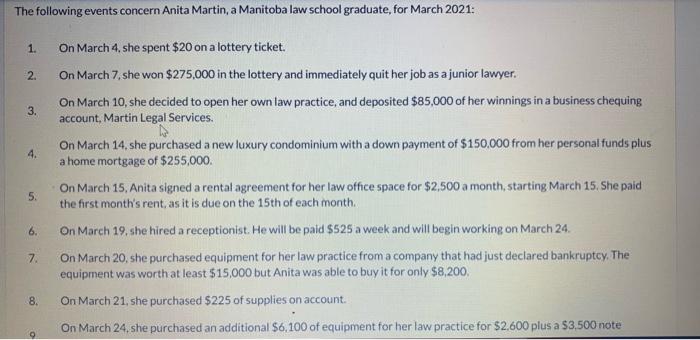

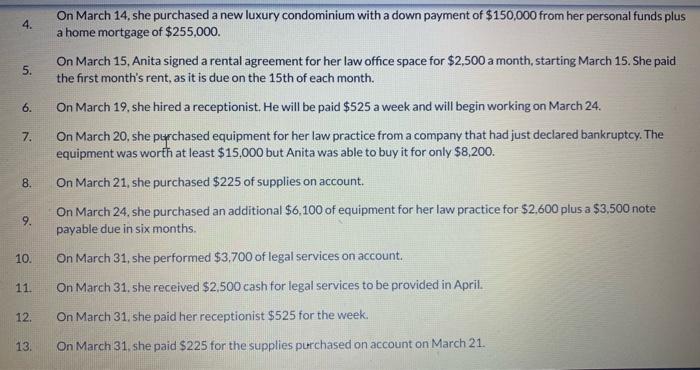

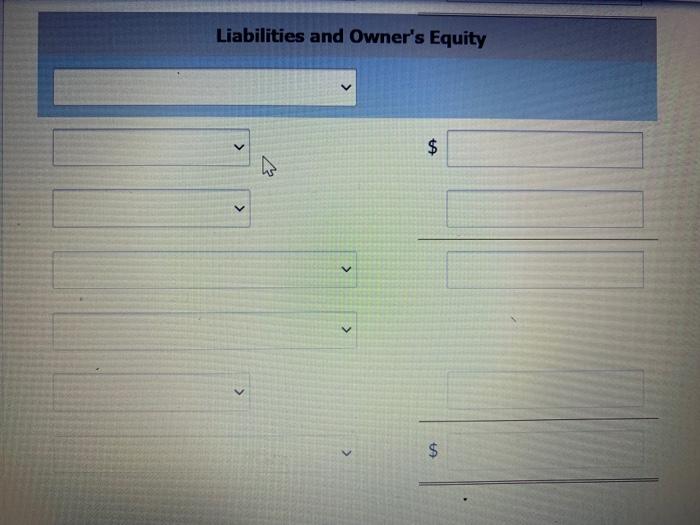

The following events concern Anita Martin, a Manitoba law school graduate, for March 2021: 1. 2. 3. 4. On March 4, she spent $20 on a lottery ticket. On March 7, she won $275,000 in the lottery and immediately quit her job as a junior lawyer. On March 10, she decided to open her own law practice, and deposited $85,000 of her winnings in a business chequing account, Martin Legal Services. On March 14, she purchased a new luxury condominium with a down payment of $150,000 from her personal funds plus a home mortgage of $255,000. On March 15, Anita signed a rental agreement for her law office space for $2,500 a month, starting March 15. She paid the first month's rent, as it is due on the 15th of each month. On March 19. she hired a receptionist. He will be paid $525 a week and will begin working on March 24. On March 20, she purchased equipment for her law practice from a company that had just declared bankruptcy. The equipment was worth at least $15,000 but Anita was able to buy it for only $8,200, On March 21, she purchased $225 of supplies on account On March 24, she purchased an additional $6,100 of equipment for her law practice for $2,600 plus a $3,500 note 5. 6. 7 8. 4. 5. 6. 7. 7 On March 14, she purchased a new luxury condominium with a down payment of $150,000 from her personal funds plus a home mortgage of $255,000. On March 15, Anita signed a rental agreement for her law office space for $2,500 a month, starting March 15. She paid the first month's rent, as it is due on the 15th of each month. On March 19, she hired a receptionist. He will be paid $525 a week and will begin working on March 24. On March 20, she purchased equipment for her law practice from a company that had just declared bankruptcy. The equipment was worth at least $15,000 but Anita was able to buy it for only $8,200. On March 21, she purchased $225 of supplies on account. On March 24, she purchased an additional $6,100 of equipment for her law practice for $2,600 plus a $3,500 note payable due in six months. On March 31, she performed $3,700 of legal services on account. On March 31, she received $2,500 cash for legal services to be provided in April. On March 31, she paid her receptionist $525 for the week. 8. ON 10. 11 12 13. On March 31. she paid $225 for the supplies purchased on account on March 21. Calculate profit and owner's equity for the month ended March 31. I Profit $ Owner's Equity $ MARTIN LEGAL SERVICES Balance Sheet Assets w $ >