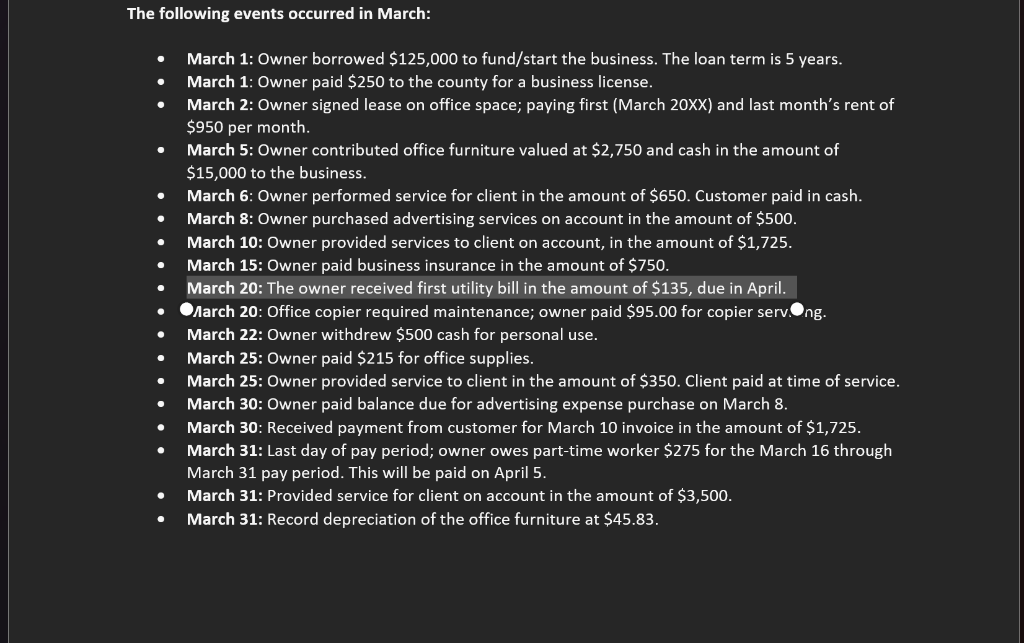

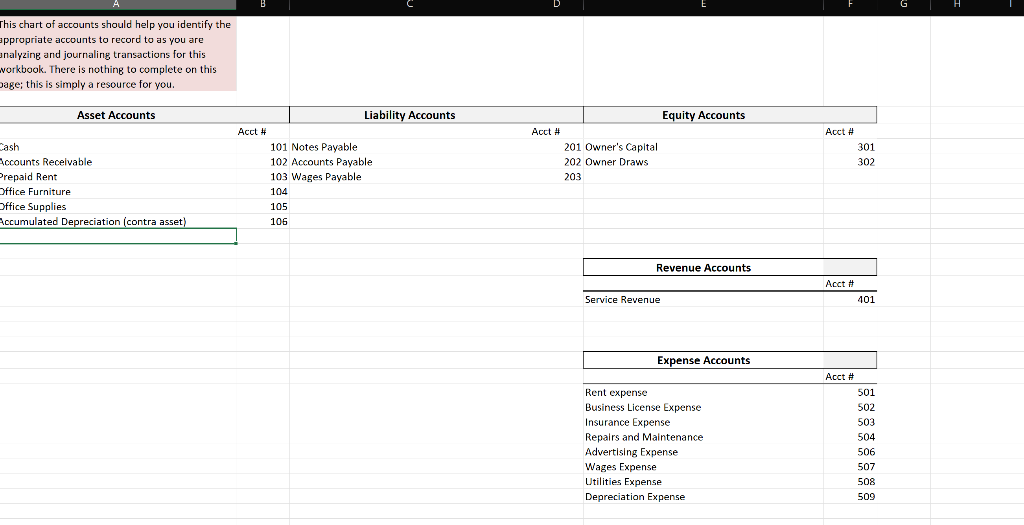

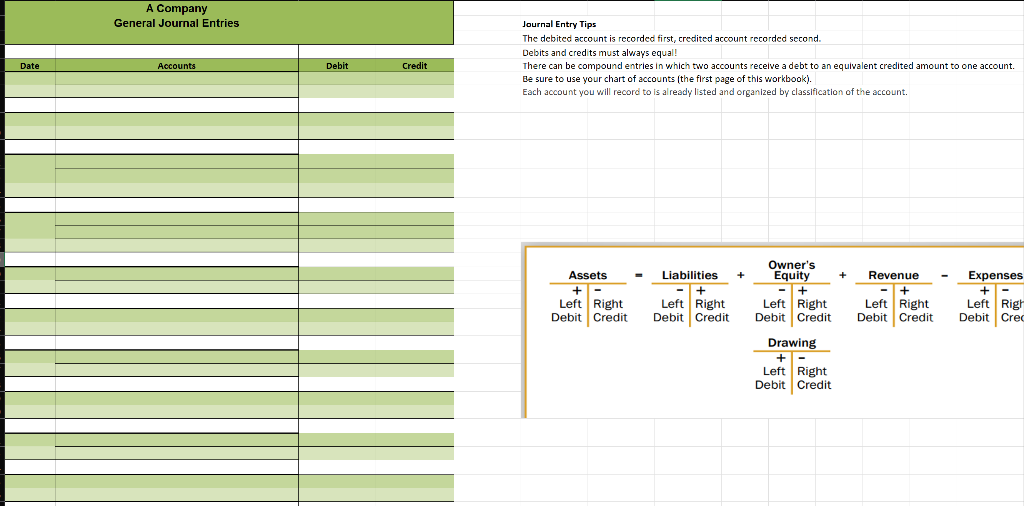

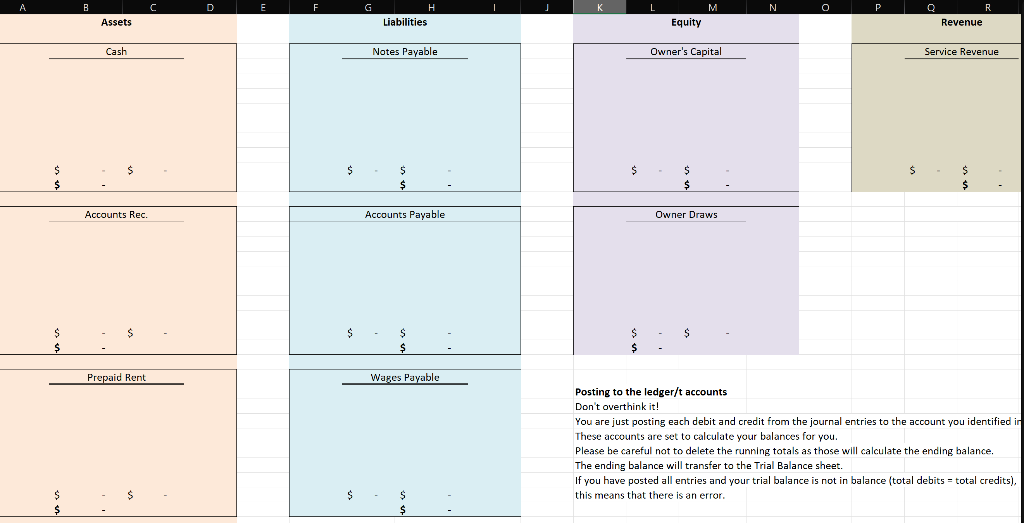

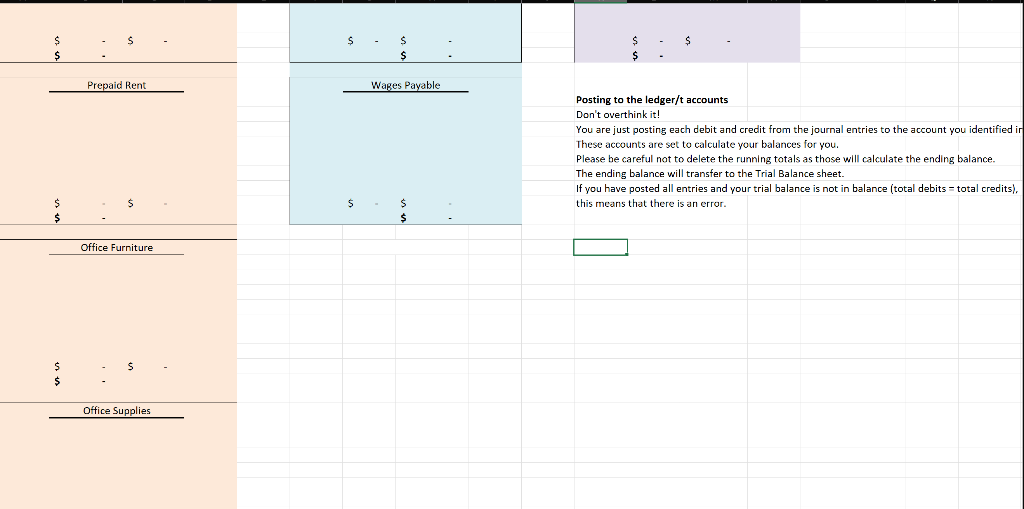

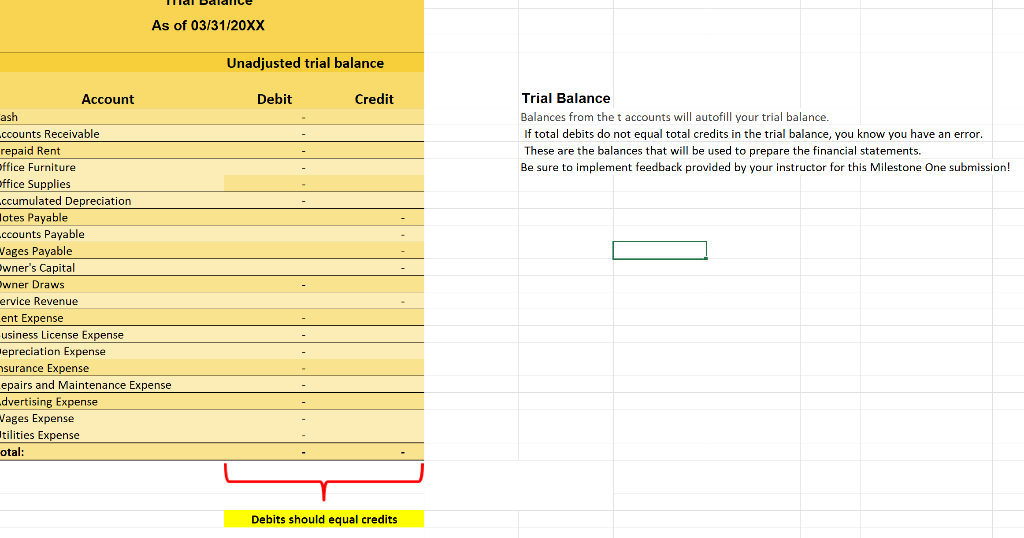

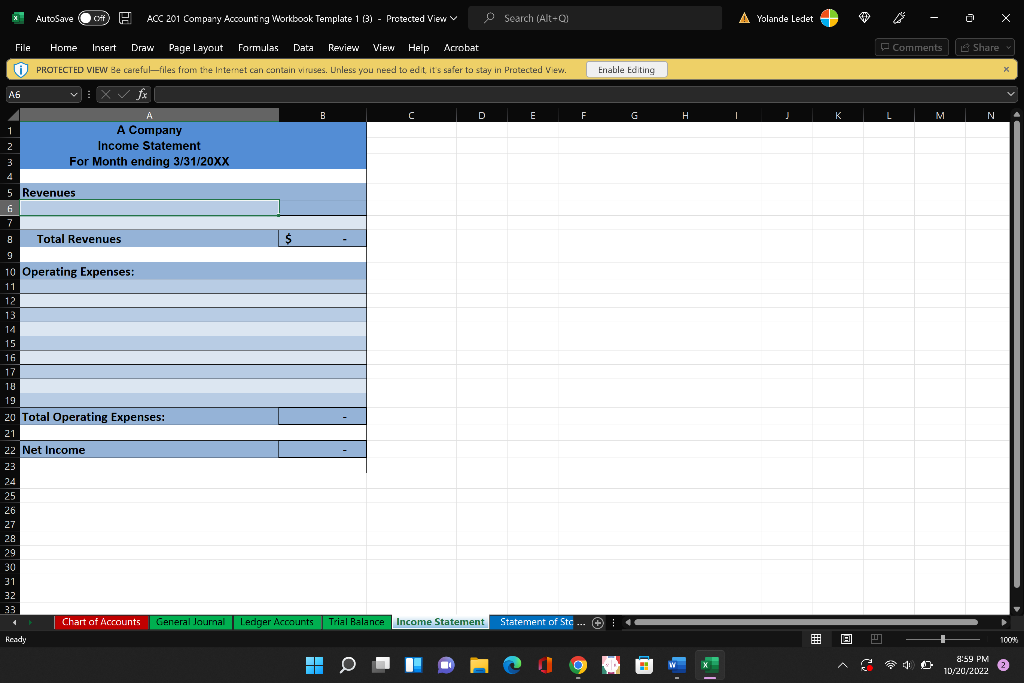

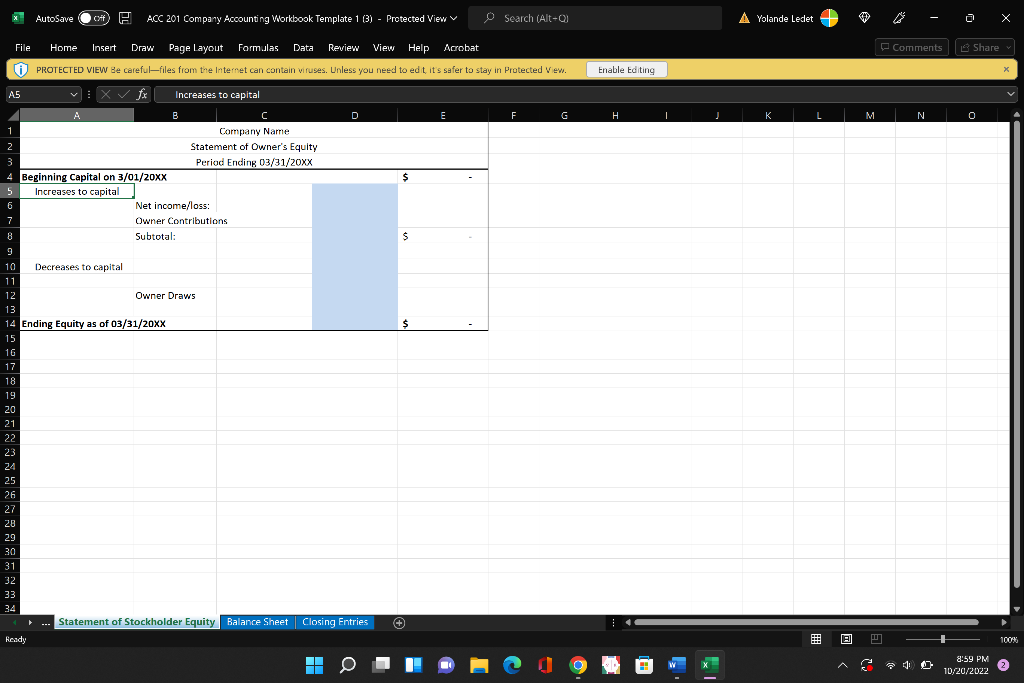

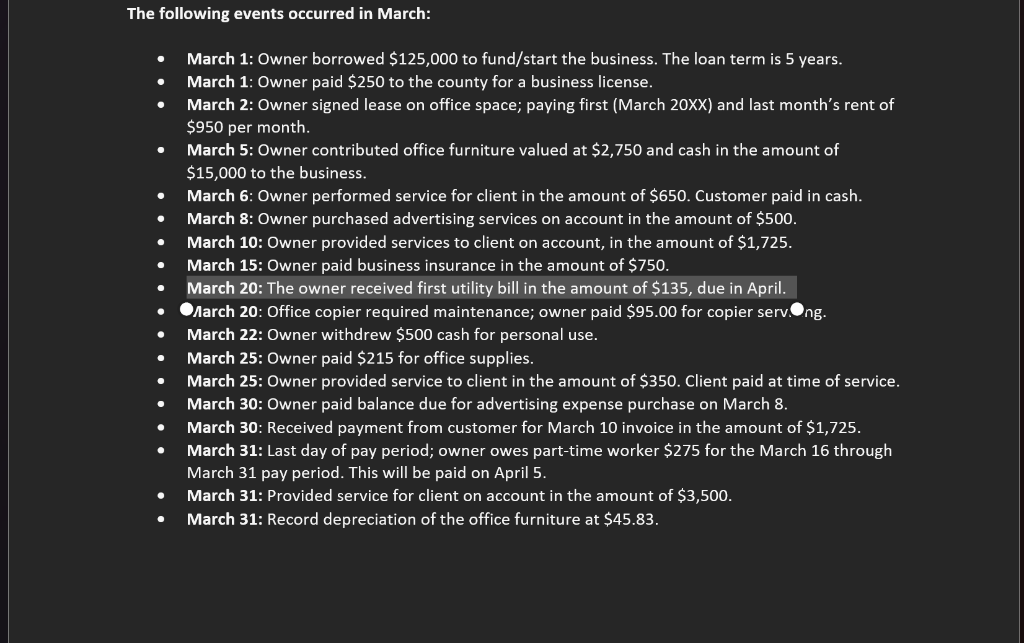

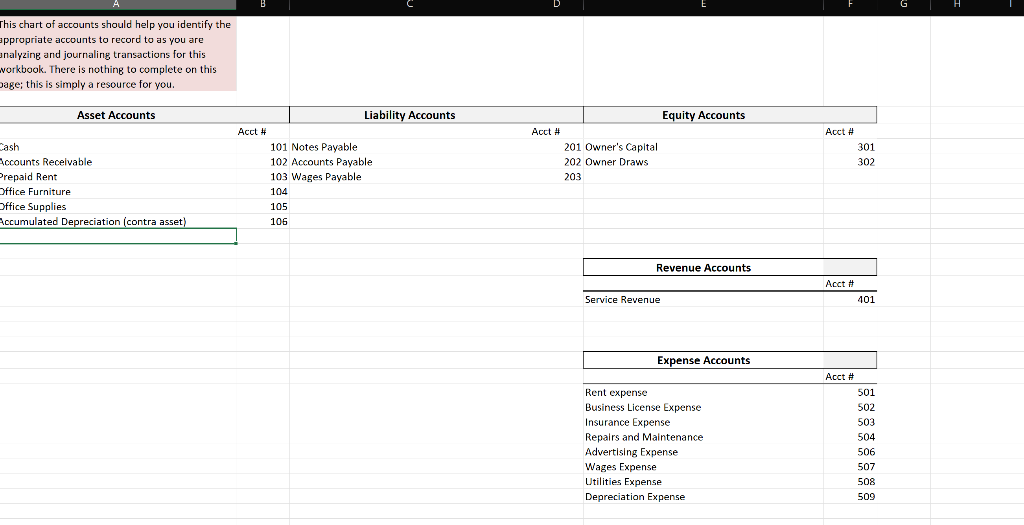

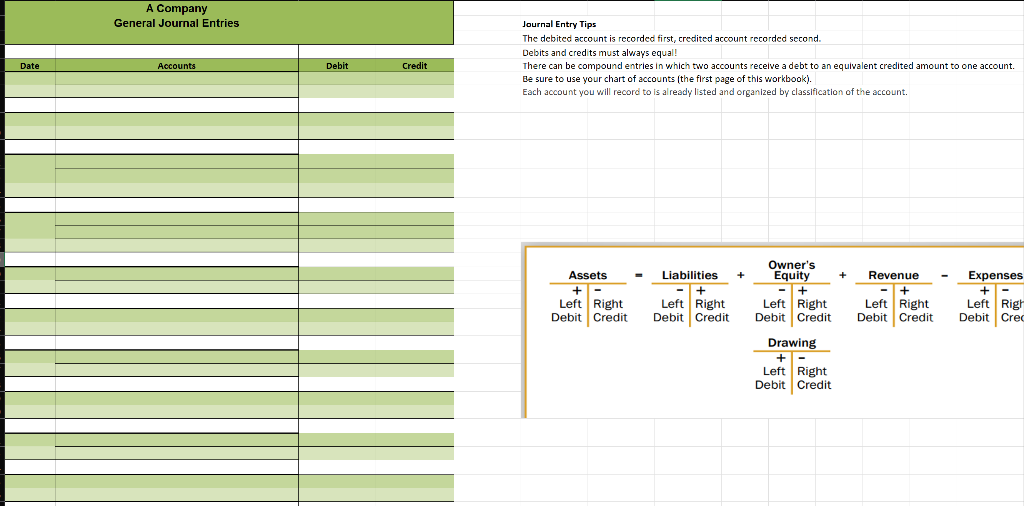

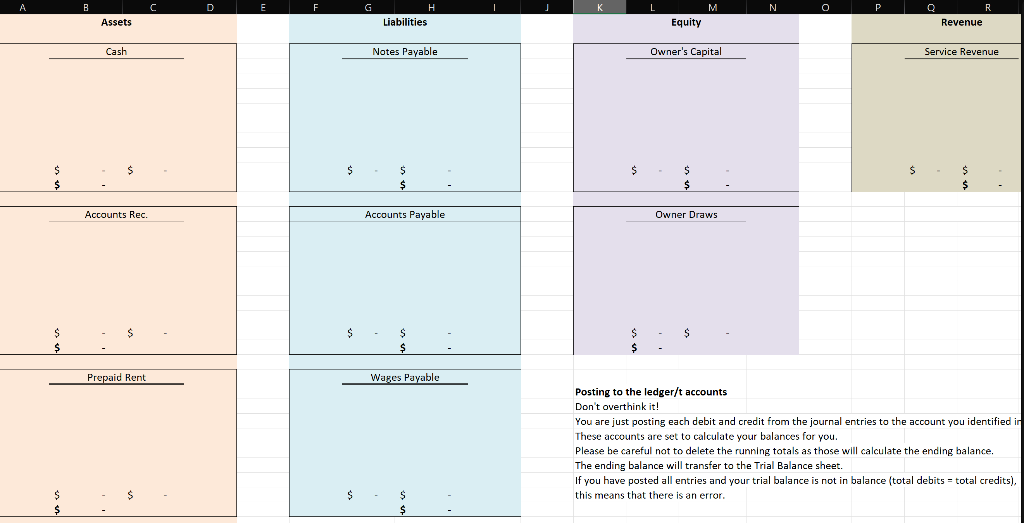

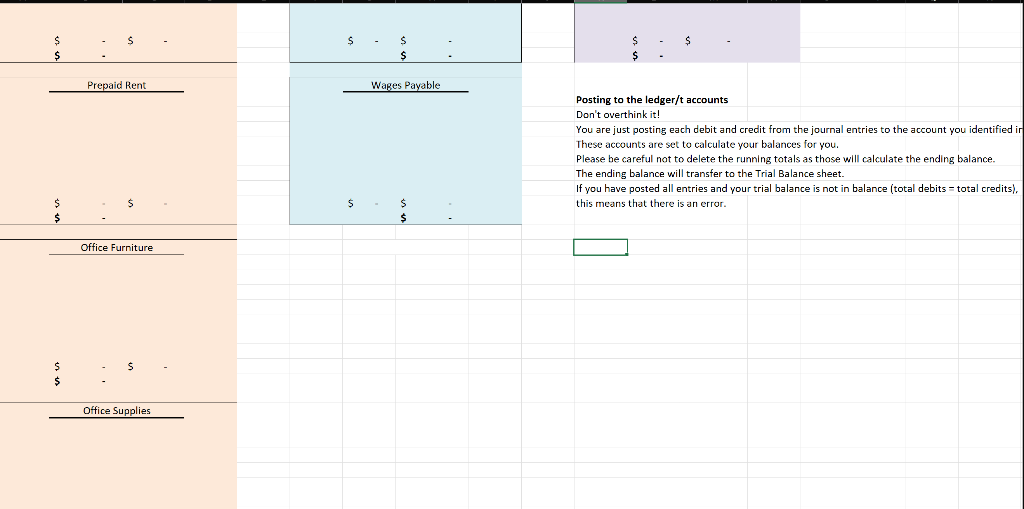

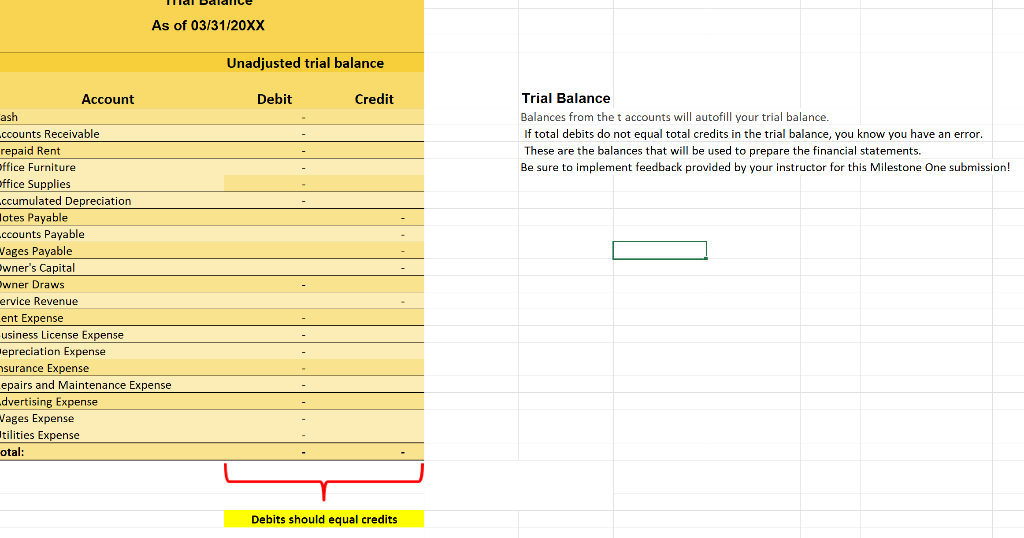

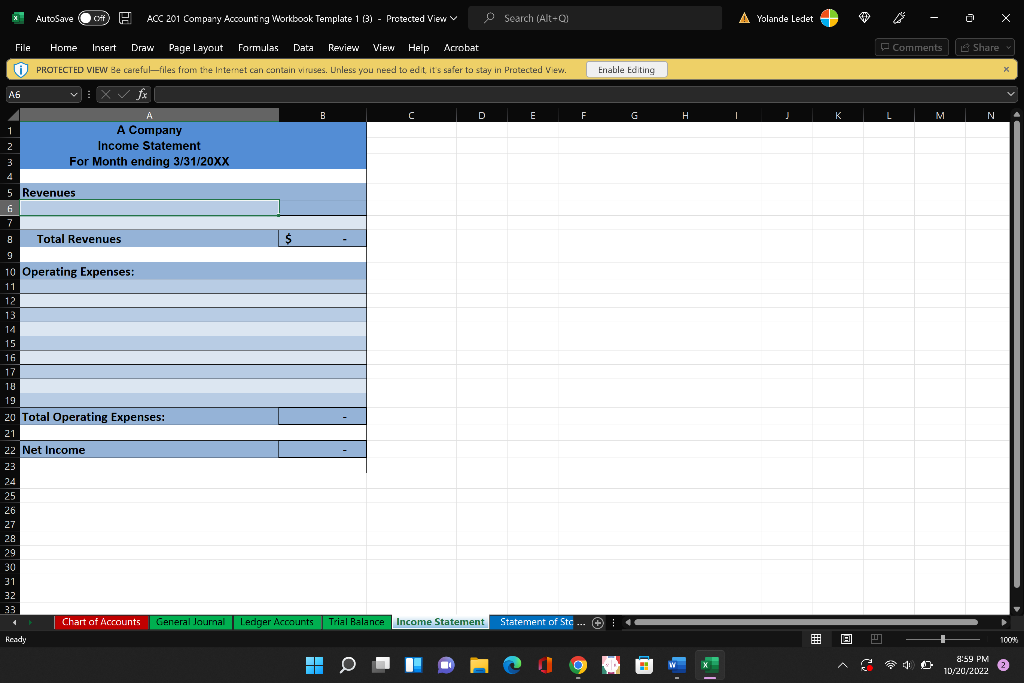

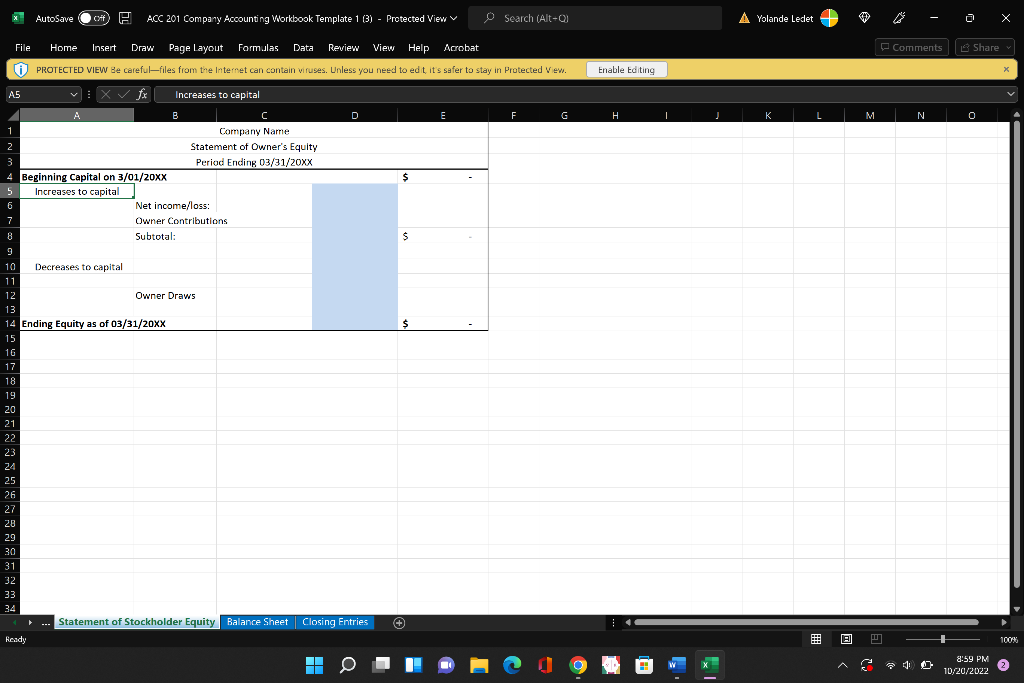

The following events occurred in March: - March 1: Owner borrowed $125,000 to fund/start the business. The loan term is 5 years. - March 1: Owner paid $250 to the county for a business license. - March 2: Owner signed lease on office space; paying first (March 20XX) and last month's rent of $950 per month. - March 5: Owner contributed office furniture valued at $2,750 and cash in the amount of $15,000 to the business. - March 6: Owner performed service for client in the amount of $650. Customer paid in cash. - March 8: Owner purchased advertising services on account in the amount of $500. - March 10: Owner provided services to client on account, in the amount of \$1,725. - March 15: Owner paid business insurance in the amount of $750. - March 20: The owner received first utility bill in the amount of $135, due in April. - Olarch 20: Office copier required maintenance; owner paid $95.00 for copier serv. Ong. - March 22: Owner withdrew \$500 cash for personal use. - March 25: Owner paid \$215 for office supplies. - March 25: Owner provided service to client in the amount of $350. Client paid at time of service. - March 30: Owner paid balance due for advertising expense purchase on March 8. - March 30: Received payment from customer for March 10 invoice in the amount of \$1,725. - March 31: Last day of pay period; owner owes part-time worker $275 for the March 16 through March 31 pay period. This will be paid on April 5. - March 31: Provided service for client on account in the amount of $3,500. - March 31: Record depreciation of the office furniture at $45.83. This chart of accounts should help you identify the appropriate accounts to record to as you are nalyzing and journaling transactions for this workbook. There is nothing to complete on this bage; this is simply a resource for you. Journal Entry Tips The debited account is recorded first, credited account recorded second. Debits and credits must always equal! There can be compound entries in which two accounts recelve a debt to an equivalent credited amount to one account. Be sure to use your chart of accounts (the flrst page of this workbook). Each account you will record to is al ready listed and organized by classification of the account. \begin{tabular}{|ccc|} \hline & Accounts Payable \\ \hline \end{tabular} Posting to the ledger/t accounts Don't overthink it! You are just posting each debit and credit from the journal entries to the account you identified ir These accounts are set to calculate your balances for you. Please be careful not to delete the running totals as thase will calculate the ending balance. The ending balance will transfer to the Trial Balance sheet. If you have posted all entries and your trial balance is not in balance (total debits = total credits). this means that there is an error. Trial Balance Balances from the t accounts will autofill your trial balance. If total debits do not equal total credits in the trial balance, you know you have an error. These are the balances that will be used to prepare the financial statements. Be sure to implement feedback provided by your instructor for this Milestone One submission! x Autosave Oof (G ACC 201 Company Accounting Workbook Template 1(3) - Protected View File Home Insert Draw Page Layout Formulas Data Review View Help Acrobat (i) PROTECTED VIEW Be careful-files from the Internet can contain wiruses. Unless you need to ed th it s safer to stay in Protected v ew. The following events occurred in March: - March 1: Owner borrowed $125,000 to fund/start the business. The loan term is 5 years. - March 1: Owner paid $250 to the county for a business license. - March 2: Owner signed lease on office space; paying first (March 20XX) and last month's rent of $950 per month. - March 5: Owner contributed office furniture valued at $2,750 and cash in the amount of $15,000 to the business. - March 6: Owner performed service for client in the amount of $650. Customer paid in cash. - March 8: Owner purchased advertising services on account in the amount of $500. - March 10: Owner provided services to client on account, in the amount of \$1,725. - March 15: Owner paid business insurance in the amount of $750. - March 20: The owner received first utility bill in the amount of $135, due in April. - Olarch 20: Office copier required maintenance; owner paid $95.00 for copier serv. Ong. - March 22: Owner withdrew \$500 cash for personal use. - March 25: Owner paid \$215 for office supplies. - March 25: Owner provided service to client in the amount of $350. Client paid at time of service. - March 30: Owner paid balance due for advertising expense purchase on March 8. - March 30: Received payment from customer for March 10 invoice in the amount of \$1,725. - March 31: Last day of pay period; owner owes part-time worker $275 for the March 16 through March 31 pay period. This will be paid on April 5. - March 31: Provided service for client on account in the amount of $3,500. - March 31: Record depreciation of the office furniture at $45.83. This chart of accounts should help you identify the appropriate accounts to record to as you are nalyzing and journaling transactions for this workbook. There is nothing to complete on this bage; this is simply a resource for you. Journal Entry Tips The debited account is recorded first, credited account recorded second. Debits and credits must always equal! There can be compound entries in which two accounts recelve a debt to an equivalent credited amount to one account. Be sure to use your chart of accounts (the flrst page of this workbook). Each account you will record to is al ready listed and organized by classification of the account. \begin{tabular}{|ccc|} \hline & Accounts Payable \\ \hline \end{tabular} Posting to the ledger/t accounts Don't overthink it! You are just posting each debit and credit from the journal entries to the account you identified ir These accounts are set to calculate your balances for you. Please be careful not to delete the running totals as thase will calculate the ending balance. The ending balance will transfer to the Trial Balance sheet. If you have posted all entries and your trial balance is not in balance (total debits = total credits). this means that there is an error. Trial Balance Balances from the t accounts will autofill your trial balance. If total debits do not equal total credits in the trial balance, you know you have an error. These are the balances that will be used to prepare the financial statements. Be sure to implement feedback provided by your instructor for this Milestone One submission! x Autosave Oof (G ACC 201 Company Accounting Workbook Template 1(3) - Protected View File Home Insert Draw Page Layout Formulas Data Review View Help Acrobat (i) PROTECTED VIEW Be careful-files from the Internet can contain wiruses. Unless you need to ed th it s safer to stay in Protected v ew