Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. General Motors is selling Chevrolet Malibu, a car with a dangerous fuel tank placement that was implicated in a number of fiery crashes.

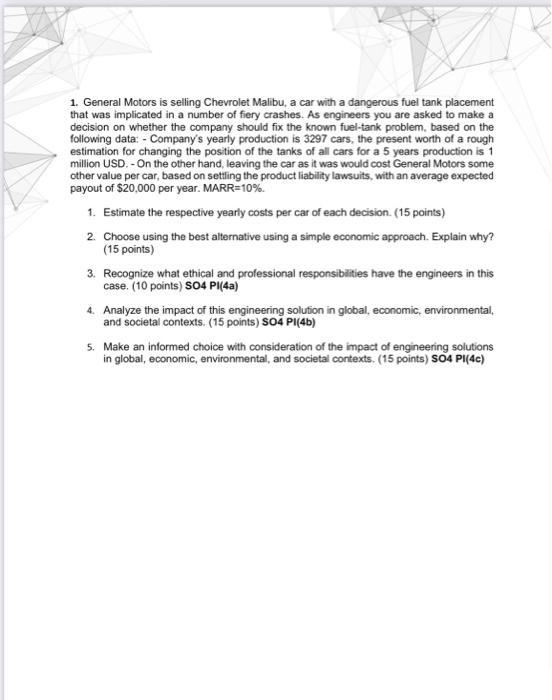

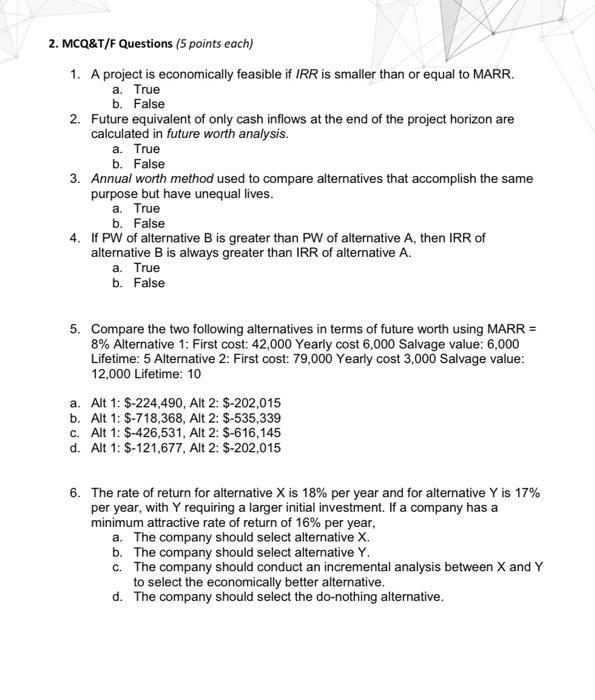

1. General Motors is selling Chevrolet Malibu, a car with a dangerous fuel tank placement that was implicated in a number of fiery crashes. As engineers you are asked to make a decision on whether the company should fix the known fuel-tank problem, based on the following data: - Company's yearly production is 3297 cars, the present worth of a rough estimation for changing the position of the tanks of all cars for a 5 years production is 1 million USD. - On the other hand, leaving the car as it was would cost General Motors some other value per car, based on settling the product liability lawsuits, with an average expected payout of $20,000 per year. MARR=10%. 1. Estimate the respective yearly costs per car of each decision. (15 points) 2. Choose using the best alternative using a simple economic approach. Explain why? (15 points) 3. Recognize what ethical and professional responsibilities have the engineers in this case. (10 points) S04 PI(4a) 4. Analyze the impact of this engineering solution in global, economic, environmental, and societal contexts. (15 points) S04 PI(4b) 5. Make an informed choice with consideration of the impact of engineering solutions in global, economic, environmental, and societal contexts. (15 points) S04 PI(4c) 2. MCQ&T/F Questions (5 points each) 1. A project is economically feasible if IRR is smaller than or equal to MARR. a. True b. False 2. Future equivalent of only cash inflows at the end of the project horizon are calculated in future worth analysis. a. True b. False 3. Annual worth method used to compare alternatives that accomplish the same purpose but have unequal lives. a. True b. False 4. If PW of alternative B is greater than PW of alternative A, then IRR of alternative B is always greater than IRR of alternative A. a. True b. False 5. Compare the two following alternatives in terms of future worth using MARR = 8% Alternative 1: First cost: 42,000 Yearly cost 6,000 Salvage value: 6,000 Lifetime: 5 Alternative 2: First cost: 79,000 Yearly cost 3,000 Salvage value: 12,000 Lifetime: 10 a. Alt 1: $-224,490, Alt 2: $-202,015 b. Alt 1: $-718,368, Alt 2: $-535,339 c. Alt 1: $-426,531, Alt 2: $-616,145 d. Alt 1: $-121,677, Alt 2: $-202,015 6. The rate of return for alternative X is 18% per year and for alternative Y is 17% per year, with Y requiring a larger initial investment. If a company has a minimum attractive rate of return of 16% per year, a. The company should select alternative X. b. The company should select alternative Y. c. The company should conduct an incremental analysis between X and Y to select the economically better alternative. d. The company should select the do-nothing alternative.

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started