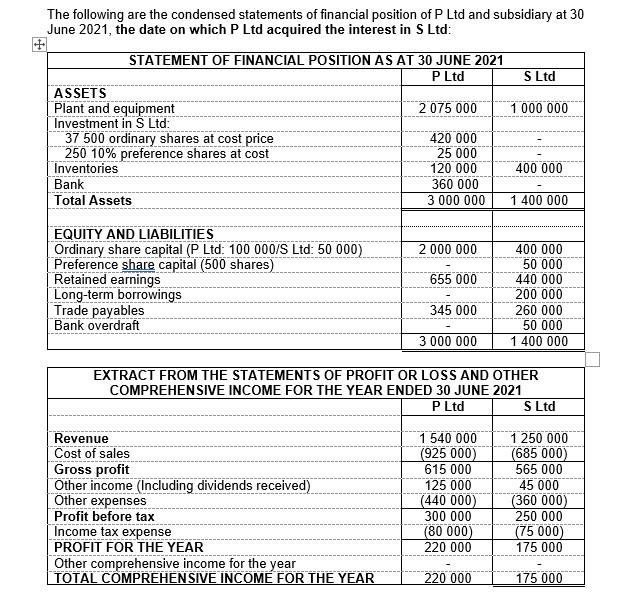

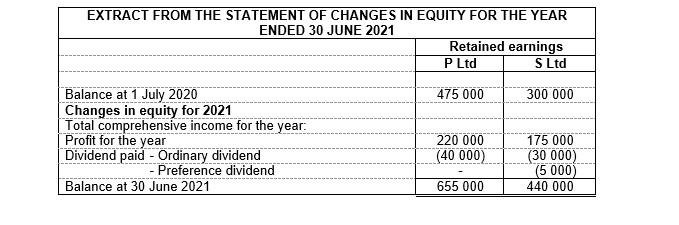

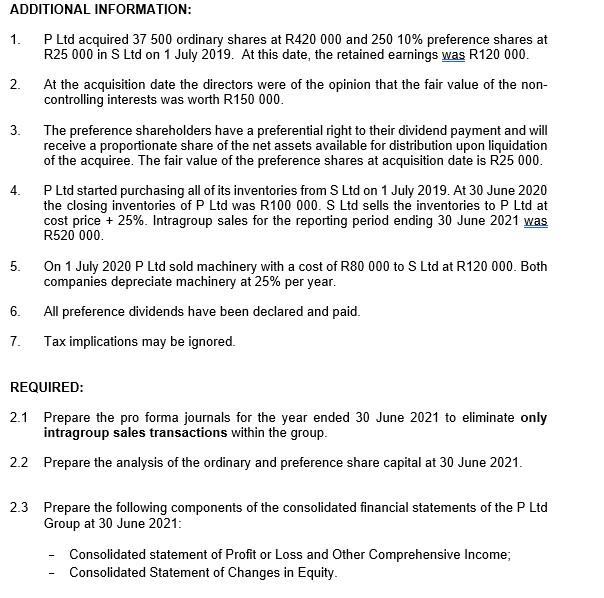

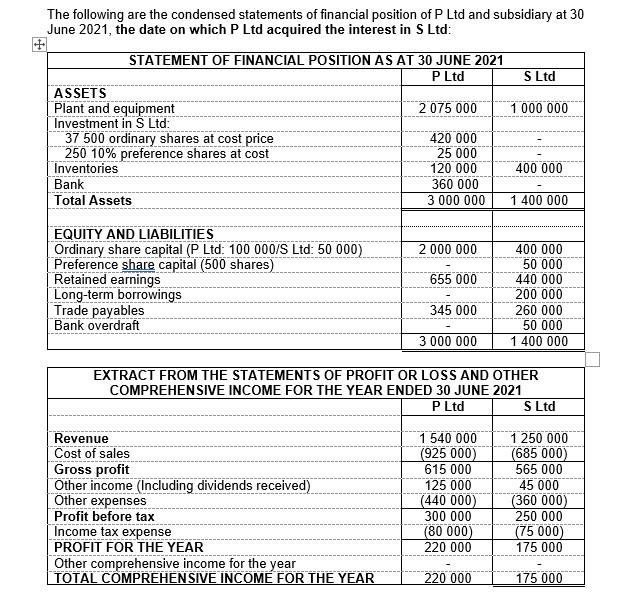

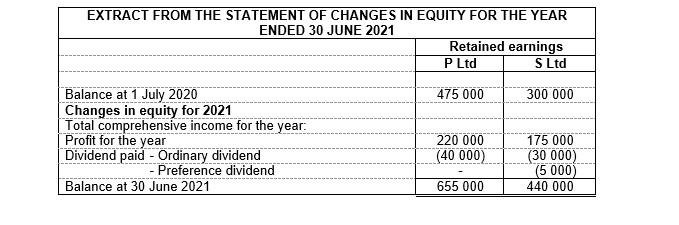

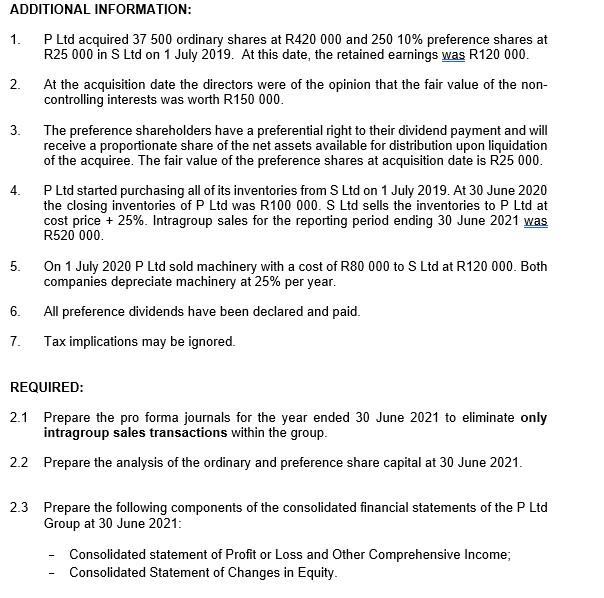

The following are the condensed statements of financial position of P Ltd and subsidiary at 30 June 2021, the date on which P Ltd acquired the interest in S Ltd: STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2021 P Ltd S Ltd ASSETS Plant and equipment 2075 000 1 000 000 Investment in S Ltd: 37 500 ordinary shares at cost price 420 000 250 10% preference shares at cost 25 000 Inventories 120 000 400 000 Bank 360 000 Total Assets 3 000 000 1 400 000 2 000 000 EQUITY AND LIABILITIES Ordinary share capital (P Ltd: 100 000/S Ltd: 50 000) Preference share capital (500 shares) Retained earnings Long-term borrowings Trade payables Bank overdraft 655 000 400 000 50 000 440 000 200 000 260 000 50 000 1 400 000 345 000 3 000 000 EXTRACT FROM THE STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2021 P Ltd S Ltd Revenue Cost of sales Gross profit Other income (Including dividends received) Other expenses Profit before tax Income tax expense PROFIT FOR THE YEAR Other comprehensive income for the year TOTAL COMPREHENSIVE INCOME FOR THE YEAR 1 540 000 (925 000) 615 000 125 000 (440 000) 300 000 (80 000) 220 000 1 250 000 (685 000) 565 000 45 000 (360 000) 250 000 (75000) 175 000 220 000 175 000 EXTRACT FROM THE STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 30 JUNE 2021 Retained earnings P Ltd S Ltd 475 000 300 000 Balance at 1 July 2020 Changes in equity for 2021 Total comprehensive income for the year. Profit for the year Dividend paid - Ordinary dividend - Preference dividend Balance at 30 June 2021 220 000 (40 000) 175 000 (30 000) (5000) 440 000 655 000 ADDITIONAL INFORMATION: 1. P Ltd acquired 37 500 ordinary shares at R420 000 and 250 10% preference shares at R25 000 in S Ltd on 1 July 2019. At this date, the retained earnings was R120 000. 2. At the acquisition date the directors were of the opinion that the fair value of the non- controlling interests was worth R150 000 3. 4. The preference shareholders have a preferential right to their dividend payment and will receive a proportionate share of the net assets available for distribution upon liquidation of the acquiree. The fair value of the preference shares at acquisition date is R25 000. P Ltd started purchasing all of its inventories from S Ltd on 1 July 2019. At 30 June 2020 the closing inventories of P Ltd was R100 000. S Ltd sells the inventories to P Ltd at cost price + 25%. Intragroup sales for the reporting period ending 30 June 2021 was R520 000 On 1 July 2020 P Ltd sold machinery with a cost of R80 000 to S Ltd at R120 000. Both companies depreciate machinery at 25% per year. All preference dividends have been declared and paid. Tax implications may be ignored. 5. . 6. 7. REQUIRED: 2.1 Prepare the pro forma journals for the year ended 30 June 2021 to eliminate only intragroup sales transactions within the group. 2.2 Prepare the analysis of the ordinary and preference share capital at 30 June 2021. 2.3 Prepare the following components of the consolidated financial statements of the P Ltd Group at 30 June 2021: Consolidated statement of Profit or Loss and Other Comprehensive Income; Consolidated Statement of Changes in Equity. The following are the condensed statements of financial position of P Ltd and subsidiary at 30 June 2021, the date on which P Ltd acquired the interest in S Ltd: STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2021 P Ltd S Ltd ASSETS Plant and equipment 2075 000 1 000 000 Investment in S Ltd: 37 500 ordinary shares at cost price 420 000 250 10% preference shares at cost 25 000 Inventories 120 000 400 000 Bank 360 000 Total Assets 3 000 000 1 400 000 2 000 000 EQUITY AND LIABILITIES Ordinary share capital (P Ltd: 100 000/S Ltd: 50 000) Preference share capital (500 shares) Retained earnings Long-term borrowings Trade payables Bank overdraft 655 000 400 000 50 000 440 000 200 000 260 000 50 000 1 400 000 345 000 3 000 000 EXTRACT FROM THE STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2021 P Ltd S Ltd Revenue Cost of sales Gross profit Other income (Including dividends received) Other expenses Profit before tax Income tax expense PROFIT FOR THE YEAR Other comprehensive income for the year TOTAL COMPREHENSIVE INCOME FOR THE YEAR 1 540 000 (925 000) 615 000 125 000 (440 000) 300 000 (80 000) 220 000 1 250 000 (685 000) 565 000 45 000 (360 000) 250 000 (75000) 175 000 220 000 175 000 EXTRACT FROM THE STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 30 JUNE 2021 Retained earnings P Ltd S Ltd 475 000 300 000 Balance at 1 July 2020 Changes in equity for 2021 Total comprehensive income for the year. Profit for the year Dividend paid - Ordinary dividend - Preference dividend Balance at 30 June 2021 220 000 (40 000) 175 000 (30 000) (5000) 440 000 655 000 ADDITIONAL INFORMATION: 1. P Ltd acquired 37 500 ordinary shares at R420 000 and 250 10% preference shares at R25 000 in S Ltd on 1 July 2019. At this date, the retained earnings was R120 000. 2. At the acquisition date the directors were of the opinion that the fair value of the non- controlling interests was worth R150 000 3. 4. The preference shareholders have a preferential right to their dividend payment and will receive a proportionate share of the net assets available for distribution upon liquidation of the acquiree. The fair value of the preference shares at acquisition date is R25 000. P Ltd started purchasing all of its inventories from S Ltd on 1 July 2019. At 30 June 2020 the closing inventories of P Ltd was R100 000. S Ltd sells the inventories to P Ltd at cost price + 25%. Intragroup sales for the reporting period ending 30 June 2021 was R520 000 On 1 July 2020 P Ltd sold machinery with a cost of R80 000 to S Ltd at R120 000. Both companies depreciate machinery at 25% per year. All preference dividends have been declared and paid. Tax implications may be ignored. 5. . 6. 7. REQUIRED: 2.1 Prepare the pro forma journals for the year ended 30 June 2021 to eliminate only intragroup sales transactions within the group. 2.2 Prepare the analysis of the ordinary and preference share capital at 30 June 2021. 2.3 Prepare the following components of the consolidated financial statements of the P Ltd Group at 30 June 2021: Consolidated statement of Profit or Loss and Other Comprehensive Income; Consolidated Statement of Changes in Equity