Answered step by step

Verified Expert Solution

Question

1 Approved Answer

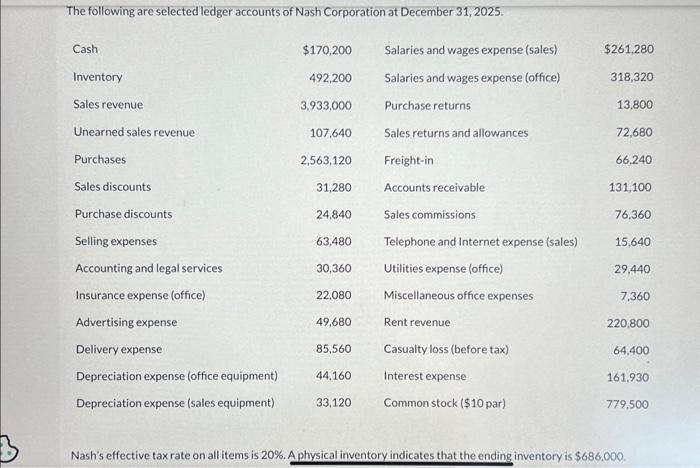

The following are selected ledger accounts of Nash Corporation at December 31, 2025. Cash $170,200 Salaries and wages expense (sales) $261,280 Inventory 492,200 Salaries

The following are selected ledger accounts of Nash Corporation at December 31, 2025. Cash $170,200 Salaries and wages expense (sales) $261,280 Inventory 492,200 Salaries and wages expense (office) 318,320 Sales revenue 3,933,000 Purchase returns 13,800 Unearned sales revenue 107,640 Sales returns and allowances 72,680 Purchases 2,563,120 Freight-in 66,240 Sales discounts 31,280 Accounts receivable 131,100 Purchase discounts 24,840 Sales commissions 76,360 Selling expenses 63,480 Telephone and Internet expense (sales) 15,640 Accounting and legal services 30,360 Utilities expense (office) 29,440 Insurance expense (office) 22,080 Miscellaneous office expenses 7,360 Advertising expense 49,680 Rent revenue 220,800 Delivery expense 85,560 Casualty loss (before tax) 64,400 Depreciation expense (office equipment) 44,160 Interest expense 161,930 Depreciation expense (sales equipment) 33,120 Common stock ($10 par) 779,500 Nash's effective tax rate on all items is 20%. A physical inventory indicates that the ending inventory is $686,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To prepare Nash Corporations income statement for the year ended December 31 2025 well follow these steps Calculate the Cost of Goods Sold COGS using the information given and the ending invent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started