Answered step by step

Verified Expert Solution

Question

1 Approved Answer

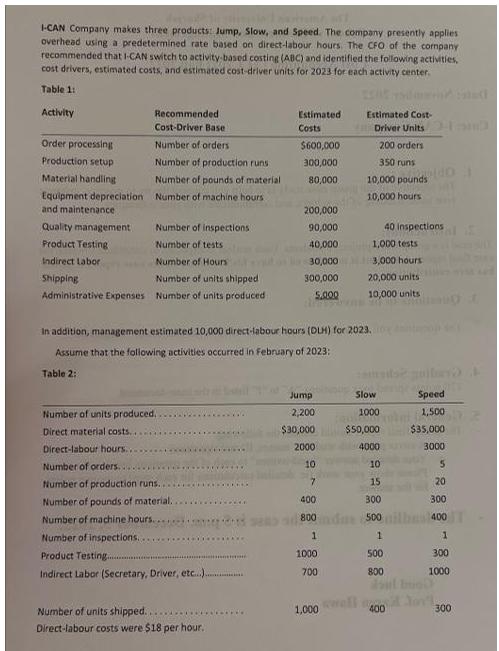

I-CAN Company makes three products: Jump, Slow, and Speed. The company presently applies overhead using a predetermined rate based on direct-labour hours. The CFO

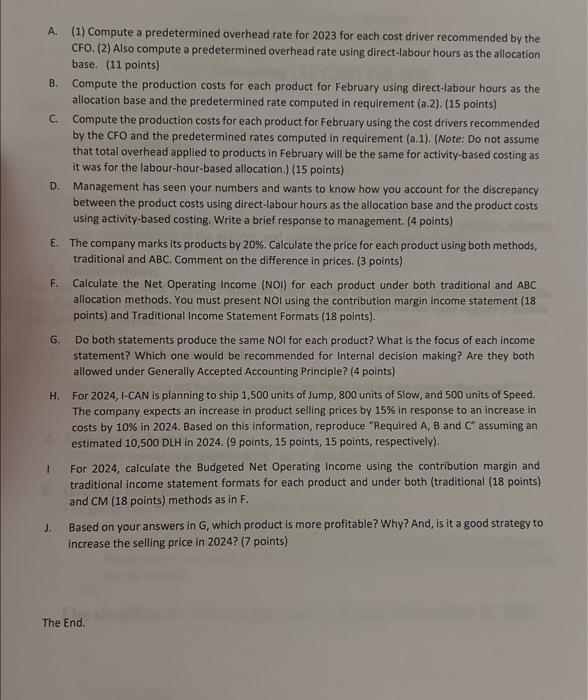

I-CAN Company makes three products: Jump, Slow, and Speed. The company presently applies overhead using a predetermined rate based on direct-labour hours. The CFO of the company recommended that I-CAN switch to activity-based costing (ABC) and identified the following activities, cost drivers, estimated costs, and estimated cost-driver units for 2023 for each activity center. Table 1:1 Activity Order processing Production setup Material handling Equipment depreciation and maintenance Quality management Product Testing Indirect Labor Shipping Recommended Cost-Driver Base Number of orders Number of production runs Number of pounds of material Number of machine hours Number of inspections Number of tests Number of Hours Number of units shipped Administrative Expenses Number of units produced Number of units produced. Direct material costs... Direct-labour hours.. Number of orders. Number of production runs. Number of pounds of material.. Number of machine hours... Number of inspections... Product Testing..... Indirect Labor (Secretary, Driver, etc...)..... Estimated Costs Number of units shipped.. Direct-labour costs were $18 per hour. $600,000 300,000 80,000 In addition, management estimated 10,000 direct-labour hours (DLH) for 2023. Assume that the following activities occurred in February of 2023: Table 2: 200,000 90,000 40,000 30,000 300,000 5.000 Jump 2,200 $30,000 2000 10 7 400 800 1 1000 700 Estimated Cost- Driver Units am 200 orders 350 runs 10,000 pounds 10,000 hours 1,000 1,000 tests 3,000 hours 20,000 units 10,000 units Slow 40 inspections 1000 $50,000 4000 10 15 300 500 1 500 800 400 Speed 1.500 $35,000 3000 5 20 300 400 1 300 1000 300 A. (1) Compute a predetermined overhead rate for 2023 for each cost driver recommended by the CFO. (2) Also compute a predetermined overhead rate using direct-labour hours as the allocation base. (11 points) B. Compute the production costs for each product for February using direct-labour hours as the allocation base and the predetermined rate computed in requirement (a.2). (15 points) C. Compute the production costs for each product for February using the cost drivers recommended by the CFO and the predetermined rates computed in requirement (a.1). (Note: Do not assume that total overhead applied to products in February will be the same for activity-based costing as it was for the labour-hour-based allocation.) (15 points) D. Management has seen your numbers and wants to know how you account for the discrepancy between the product costs using direct-labour hours as the allocation base and the product costs using activity-based costing. Write a brief response to management. (4 points) E. The company marks its products by 20%. Calculate the price for each product using both methods, traditional and ABC. Comment on the difference in prices. (3 points) F. Calculate the Net Operating Income (NOI) for each product under both traditional and ABC allocation methods. You must present NOI using the contribution margin income statement (18 points) and Traditional Income Statement Formats (18 points). G. Do both statements produce the same NOI for each product? What is the focus of each income statement? Which one would be recommended for Internal decision making? Are they both allowed under Generally Accepted Accounting Principle? (4 points) H. For 2024, 1-CAN is planning to ship 1,500 units of Jump, 800 units of Slow, and 500 units of Speed. The company expects an increase in product selling prices by 15% in response to an increase in costs by 10% in 2024. Based on this information, reproduce "Required A, B and C" assuming an estimated 10,500 DLH in 2024. (9 points, 15 points, 15 points, respectively). 1 J. For 2024, calculate the Budgeted Net Operating Income using the contribution margin and traditional income statement formats for each product and under both (traditional (18 points) and CM (18 points) methods as in F. Based on your answers in G, which product is more profitable? Why? And, is it a good strategy to increase the selling price in 2024? (7 points) The End.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 General guidance The answer provided below has been developed in a clear step by step manner 2 Step By Step Step 1 Solution As per given data Requirement A Computation of predetermined overhe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started