Answered step by step

Verified Expert Solution

Question

1 Approved Answer

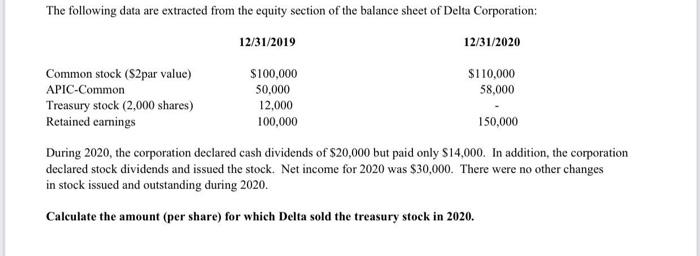

The following data are extracted from the equity section of the balance sheet of Delta Corporation: 12/31/2019 12/31/2020 Common stock ($2par value) s100,000 S110,000

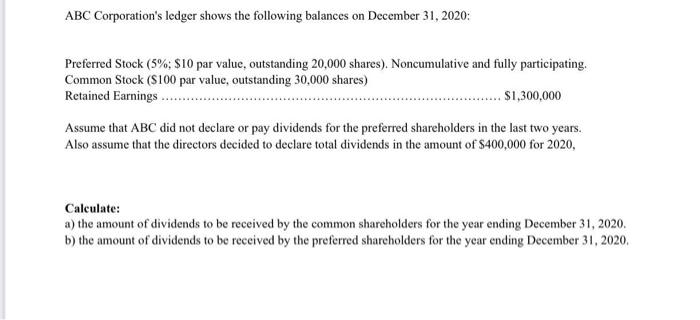

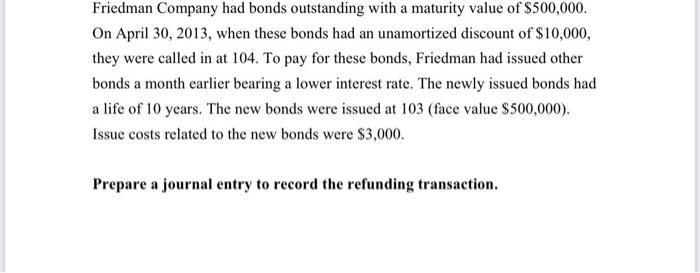

The following data are extracted from the equity section of the balance sheet of Delta Corporation: 12/31/2019 12/31/2020 Common stock ($2par value) s100,000 S110,000 APIC-Common 50,000 58,000 Treasury stock (2,000 shares) Retained eamings 12,000 100,000 150,000 During 2020, the corporation declared cash dividends of $20,000 but paid only $14,000. In addition, the corporation declared stock dividends and issued the stock. Net income for 2020 was $30,000. There were no other changes in stock issued and outstanding during 2020. Caleulate the amount (per share) for which Delta sold the treasury stock in 2020. ABC Corporation's ledger shows the following balances on December 31, 2020: Preferred Stock (5%; $10 par value, outstanding 20,000 shares). Noncumulative and fully participating. Common Stock (S100 par value, outstanding 30,000 shares) Retained Earnings .. ..S1,300,000 Assume that ABC did not declare or pay dividends for the preferred shareholders in the last two years. Also assume that the directors decided to declare total dividends in the amount of $400,000 for 2020, Calculate: a) the amount of dividends to be received by the common shareholders for the year ending December 31, 2020. b) the amount of dividends to be reccived by the preferred shareholders for the year ending December 31, 2020. Friedman Company had bonds outstanding with a maturity value of S500,000. On April 30, 2013, when these bonds had an unamortized discount of $10,000, they were called in at 104. To pay for these bonds, Friedman had issued other bonds a month earlier bearing a lower interest rate. The newly issued bonds had a life of 10 years. The new bonds were issued at 103 (face value S500,000). Issue costs related to the new bonds were $3,000. Prepare a journal entry to record the refunding transaction.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation Nividend Pen Prefemed stock 10000 20000 Total Dividend ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started