Answered step by step

Verified Expert Solution

Question

1 Approved Answer

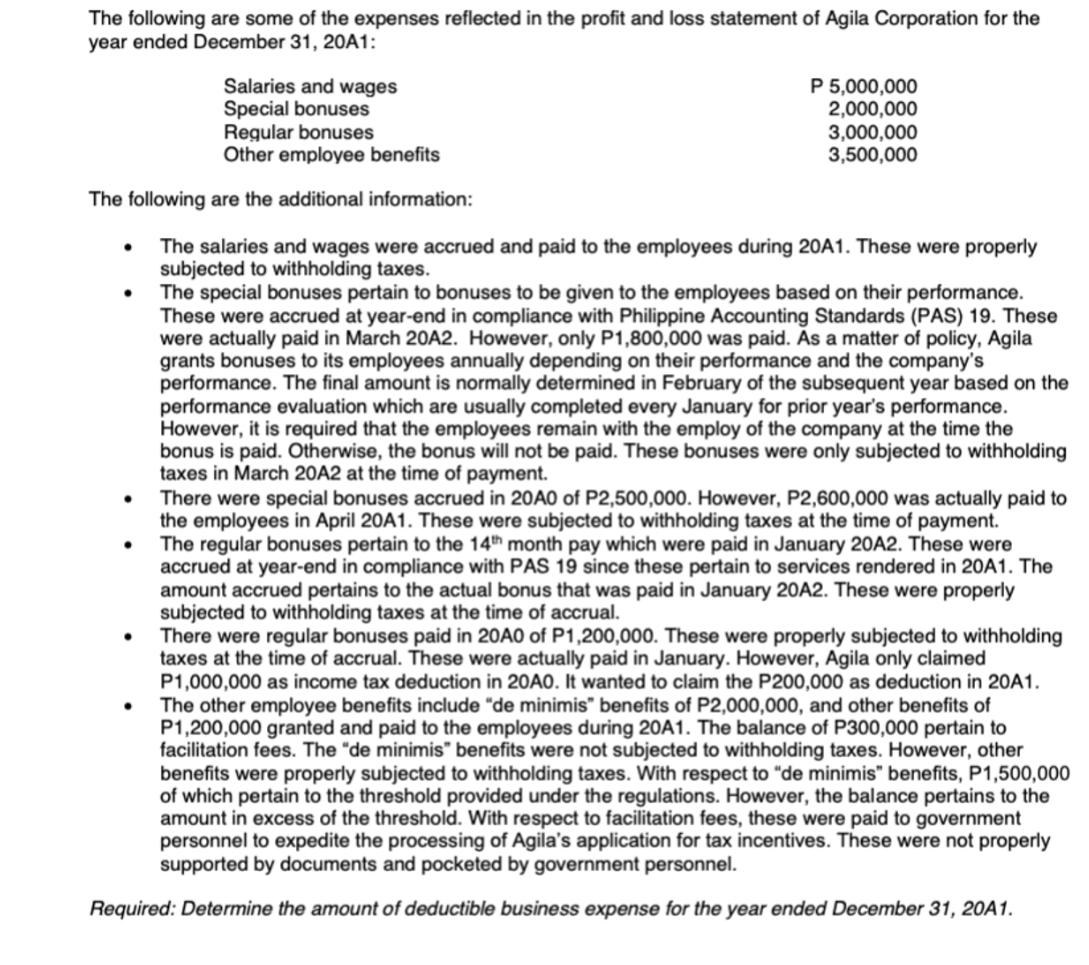

The following are some of the expenses reflected in the profit and loss statement of Agila Corporation for the year ended December 31, 20A1:

The following are some of the expenses reflected in the profit and loss statement of Agila Corporation for the year ended December 31, 20A1: Salaries and wages Special bonuses Regular bonuses Other employee benefits The following are the additional information: P 5,000,000 2,000,000 3,000,000 3,500,000 The salaries and wages were accrued and paid to the employees during 20A1. These were properly subjected to withholding taxes. The special bonuses pertain to bonuses to be given to the employees based on their performance. These were accrued at year-end in compliance with Philippine Accounting Standards (PAS) 19. These were actually paid in March 20A2. However, only P1,800,000 was paid. As a matter of policy, Agila grants bonuses to its employees annually depending on their performance and the company's performance. The final amount is normally determined in February of the subsequent year based on the performance evaluation which are usually completed every January for prior year's performance. However, it is required that the employees remain with the employ of the company at the time the bonus is paid. Otherwise, the bonus will not be paid. These bonuses were only subjected to withholding taxes in March 20A2 at the time of payment. There were special bonuses accrued in 20A0 of P2,500,000. However, P2,600,000 was actually paid to the employees in April 20A1. These were subjected to withholding taxes at the time of payment. The regular bonuses pertain to the 14th month pay which were paid in January 20A2. These were accrued at year-end in compliance with PAS 19 since these pertain to services rendered in 20A1. The amount accrued pertains to the actual bonus that was paid in January 20A2. These were properly subjected to withholding taxes at the time of accrual. There were regular bonuses paid in 20A0 of P1,200,000. These were properly subjected to withholding taxes at the time of accrual. These were actually paid in January. However, Agila only claimed P1,000,000 as income tax deduction in 20A0. It wanted to claim the P200,000 as deduction in 20A1. The other employee benefits include "de minimis" benefits of P2,000,000, and other benefits of P1,200,000 granted and paid to the employees during 20A1. The balance of P300,000 pertain to facilitation fees. The "de minimis" benefits were not subjected to withholding taxes. However, other benefits were properly subjected to withholding taxes. With respect to "de minimis" benefits, P1,500,000 of which pertain to the threshold provided under the regulations. However, the balance pertains to the amount in excess of the threshold. With respect to facilitation fees, these were paid to government personnel to expedite the processing of Agila's application for tax incentives. These were not properly supported by documents and pocketed by government personnel. Required: Determine the amount of deductible business expense for the year ended December 31, 20A1.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided the deductible business expenses for Agila Corporation for the year ended December 31 20A1 are as follows Salaries a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started