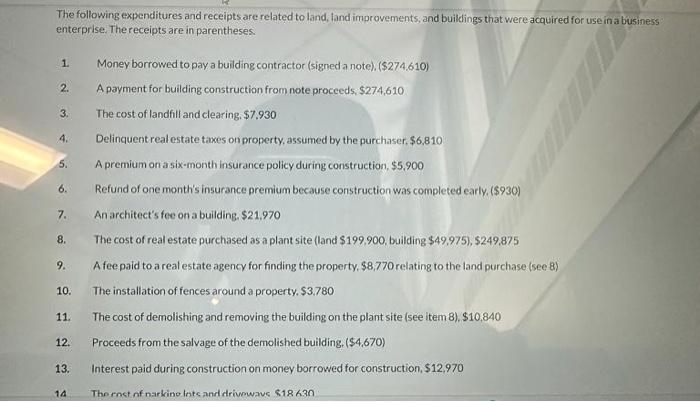

The following expenditures and receipts are related to land, land improvements, and buildings that were acquired for use in a business enterprise. Thereceipts are in parentheses. 1. Money borrowed to pay a building contractor (signed a note), ($274.610) 2. A payment for building construction from note proceeds, $274,610 3. The cost of landfill and clearing, $7,930 4. Delinquentreal estate taxes on property, assumed by the purchaser, $6,810 5. A premium on a six-month insurance policy during construction, $5.900 6. Refund of one month's insurance premium because construction was completed early. ($930) 7. An architect's fee on a building, $21,970 8. The cost of real estate purchased as a plant site (land $199,900, building $49,975 ), $249,875 9. A feepaid to a real estate agency for finding the property, $8,770 relating to the land purchase (see 8 ) 10. The installation of fences around a property. $3.780 11. The cost of demolishing and removing the building on the plant site (see item 8 ), $10,840 12. Proceeds from the salvage of the demolished building, ($4,670) 13. Interest paid during construction on money borrowed for construction, $12,970 14. Therest of narkino lots and drivmwave $1863n The following expenditures and receipts are related to land, land improvements, and buildings that were acquired for use in a business enterprise. Thereceipts are in parentheses. 1. Money borrowed to pay a building contractor (signed a note), ($274.610) 2. A payment for building construction from note proceeds, $274,610 3. The cost of landfill and clearing, $7,930 4. Delinquentreal estate taxes on property, assumed by the purchaser, $6,810 5. A premium on a six-month insurance policy during construction, $5.900 6. Refund of one month's insurance premium because construction was completed early. ($930) 7. An architect's fee on a building, $21,970 8. The cost of real estate purchased as a plant site (land $199,900, building $49,975 ), $249,875 9. A feepaid to a real estate agency for finding the property, $8,770 relating to the land purchase (see 8 ) 10. The installation of fences around a property. $3.780 11. The cost of demolishing and removing the building on the plant site (see item 8 ), $10,840 12. Proceeds from the salvage of the demolished building, ($4,670) 13. Interest paid during construction on money borrowed for construction, $12,970 14. Therest of narkino lots and drivmwave $1863n