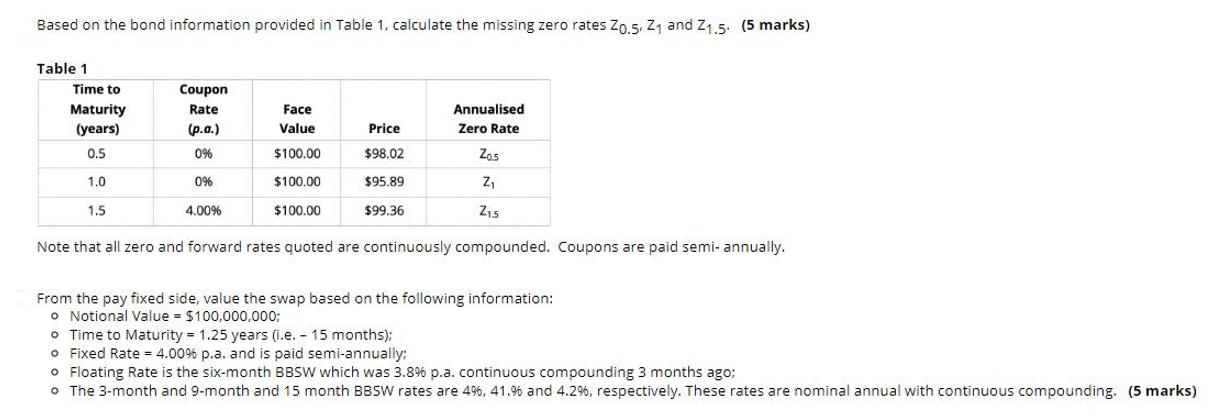

Based on the bond information provided in Table 1, calculate the missing zero rates Zo.5, Z and Z.5. (5 marks) Table 1 Time to

Based on the bond information provided in Table 1, calculate the missing zero rates Zo.5, Z and Z.5. (5 marks) Table 1 Time to Maturity (years) 0.5 1.0 1.5 Coupon Rate (p.a.) 0% 0% 4.00% Face Value $100.00 $100.00 $100.00 Price $98.02 $95.89 $99.36 Annualised Zero Rate Zos Z Z5 Note that all zero and forward rates quoted are continuously compounded. Coupons are paid semi-annually. From the pay fixed side, value the swap based on the following information: o Notional Value = $100,000,000; o Time to Maturity = 1.25 years (i.e. - 15 months); o Fixed Rate = 4.00% p.a. and is paid semi-annually; o Floating Rate is the six-month BBSW which was 3.8% p.a. continuous compounding 3 months ago: o The 3-month and 9-month and 15 month BBSW rates are 4%6, 41.96 and 4.2%, respectively. These rates are nominal annual with continuous compounding. (5 marks)

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Calculation of Zero Rates Zo5 Z1 and Z15 Zero Rate Zo5 198020511 414 Zero Rate Z1 19589111 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started