Question

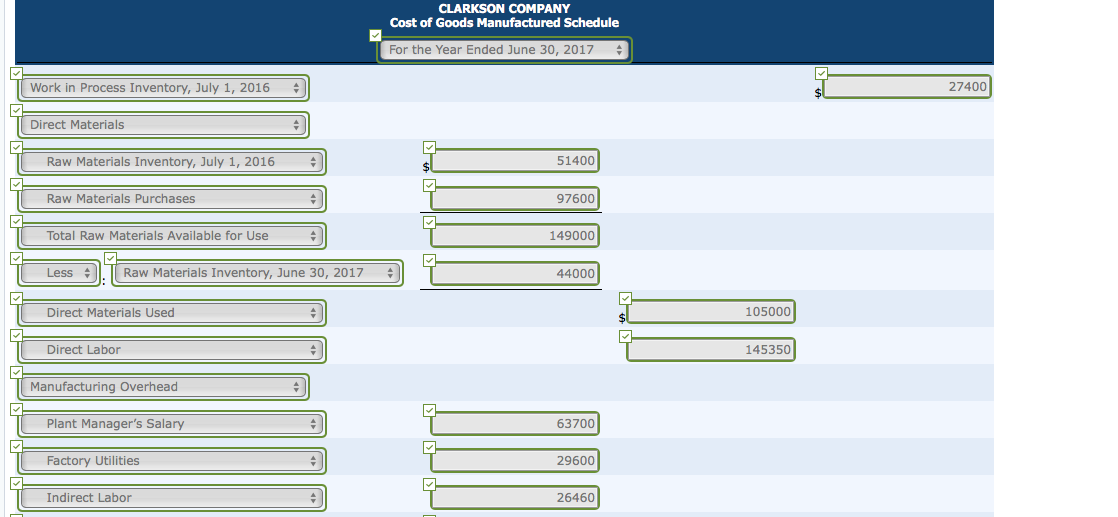

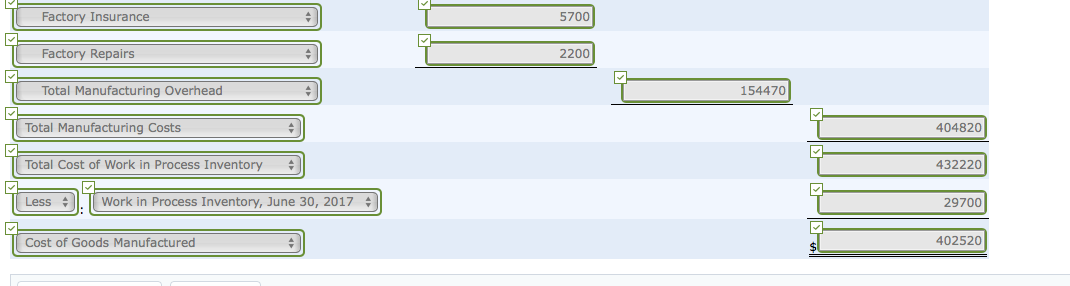

The following data were taken from the records of Clarkson Company for the fiscal year ended June 30, 2017. Raw Materials Inventory 7/1/16 $51,400 Factory

The following data were taken from the records of Clarkson Company for the fiscal year ended June 30, 2017.

Raw Materials Inventory 7/1/16 $51,400 Factory Insurance $5,700 Raw Materials Inventory 6/30/17 $44,000 Factory Machinery Depreciation $17,200 Finished Goods Inventory 7/1/16 $99,000 Factory Utilities $29,600 Finished Goods Inventory 6/30/17 $27,100 Office Utilities Expense $9,450 Work in Process Inventory 7/1/16 $27,400 Sales Revenue $560,000 Work in Process Inventory 6/30/17 $29,700 Sales Discounts $4,800 Direct Labor $145,350 Plant Managers Salary $63,700 Indirect Labor $26,460 Factory Property Taxes $9,610 Accounts Receivable $30,900 Factory Repairs $2,200 Raw Materials Purchases 97,600 Cash 35,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started