The following are three small questions in a big question, please help me answer, thank you

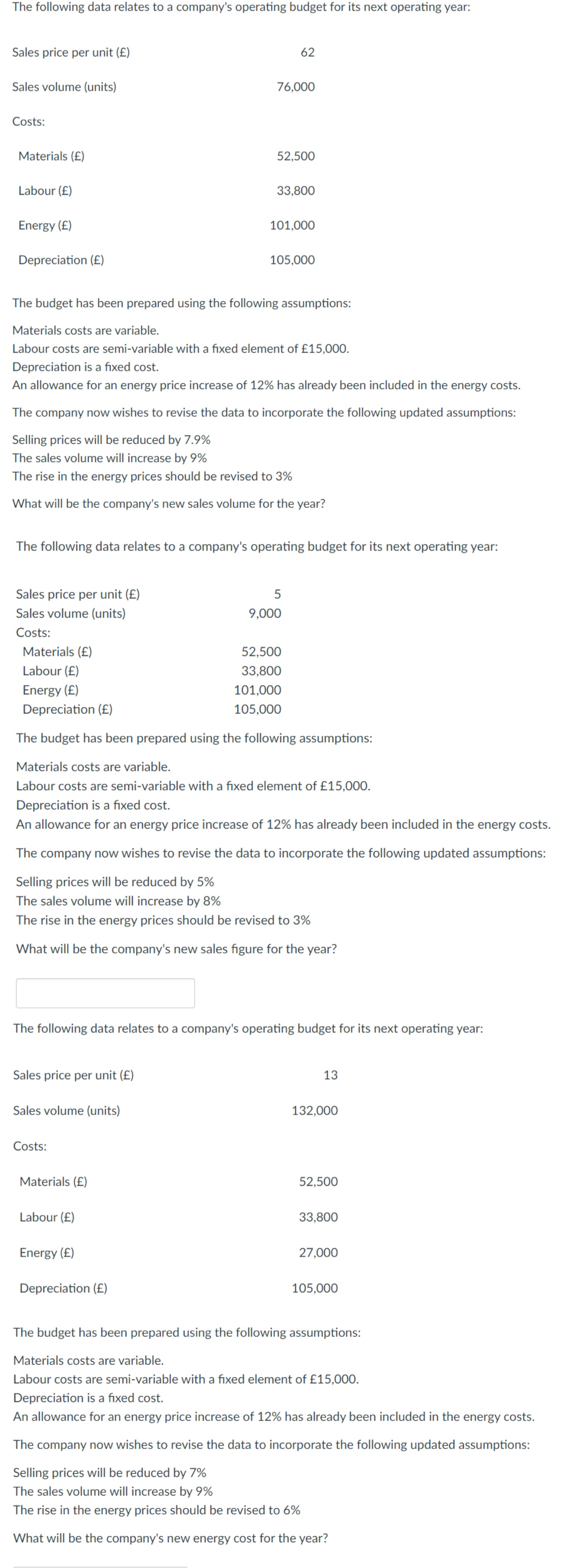

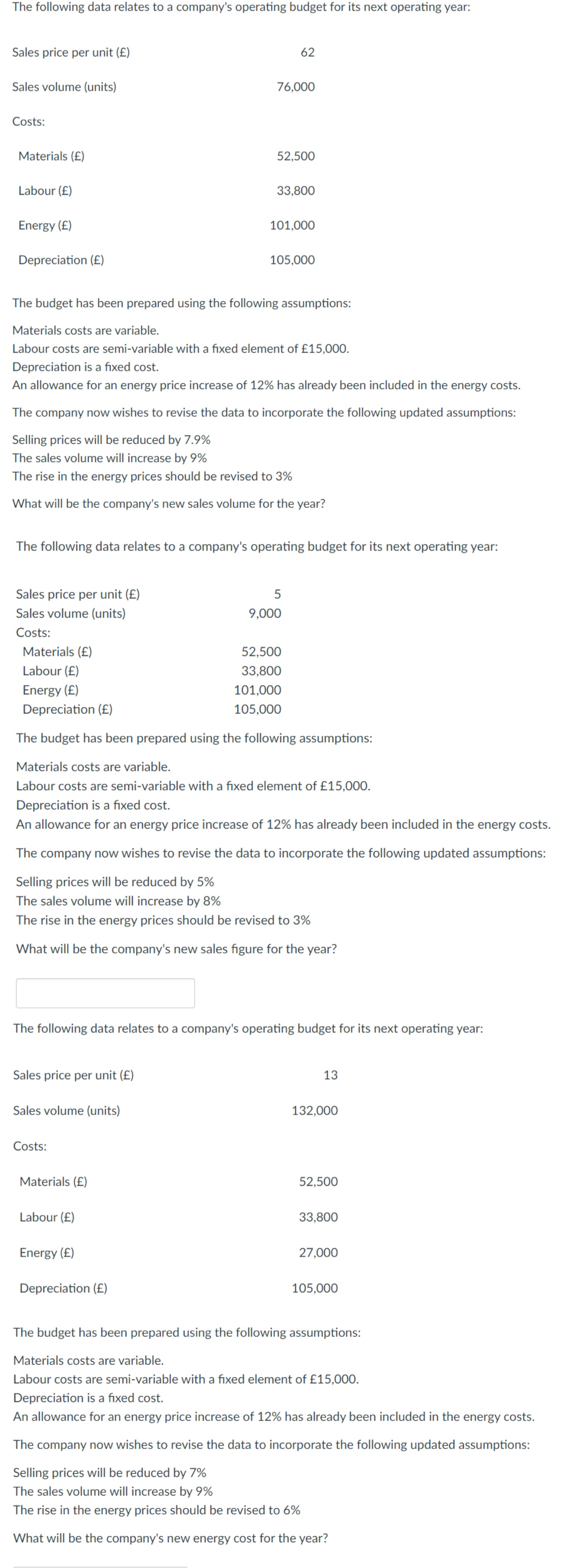

The following data relates to a company's operating budget for its next operating year: Sales price per unit () 62 Sales volume (units) 76,000 Costs: Materials () 52,500 Labour () 33,800 Energy () 101,000 Depreciation () 105,000 The budget has been prepared using the following assumptions: Materials costs are variable. Labour costs are semi-variable with a fixed element of 15,000. Depreciation is a fixed cost. An allowance for an energy price increase of 12% has already been included in the energy costs. The company now wishes to revise the data to incorporate the following updated assumptions: Selling prices will be reduced by 7.9% The sales volume will increase by 9% The rise in the energy prices should be revised to 3% What will be the company's new sales volume for the year? The following data relates to a company's operating budget for its next operating year: 5 9,000 Sales price per unit () Sales volume (units) Costs: Materials () Labour () Energy () Depreciation () 52,500 33,800 101,000 105,000 The budget has been prepared using the following assumptions: Materials costs are variable. Labour costs are semi-variable with a fixed element of 15,000. Depreciation is a fixed cost. An allowance for an energy price increase of 12% has already been included in the energy costs. The company now wishes to revise the data to incorporate the following updated assumptions: Selling prices will be reduced by 5% The sales volume will increase by 8% The rise in the energy prices should be revised to 3% What will be the company's new sales figure for the year? The following data relates to a company's operating budget for its next operating year: Sales price per unit () 13 Sales volume (units) 132,000 Costs: Materials () 52,500 Labour () 33,800 Energy () 27,000 Depreciation () 105,000 The budget has been prepared using the following assumptions: Materials costs are variable. Labour costs are semi-variable with a fixed element of 15,000. Depreciation is a fixed cost. An allowance for an energy price increase of 12% has already been included in the energy costs. The company now wishes to revise the data to incorporate the following updated assumptions: Selling prices will be reduced by 7% The sales volume will increase by 9% The rise in the energy prices should be revised to 6% What will be the company's new energy cost for the year