Answered step by step

Verified Expert Solution

Question

1 Approved Answer

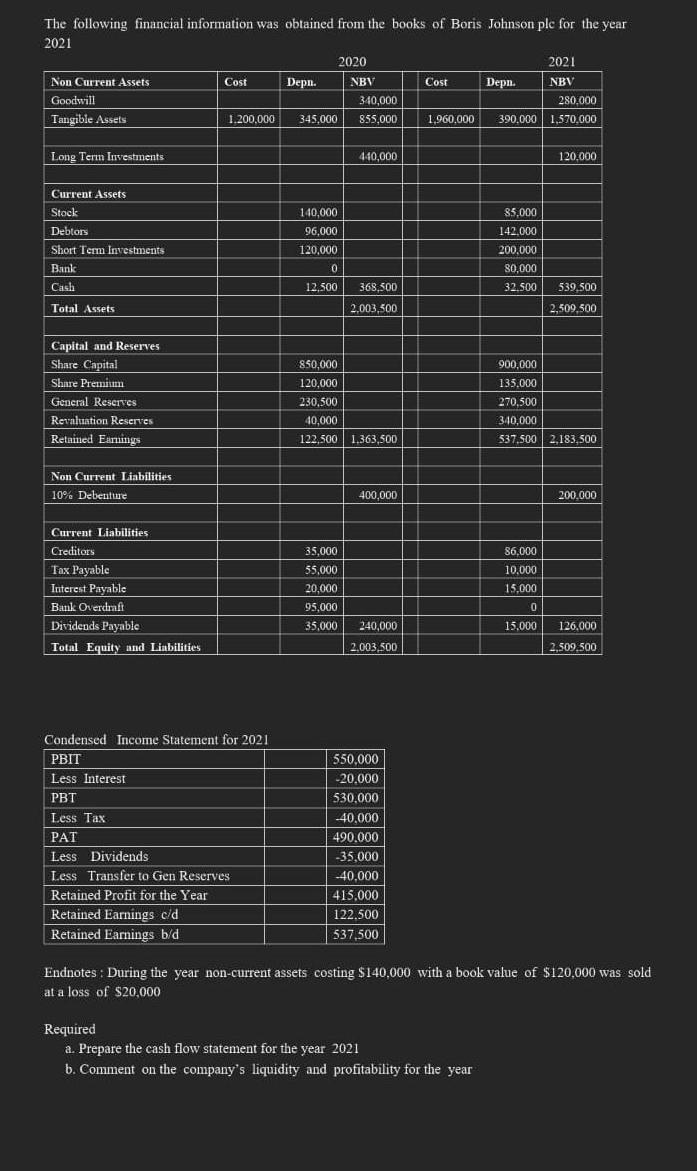

The following financial information was obtained from the books of Boris Johnson ple for the year 2021 Non Current Assets. Goodwill Tangible Assets Long

The following financial information was obtained from the books of Boris Johnson ple for the year 2021 Non Current Assets. Goodwill Tangible Assets Long Term Investments Current Assets Stock Debtors Short Term Investments Bank Cash Total Assets Capital and Reserves Share Capital Share Premium General Reserves Revaluation Reserves Retained Earnings Non Current Liabilities. 10% Debenture Current Liabilities Creditors Tax Payable Interest Payable Bank Overdraft Dividends Payable Total Equity and Liabilities Cost 1.200,000 Condensed Income Statement for 20211 PBIT Less Interest PBT Less Tax PAT Less Dividends Less Transfer to Gen Reserves Retained Profit for the Year Retained Earnings c/d Retained Earnings b/d Depn. 345,000 2020 140,000 96,000 120,000 0 12,500 NBV 35,000 55,000 20,000 95,000 35,000 340,000 855,000 440,000 368,500 2,003,500 850,000 120,000 230,500 40,000 122,500 1,363,500 400,000 240,000 2,003,500 550,000 -20,000 530,000 -40,000 490.000 -35,000 -40,000 415,000 122.500 537,500 Cost Depn. 280,000 1,960,000 390,000 1,570,000 Required a. Prepare the cash flow statement for the year 2021 b. Comment on the company's liquidity and profitability for the year 85,000 142,000 200,000 80,000 32,500 2021 NBV 86,000 10,000 15,000 0 15,000 120.000 539,500 2,509,500 900,000 135.000 270,500 340,000 537,500 2,183,500 200,000 126.000 2,509,500 Endnotes: During the year non-current assets costing $140,000 with a book value of $120,000 was sold at a loss of $20,000

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Cash flow refers to the net balance of cash moving into and out of a business at a specific ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started