Question

The following data were extracted from the financial statements of a company for the year ended December 31. Net profit 70,000 Depreciation expense 14,000

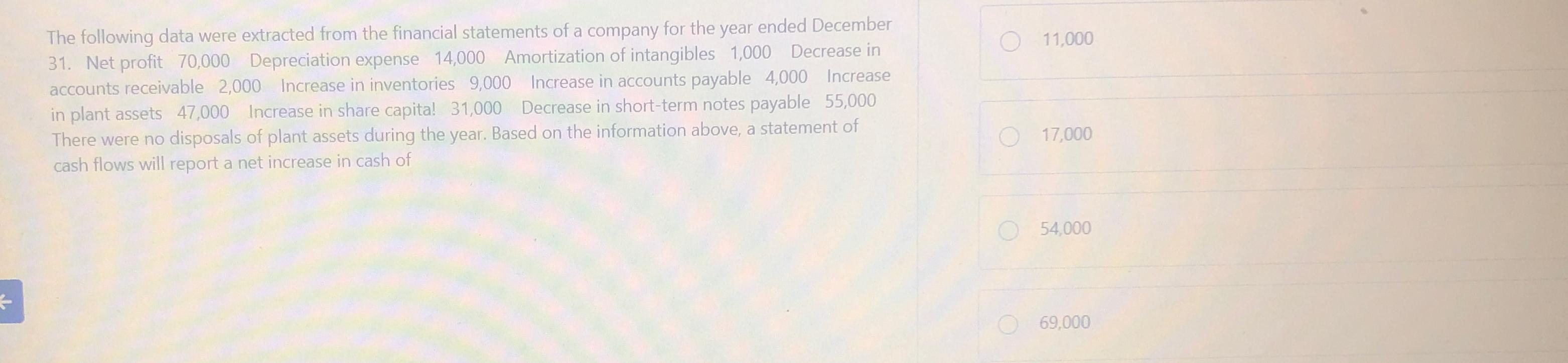

The following data were extracted from the financial statements of a company for the year ended December 31. Net profit 70,000 Depreciation expense 14,000 Amortization of intangibles 1,000 Decrease in accounts receivable 2,000 Increase in inventories 9,000 Increase in accounts payable 4,000 Increase in plant assets 47,000 Increase in share capita! 31,000 Decrease in short-term notes payable 55,000 There were no disposals of plant assets during the year. Based on the information above, a statement of cash flows will report a net increase in cash of O 11,000 17,000 54,000 69,000

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The image youve uploaded contains financial data and is related to the preparation of a cash flow st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

11th Edition

9780538480901, 9781111525774, 538480890, 538480904, 1111525773, 978-0538480895

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App