Question

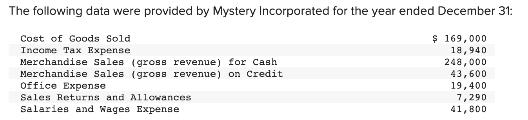

The following data were provided by Mystery Incorporated for the year ended December 31: $ 169,000 18,940 248,000 43,600 19,400 7,290 41,800 Cost of

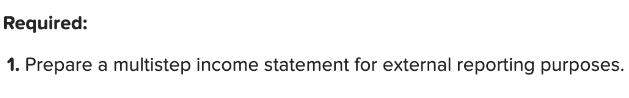

The following data were provided by Mystery Incorporated for the year ended December 31: $ 169,000 18,940 248,000 43,600 19,400 7,290 41,800 Cost of Goods Sold Income Tax Expense Merchandise Sales (grOss revenue) for Cash Merchandise Sales (gros8 revenue) on Credit Office Expense Sales Returns and Allowances Salaries and Wages Expense Required: 1. Prepare a multistep income statement for external reporting purposes. Required: 1. Prepare a multistep income statement for external reporting purposes. MYSTERY INCORPORATED Income Statement For the Year Ended December 31 $ %24

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Net Sales Cash Sales Credit sales Sales returns and allowan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Accounting

Authors: Fred Phillips, Robert Libby, Patricia Libby

6th edition

1259864235, 1259864230, 1260159547, 126015954X, 978-1259864230

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App