Answered step by step

Verified Expert Solution

Question

1 Approved Answer

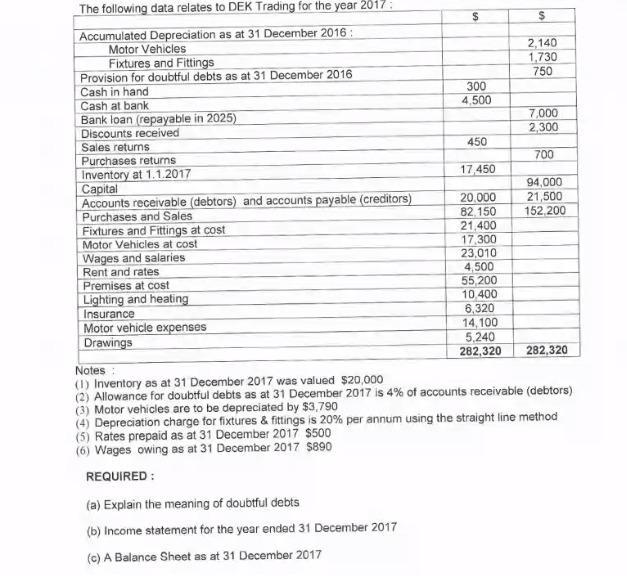

The following data relates to DEK Trading for the year 2017: Accumulated Depreciation as at 31 December 2016: Motor Vehicles Fixtures and Fittings Provision

The following data relates to DEK Trading for the year 2017: Accumulated Depreciation as at 31 December 2016: Motor Vehicles Fixtures and Fittings Provision for doubtful debts as at 31 December 2016 Cash in hand Cash at bank Bank loan (repayable in 2025) Discounts received Sales returns Purchases returns Inventory at 1.1.2017 Capital Accounts receivable (debtors) and accounts payable (creditors) Purchases and Sales Fixtures and Fittings at cost Motor Vehicles at cost Wages and salaries Rent and rates Premises at cost Lighting and heating Insurance Motor vehicle expenses Drawings 2,140 1,730 750 300 4,500 7.000 2,300 450 700 17,450 94,000 21,500 152.200 20,000 82,150 21,400 17.300 23,010 4,500 55,200 10,400 6,320 14,100 5,240 282,320 282,320 Notes : (1) Inventory as at 31 December 2017 was valued $20,000 (2) Allowance for doubtful debts as at 31 December 2017 is 4% of accounts receivable (debtors) (3) Motor vehicles are to be depreciated by $3,790 (4) Depreciation charge for fixtures & fittings is 20% per annum using the straight line method (5) Rates prepaid as at 31 December 2017 $500 (6) Wages owing as at 31 December 2017 $890 REQUIRED : (a) Explain the meaning of doubtful debts (b) Income statement for the year ended 31 December 2017 (c) A Balance Sheet as at 31 December 2017 The following data relates to DEK Trading for the year 2017: Accumulated Depreciation as at 31 December 2016: Motor Vehicles Fixtures and Fittings Provision for doubtful debts as at 31 December 2016 Cash in hand Cash at bank Bank loan (repayable in 2025) Discounts received Sales returns Purchases returns Inventory at 1.1.2017 Capital Accounts receivable (debtors) and accounts payable (creditors) Purchases and Sales Fixtures and Fittings at cost Motor Vehicles at cost Wages and salaries Rent and rates Premises at cost Lighting and heating Insurance Motor vehicle expenses Drawings 2,140 1,730 750 300 4,500 7.000 2,300 450 700 17,450 94,000 21,500 152.200 20,000 82,150 21,400 17.300 23,010 4,500 55,200 10,400 6,320 14,100 5,240 282,320 282,320 Notes : (1) Inventory as at 31 December 2017 was valued $20,000 (2) Allowance for doubtful debts as at 31 December 2017 is 4% of accounts receivable (debtors) (3) Motor vehicles are to be depreciated by $3,790 (4) Depreciation charge for fixtures & fittings is 20% per annum using the straight line method (5) Rates prepaid as at 31 December 2017 $500 (6) Wages owing as at 31 December 2017 $890 REQUIRED : (a) Explain the meaning of doubtful debts (b) Income statement for the year ended 31 December 2017 (c) A Balance Sheet as at 31 December 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Meaning of doubtful debts Doubtful debts are the amounts owed to a com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started