Question

The following are the 2021 and forecasted 2022 and 2023 balance sheets and income statements for SBD. Assume a tax rate of 20%, a discount

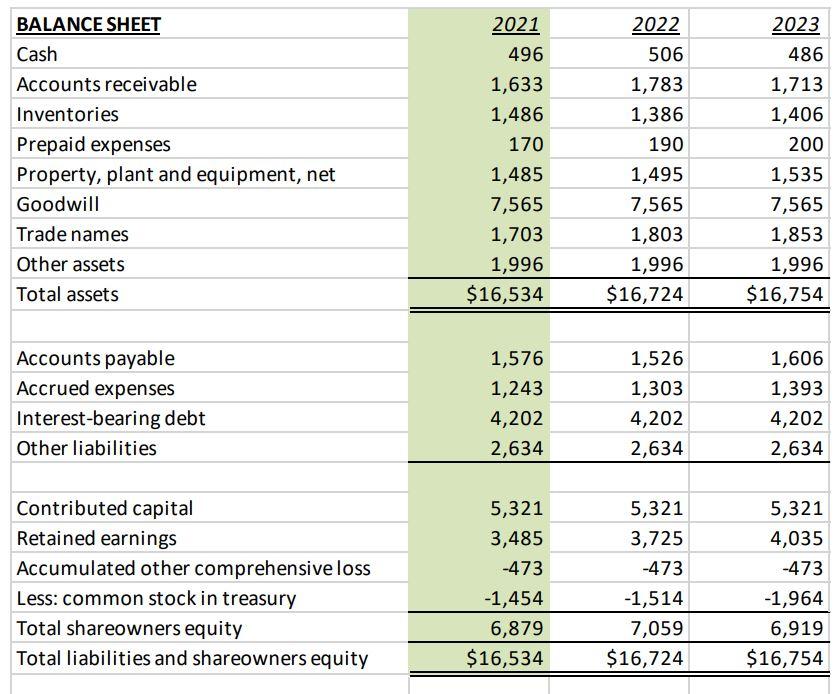

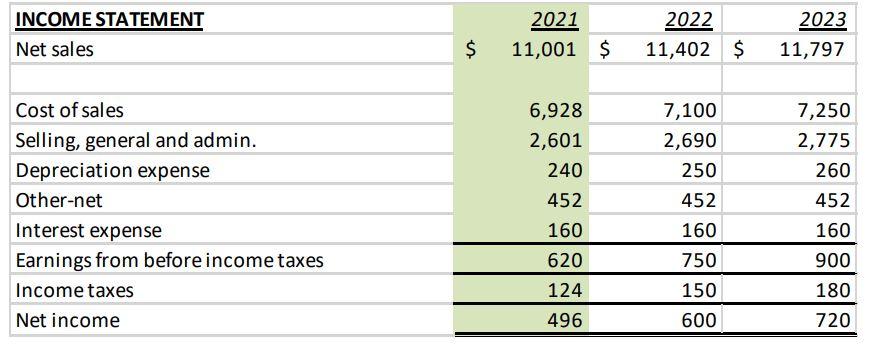

The following are the 2021 and forecasted 2022 and 2023 balance sheets and income statements for SBD. Assume a tax rate of 20%, a discount rate of 8% and that interest-bearing debt on the balance sheet and interest expense will remain constant going forward. For purposes of this problem only, assume that there is no depreciation included in Cost of Sales. SBD had 155 million shares outstanding on December 31, 2021. Assume that all of the assets and liabilities on SBDs 2021 balance sheet are carried at approximate fair value, except that the original Stanley brand which was internally developed is worth $4,500, total Property, Plant and Equipment is worth only $1,200, a lawsuit that is not included in the liabilities on the balance sheet is expected to cost $500 to resolve and a Superfund environmental obligation which is included in Other liabilities at $100 is expected to cost $300 to remediate.

Estimate the fair value of a share of SBDs stock as of December 31, 2021 using the balance sheet approach.

INCOME STATEMENT Net sales \begin{tabular}{rr|r|rr|} & 2021 & 2022 & & 2023 \\ $11,001 & $ & 11,402 & $ & 11,797 \end{tabular} Cost of sales Selling, general and admin. Depreciation expense Other-net Interest expense Earnings from before income taxes Income taxes Net income \begin{tabular}{|r|r|r|} \hline 6,928 & 7,100 & 7,250 \\ \hline 2,601 & 2,690 & 2,775 \\ \hline 240 & 250 & 260 \\ \hline 452 & 452 & 452 \\ \hline 160 & 160 & 160 \\ \hline 620 & 750 & 900 \\ \hline 124 & 150 & 180 \\ \hline 496 & 600 & 720 \\ \hline \end{tabular} INCOME STATEMENT Net sales \begin{tabular}{rr|r|rr|} & 2021 & 2022 & & 2023 \\ $11,001 & $ & 11,402 & $ & 11,797 \end{tabular} Cost of sales Selling, general and admin. Depreciation expense Other-net Interest expense Earnings from before income taxes Income taxes Net income \begin{tabular}{|r|r|r|} \hline 6,928 & 7,100 & 7,250 \\ \hline 2,601 & 2,690 & 2,775 \\ \hline 240 & 250 & 260 \\ \hline 452 & 452 & 452 \\ \hline 160 & 160 & 160 \\ \hline 620 & 750 & 900 \\ \hline 124 & 150 & 180 \\ \hline 496 & 600 & 720 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started