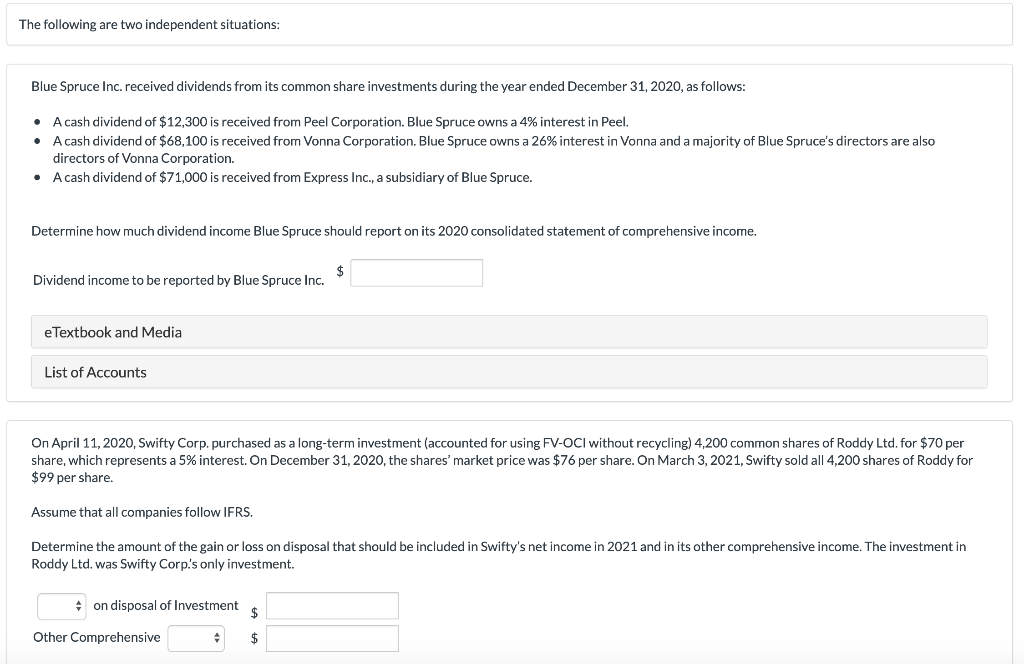

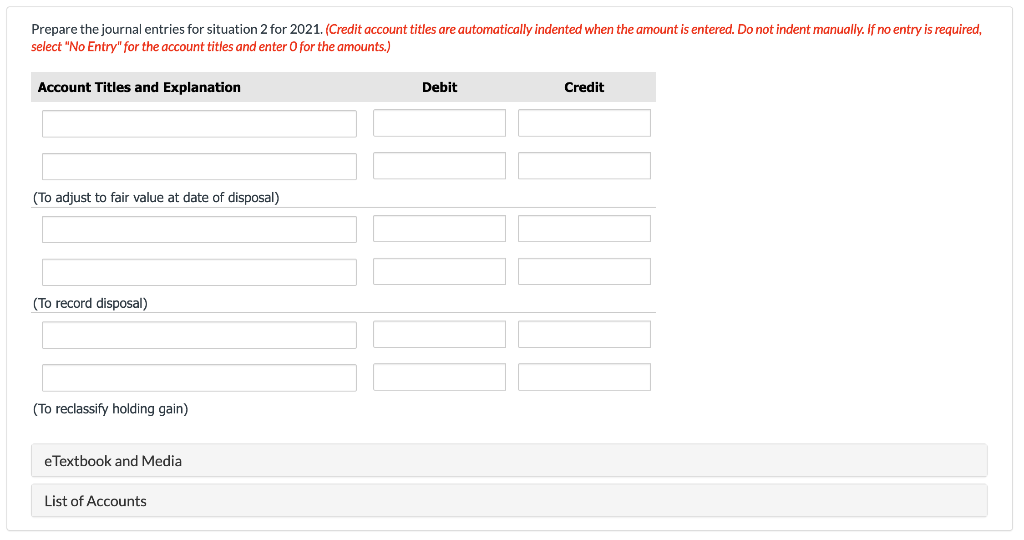

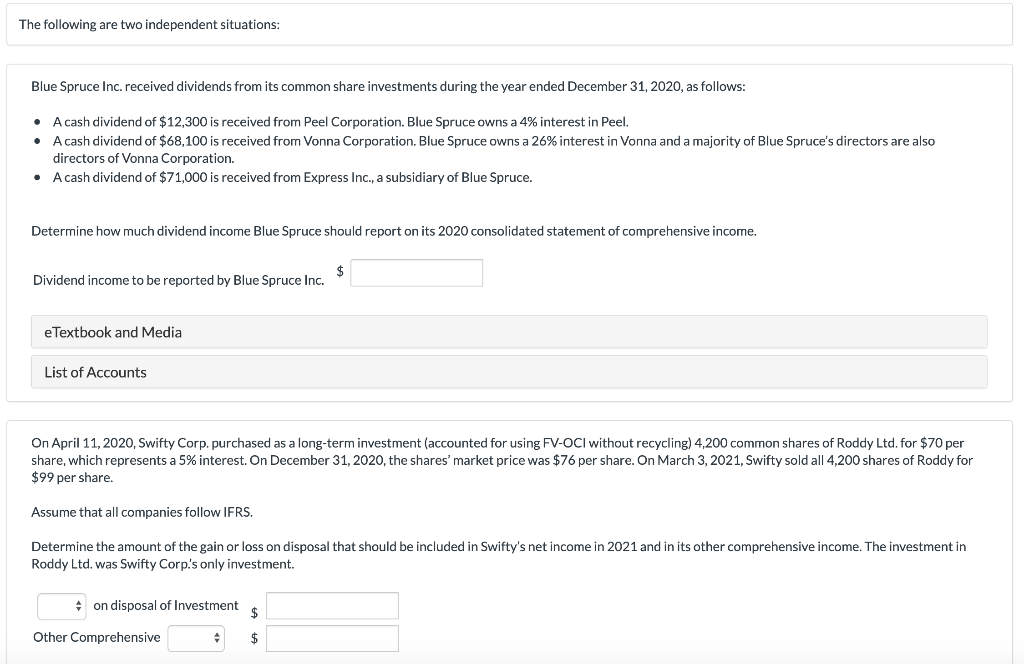

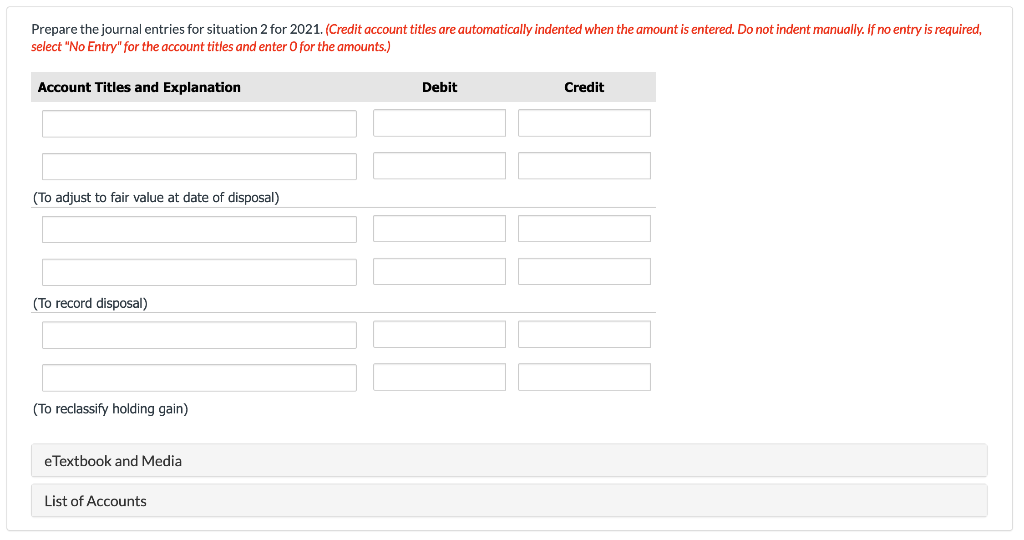

The following are two independent situations: Blue Spruce Inc. received dividends from its common share investments during the year ended December 31, 2020, as follows: A cash dividend of $12,300 is received from Peel Corporation. Blue Spruce owns a 4% interest in Peel. A cash dividend of $68,100 is received from Vonna Corporation. Blue Spruce owns a 26% interest in Vonna and a majority of Blue Spruce's directors are also directors of Vonna Corporation A cash dividend of $71,000 is received from Express Inc., a subsidiary of Blue Spruce. Determine how much dividend income Blue Spruce should report on its 2020 consolidated statement of comprehensive income Dividend income to be reported by Blue Spruce Inc. eTextbook and Media List of Accounts On April 11,2020, Swifty Corp. purchased as a long-term investment (accounted for using FV-OCI without recycling) 4,200 common shares of Roddy Ltd. for $70 per share, which represents a 5% interest. On December 31, 2020, the shares' market price was $76 per share. On March 3, 2021, Swifty sold all 4,200 shares of Roddy for $99 per share. Assume that all companies follow IFRS. Determine the amount of the gain or loss on disposal that should be included in Swifty's net income in 2021 and in its other comprehensive income. The investment in Roddy Ltd. was Swifty Corp's only investment. on disposal of Investment Other Comprehensive $ Prepare the journal entries for situation 2 for 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (To adjust to fair value at date of disposal) (To record disposal) (To reclassify holding gain) eTextbook and Media List of Accounts The following are two independent situations: Blue Spruce Inc. received dividends from its common share investments during the year ended December 31, 2020, as follows: A cash dividend of $12,300 is received from Peel Corporation. Blue Spruce owns a 4% interest in Peel. A cash dividend of $68,100 is received from Vonna Corporation. Blue Spruce owns a 26% interest in Vonna and a majority of Blue Spruce's directors are also directors of Vonna Corporation A cash dividend of $71,000 is received from Express Inc., a subsidiary of Blue Spruce. Determine how much dividend income Blue Spruce should report on its 2020 consolidated statement of comprehensive income Dividend income to be reported by Blue Spruce Inc. eTextbook and Media List of Accounts On April 11,2020, Swifty Corp. purchased as a long-term investment (accounted for using FV-OCI without recycling) 4,200 common shares of Roddy Ltd. for $70 per share, which represents a 5% interest. On December 31, 2020, the shares' market price was $76 per share. On March 3, 2021, Swifty sold all 4,200 shares of Roddy for $99 per share. Assume that all companies follow IFRS. Determine the amount of the gain or loss on disposal that should be included in Swifty's net income in 2021 and in its other comprehensive income. The investment in Roddy Ltd. was Swifty Corp's only investment. on disposal of Investment Other Comprehensive $ Prepare the journal entries for situation 2 for 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (To adjust to fair value at date of disposal) (To record disposal) (To reclassify holding gain) eTextbook and Media List of Accounts