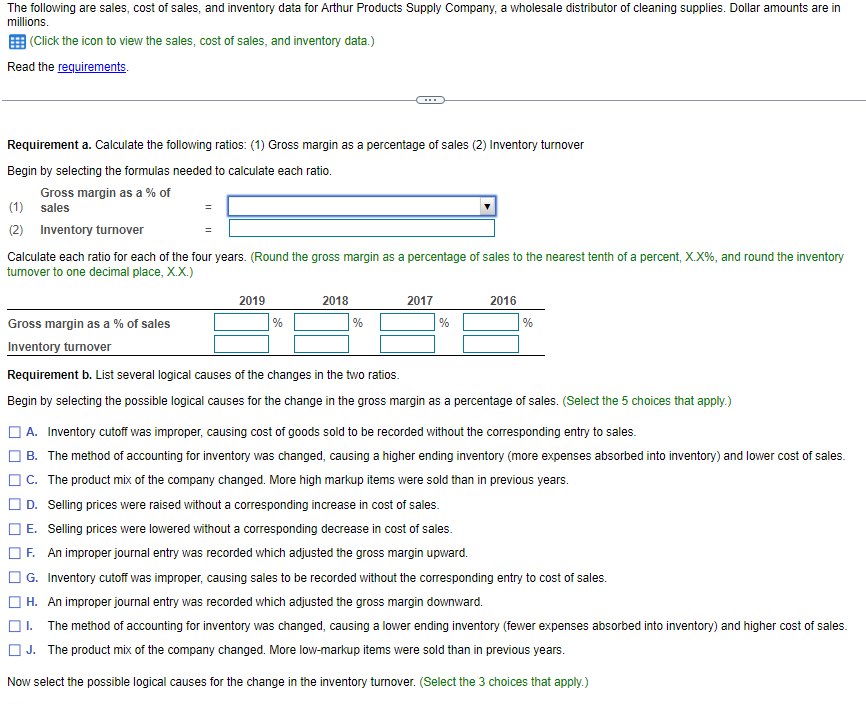

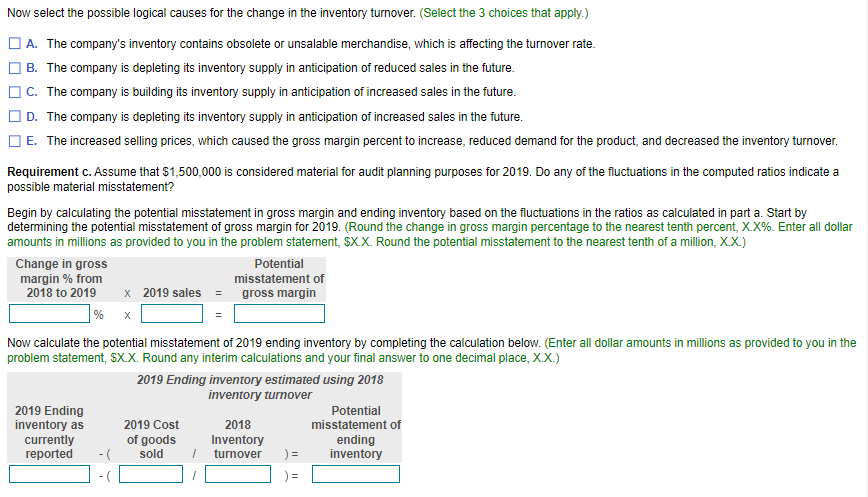

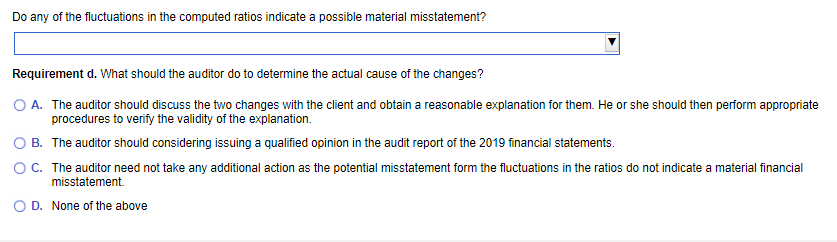

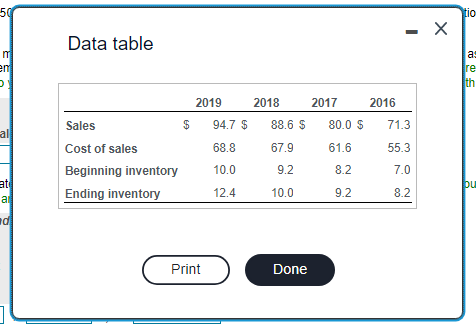

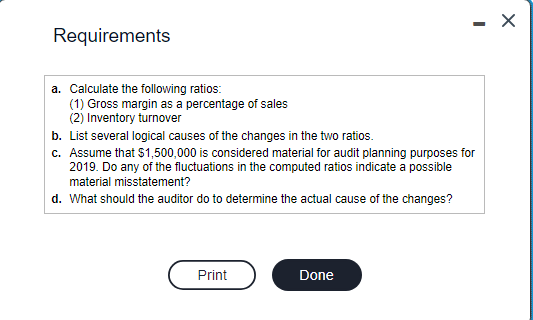

The following are sales, cost of sales, and inventory data for Arthur Products Supply Company, a wholesale distributor of cleaning supplies. Dollar amounts are in millions. (Click the icon to view the sales, cost of sales, and inventory data.) Read the Requirement a. Calculate the following ratios: (1) Gross margin as a percentage of sales (2) Inventory turnover Begin by selecting the formulas needed to calculate each ratio. Calculate each ratio for each of the four years. (Round the gross margin as a percentage of sales to the nearest tenth of a percent, X.X\%, and round the inventory turnover to one decimal place, X.X.) Requirement b. List several logical causes of the changes in the two ratios. Begin by selecting the possible logical causes for the change in the gross margin as a percentage of sales. (Select the 5 choices that apply.) A. Inventory cutoff was improper, causing cost of goods sold to be recorded without the corresponding entry to sales. B. The method of accounting for inventory was changed, causing a higher ending inventory (more expenses absorbed into inventory) and lower cost of sales. C. The product mix of the company changed. More high markup items were sold than in previous years. D. Selling prices were raised without a corresponding increase in cost of sales. E. Selling prices were lowered without a corresponding decrease in cost of sales. F. An improper journal entry was recorded which adjusted the gross margin upward. G. Inventory cutoff was improper, causing sales to be recorded without the corresponding entry to cost of sales. H. An improper journal entry was recorded which adjusted the gross margin downward. I. The method of accounting for inventory was changed, causing a lower ending inventory (fewer expenses absorbed into inventory) and higher cost of sales. J. The product mix of the company changed. More low-markup items were sold than in previous years. Now select the possible logical causes for the change in the inventory turnover. (Select the 3 choices that apply.) Now select the possible logical causes for the change in the inventory turnover. (Select the 3 choices that apply.) A. The company's inventory contains obsolete or unsalable merchandise, which is affecting the turnover rate. B. The company is depleting its inventory supply in anticipation of reduced sales in the future. C. The company is building its inventory supply in anticipation of increased sales in the future. D. The company is depleting its inventory supply in anticipation of increased sales in the future. E. The increased selling prices, which caused the gross margin percent to increase, reduced demand for the product, and decreased the inventory turnover. Requirement c. Assume that $1,500,000 is considered material for audit planning purposes for 2019 . Do any of the fluctuations in the computed ratios indicate a possible material misstatement? Begin by calculating the potential misstatement in gross margin and ending inventory based on the fluctuations in the ratios as calculated in part a. Start by determining the potential misstatement of gross margin for 2019 . (Round the change in gross margin percentage to the nearest tenth percent, X.X%. Enter all dollar amounts in millions as provided to you in the problem statement, $X.X. Round the potential misstatement to the nearest tenth of a million, X.X.) Now calculate the potential misstatement of 2019 ending inventory by completing the calculation below. (Enter all dollar amounts in millions as provided to you in the problem statement, $X.X. Round any interim calculations and your final answer to one decimal place, X.X.) Do any of the fluctuations in the computed ratios indicate a possible material misstatement? Requirement d. What should the auditor do to determine the actual cause of the changes? A. The auditor should discuss the two changes with the client and obtain a reasonable explanation for them. He or she should then perform appropriate procedures to verify the validity of the explanation. B. The auditor should considering issuing a qualified opinion in the audit report of the 2019 financial statements. C. The auditor need not take any additional action as the potential misstatement form the fluctuations in the ratios do not indicate a material financial misstatement. D. None of the above Data table Requirements a. Calculate the following ratios: (1) Gross margin as a percentage of sales (2) Inventory turnover b. List several logical causes of the changes in the two ratios. c. Assume that $1,500,000 is considered material for audit planning purposes for 2019. Do any of the fluctuations in the computed ratios indicate a possible material misstatement? d. What should the auditor do to determine the actual cause of the changes