Question

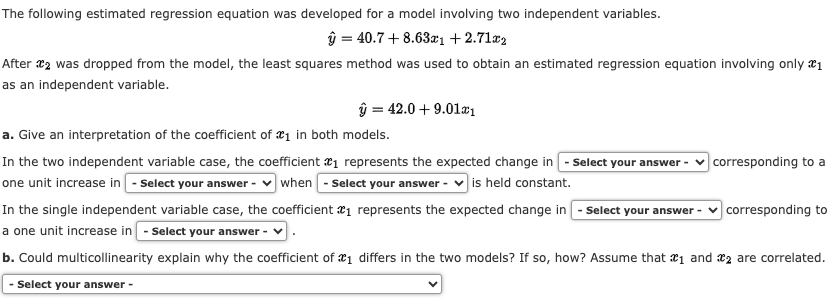

The following estimated regression equation was developed for a model involving two independent variables. hat(y)=40.7+8.63x_(1)+2.71x_(2) After x_(2) was dropped from the model, the least

The following estimated regression equation was developed for a model involving two independent variables.\

hat(y)=40.7+8.63x_(1)+2.71x_(2)\ After

x_(2)was dropped from the model, the least squares method was used to obtain an estimated regression equation involving only

x_(1)\ as an independent variable.\

hat(y)=42.0+9.01x_(1)\ a. Give an interpretation of the coefficient of

x_(1)in both models.\ In the two independent variable case, the coefficient

x_(1)represents the expected change in\ corresponding to a\ one unit increase in\ when\ is held constant.\ In the single independent variable case, the coefficient

x_(1)represents the expected change in\ corresponding to\ a one unit increase in\ b. Could multicollinearity explain why the coefficient of

x_(1)differs in the two models? If so, how? Assume that

x_(1)and

x_(2)are correlated.\

\\\\sqrt(-s)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started