Answered step by step

Verified Expert Solution

Question

1 Approved Answer

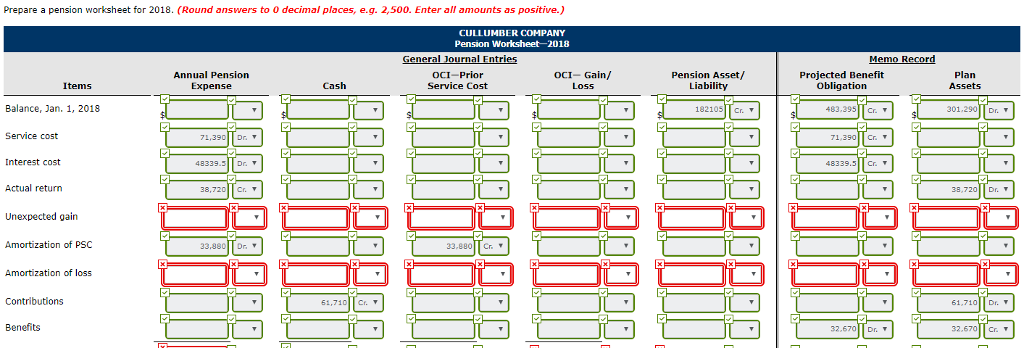

The following data relate to the operation of Cullumber Co.s pension plan in 2018. Service cost $71,390 Actual return on plan assets 38,720 Amortization of

The following data relate to the operation of Cullumber Co.s pension plan in 2018.

| Service cost | $71,390 | |

| Actual return on plan assets | 38,720 | |

| Amortization of prior service cost | 33,880 | |

| Annual contributions | 61,710 | |

| Benefits paid retirees | 32,670 | |

| Average service life of all employees | 25 years |

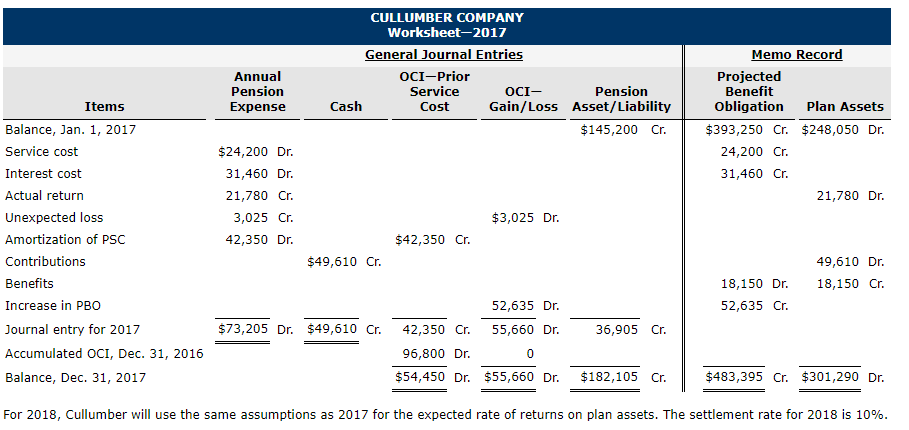

The pension worksheet for 2017 is presented below.

-------------------------------------------------------------

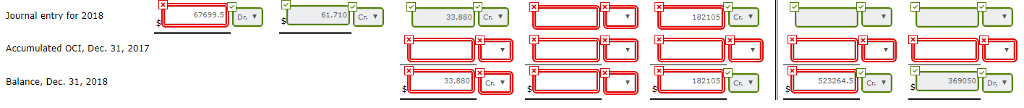

Calculate the amortization of the loss, if any, in 2018 using the corridor approach.

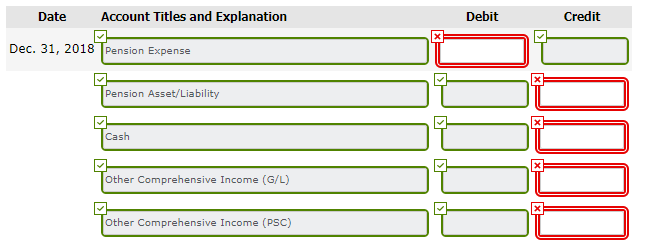

Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31.

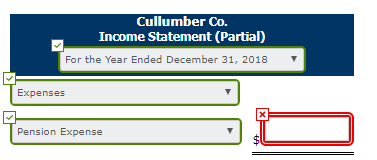

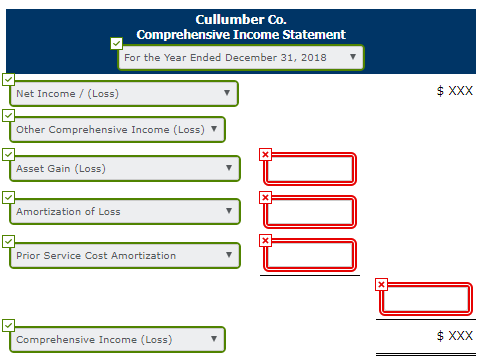

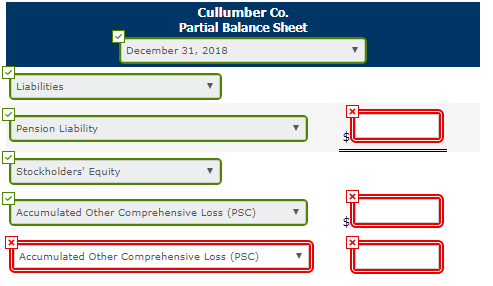

Indicate the pension amounts reported in the financial statements.

CULLUMBER COMPANY Worksheet-2017 General Journal Entrie emo Recor Annual Pension Expense OCI-Prior Service Cost Projected Pension Benefit OCI- Gain/Loss Asset/Liability Cash Obligation Plan Assets $393,250 Cr. $248,050 Dr. Items Balance, Jan. 1, 2017 Service cost Interest cost Actual return Unexpected loss Amortization of PSOC Contributions Benefits Increase in PBO Journal entry for 2017 Accumulated OCI, Dec. 31, 2016 Balance, Dec. 31, 2017 $145,200 Cr. $24,200 Dr. 31,460 Dr. 21,780 Cr. 3,025 Cr. 42,350 Dr 24,200 Cr. 31,460 Cr. 21,780 Dr. $3,025 Dr. $42,350 Cr. $49,610 Cr. 49,610 Dr. 18,150 Dr. 18,150 Cr. 52,635 Dr. $73,205 Dr. $49,610 Cr. 42,350 Cr. 55,660 Dr 52,635 Cr. 36,905 Cr. 96,800 Dr. $54,450 Dr. $55,660 Dr. $182,105 Cr $483,395 Cr. $301,290 Dr For 2018, Cullumber will use the same assumptions as 2017 for the expected rate of returns on plan assets. The settlement rate for 2018 is 10% CULLUMBER COMPANY Worksheet-2017 General Journal Entrie emo Recor Annual Pension Expense OCI-Prior Service Cost Projected Pension Benefit OCI- Gain/Loss Asset/Liability Cash Obligation Plan Assets $393,250 Cr. $248,050 Dr. Items Balance, Jan. 1, 2017 Service cost Interest cost Actual return Unexpected loss Amortization of PSOC Contributions Benefits Increase in PBO Journal entry for 2017 Accumulated OCI, Dec. 31, 2016 Balance, Dec. 31, 2017 $145,200 Cr. $24,200 Dr. 31,460 Dr. 21,780 Cr. 3,025 Cr. 42,350 Dr 24,200 Cr. 31,460 Cr. 21,780 Dr. $3,025 Dr. $42,350 Cr. $49,610 Cr. 49,610 Dr. 18,150 Dr. 18,150 Cr. 52,635 Dr. $73,205 Dr. $49,610 Cr. 42,350 Cr. 55,660 Dr 52,635 Cr. 36,905 Cr. 96,800 Dr. $54,450 Dr. $55,660 Dr. $182,105 Cr $483,395 Cr. $301,290 Dr For 2018, Cullumber will use the same assumptions as 2017 for the expected rate of returns on plan assets. The settlement rate for 2018 is 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started