Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following data pertain to the death of a resident alien: Property acquired by decedent prior to marriage Property acquired by surviving spouse prior

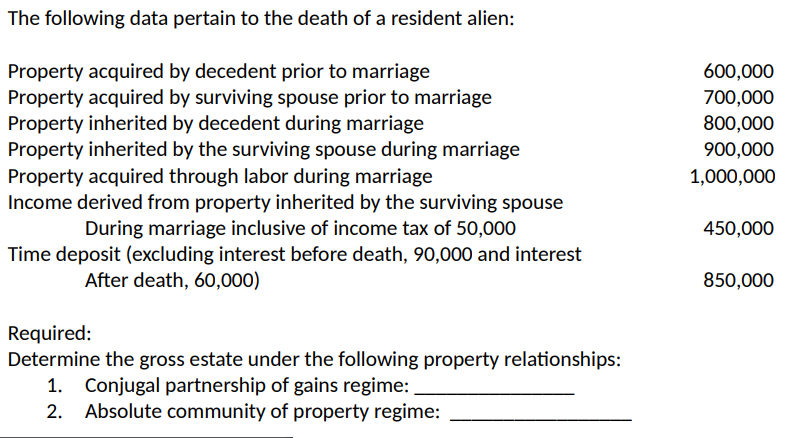

The following data pertain to the death of a resident alien: Property acquired by decedent prior to marriage Property acquired by surviving spouse prior to marriage Property inherited by decedent during marriage Property inherited by the surviving spouse during marriage Property acquired through labor during marriage Income derived from property inherited by the surviving spouse During marriage inclusive of income tax of 50,000 Time deposit (excluding interest before death, 90,000 and interest 600,000 700,000 800,000 900,000 1,000,000 450,000 After death, 60,000) 850,000 Required: Determine the gross estate under the following property relationships: 1. Conjugal partnership of gains regime: 2. Absolute community of property regime:

Step by Step Solution

★★★★★

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Gross estate means the total amount at the time of death before any debt is deducted thus we will re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started