Answered step by step

Verified Expert Solution

Question

1 Approved Answer

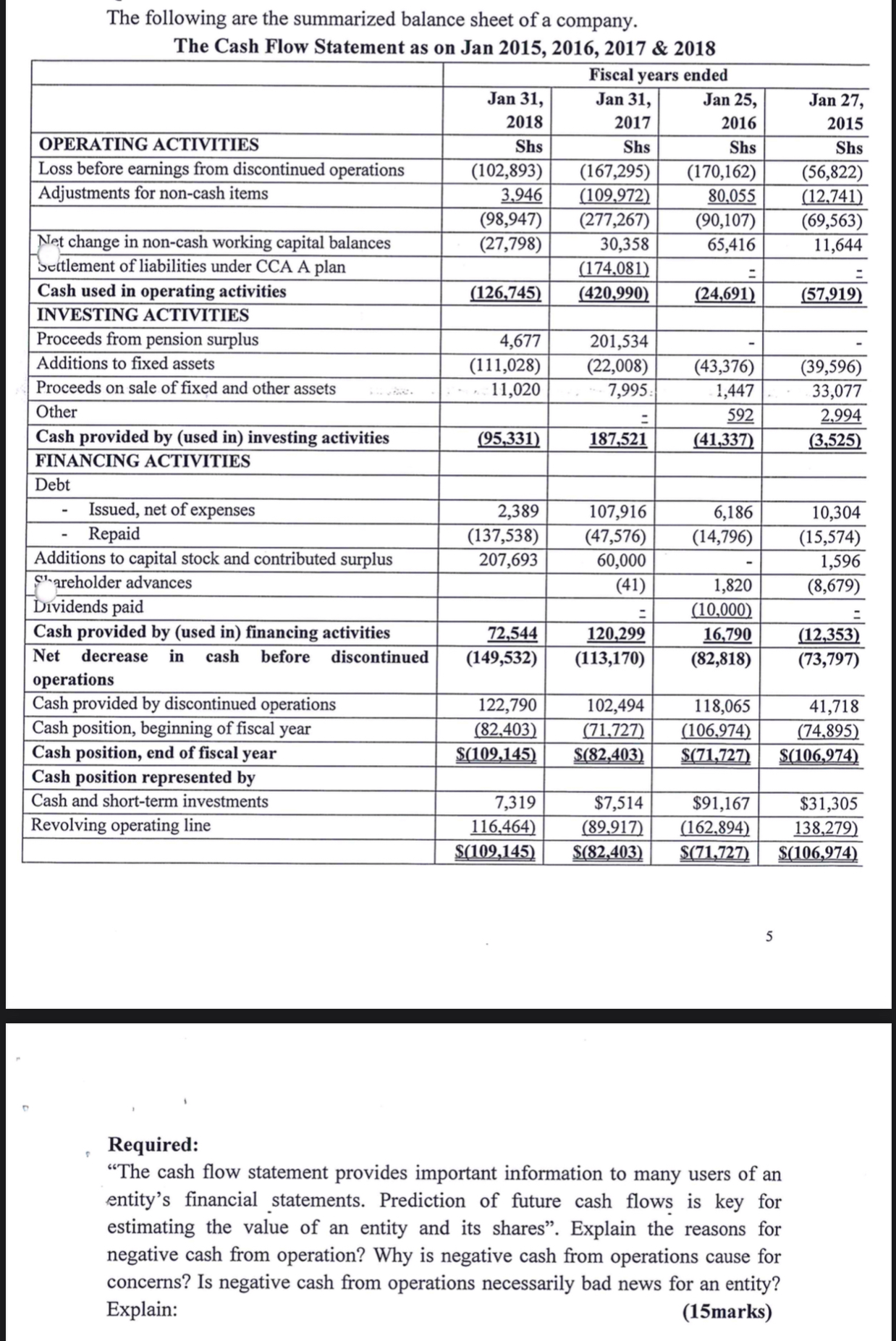

The following are the summarized balance sheet of a company. The Cash Flow Statement as on Jan 2015, 2016, 2017 & 2018 Fiscal years

The following are the summarized balance sheet of a company. The Cash Flow Statement as on Jan 2015, 2016, 2017 & 2018 Fiscal years ended Jan 31, Jan 31, Jan 25, Jan 27, 2018 2017 2016 2015 OPERATING ACTIVITIES Shs Shs Shs Shs Loss before earnings from discontinued operations Adjustments for non-cash items (102,893) (167,295) (170,162) (56,822) 3,946 (109,972) 80,055 (12,741) (98,947) (277,267) (90,107) (69,563) Net change in non-cash working capital balances (27,798) 30,358 65,416 11,644 Settlement of liabilities under CCA A plan (174,081) = Cash used in operating activities (126,745) (420,990) (24,691) (57,919) INVESTING ACTIVITIES Proceeds from pension surplus 4,677 201,534 Additions to fixed assets (111,028) (22,008) (43,376) (39,596) Proceeds on sale of fixed and other assets 11,020 7,995: 1,447 33,077 Other = 592 2,994 Cash provided by (used in) investing activities (95,331) 187,521 (41,337) (3,525) FINANCING ACTIVITIES Debt Issued, net of expenses 2,389 107,916 6,186 Repaid (137,538) (47,576) (14,796) 10,304 (15,574) Additions to capital stock and contributed surplus 207,693 60,000 1,596 Shareholder advances (41) 1,820 (8,679) Dividends paid = (10,000) Cash provided by (used in) financing activities 72,544 120,299 16,790 (12,353) Net decrease in cash before discontinued (149,532) (113,170) (82,818) (73,797) operations Cash provided by discontinued operations 122,790 102,494 118,065 41,718 Cash position, beginning of fiscal year (82,403) (71,727) (106,974) (74,895) Cash position, end of fiscal year Cash position represented by Cash and short-term investments Revolving operating line $(109,145) $(82,403) $(71,727) $(106,974) 7,319 116,464) $(109,145) $7,514 $91,167 (89.917) (162,894) $(82,403) $31,305 138,279) $(71,727) $(106,974) 5 Required: "The cash flow statement provides important information to many users of an entity's financial statements. Prediction of future cash flows is key for estimating the value of an entity and its shares". Explain the reasons for negative cash from operation? Why is negative cash from operations cause for concerns? Is negative cash from operations necessarily bad news for an entity? Explain: (15marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started