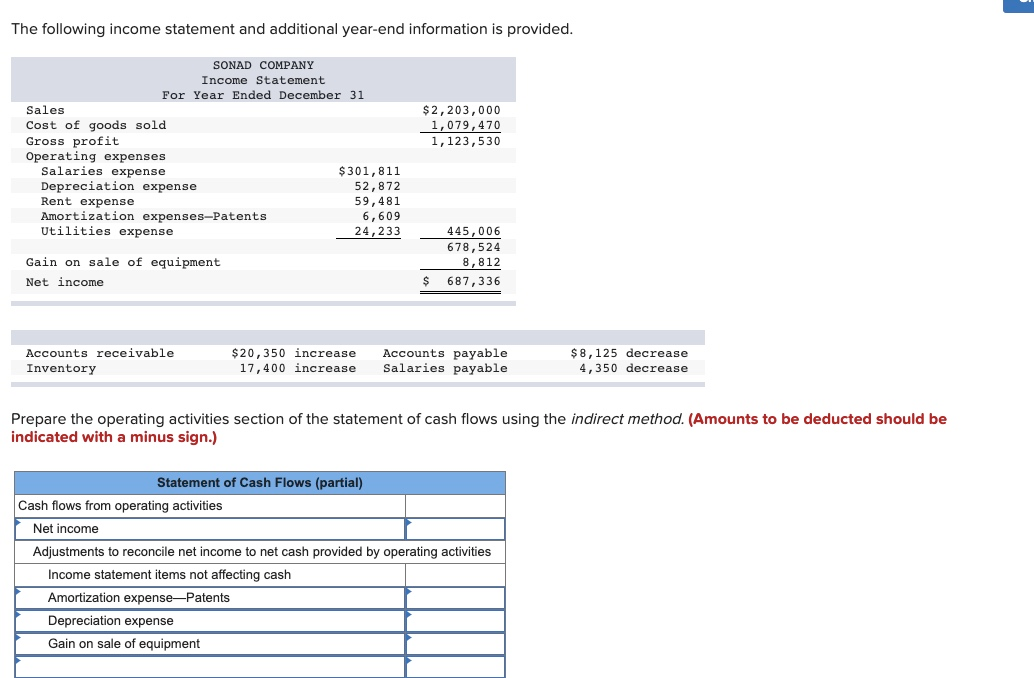

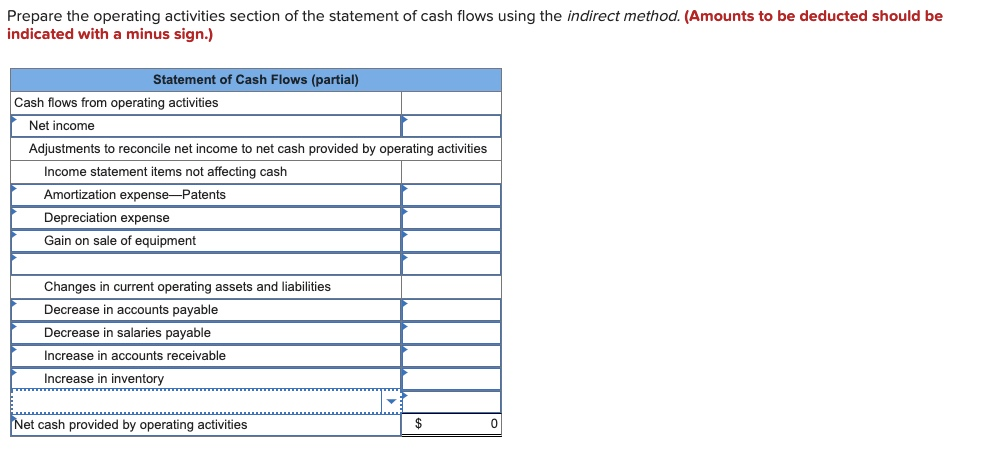

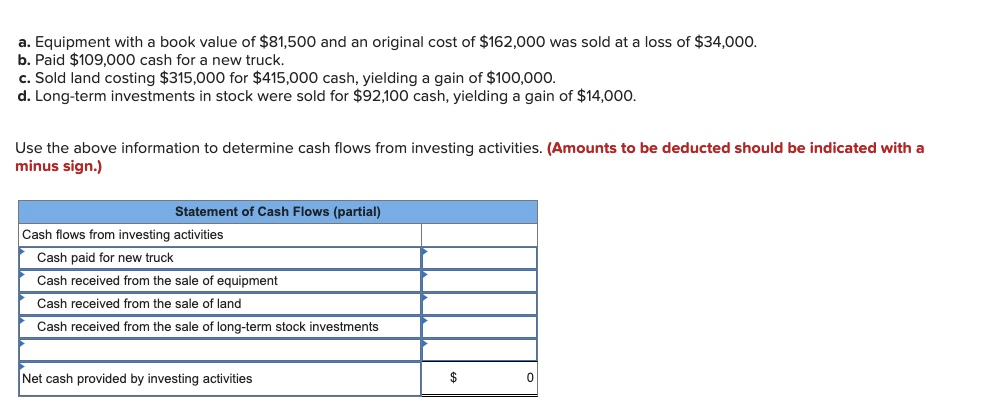

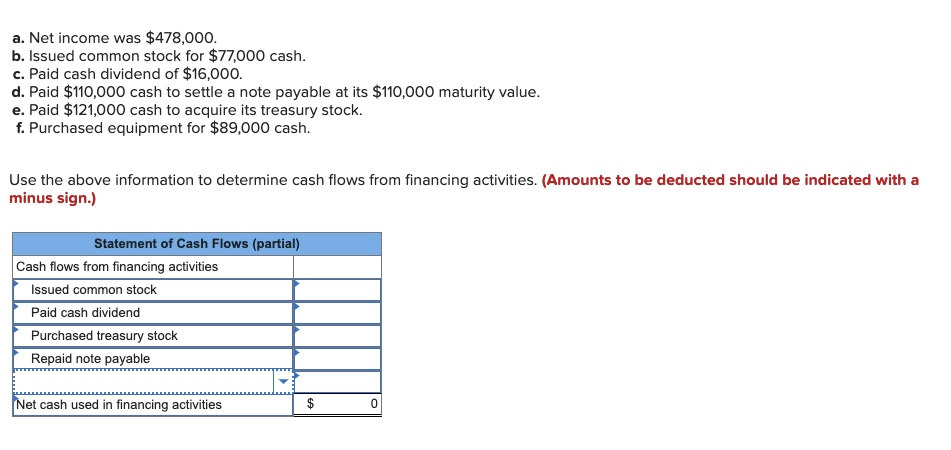

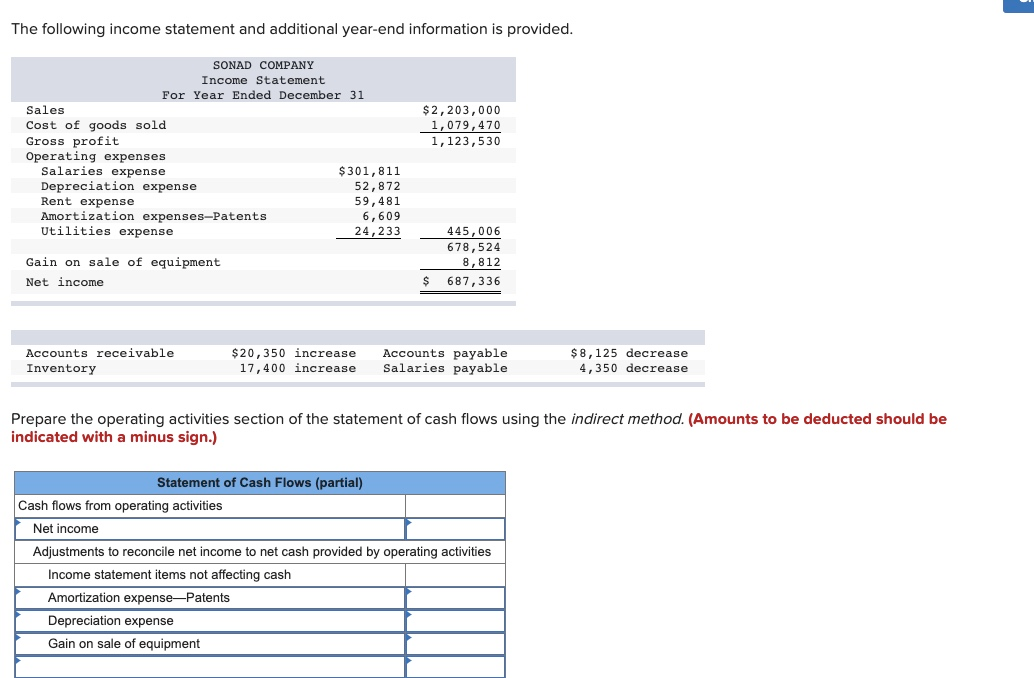

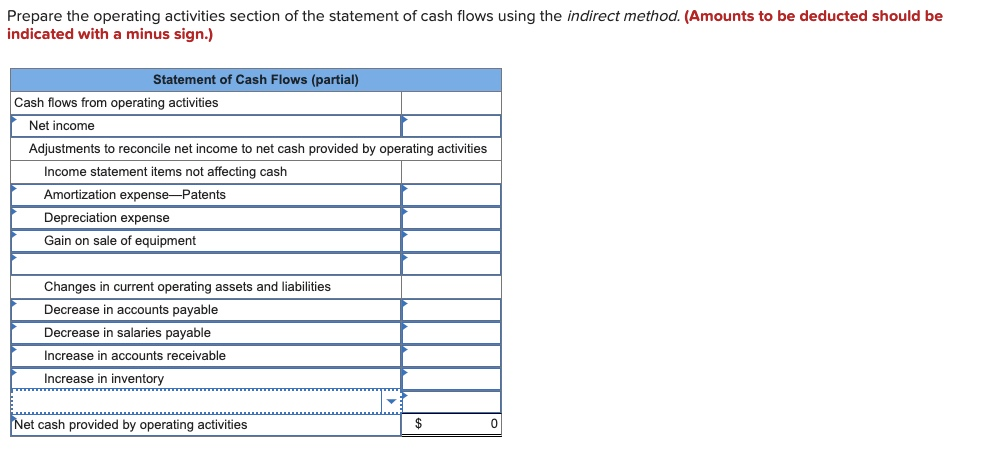

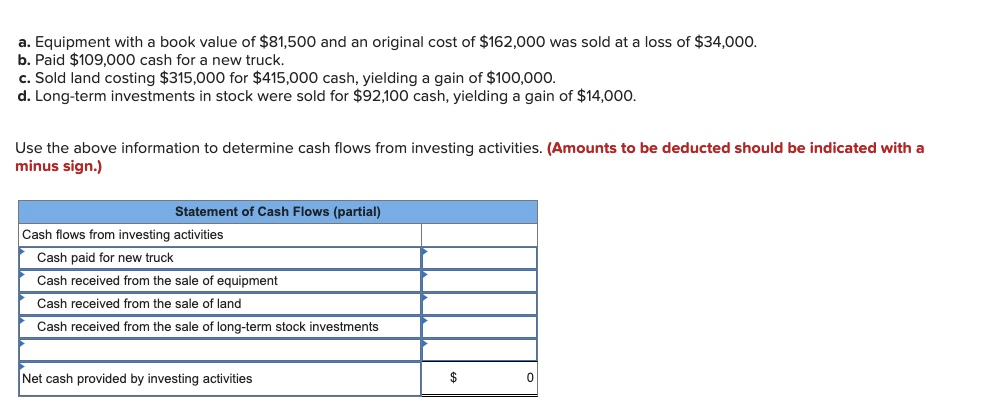

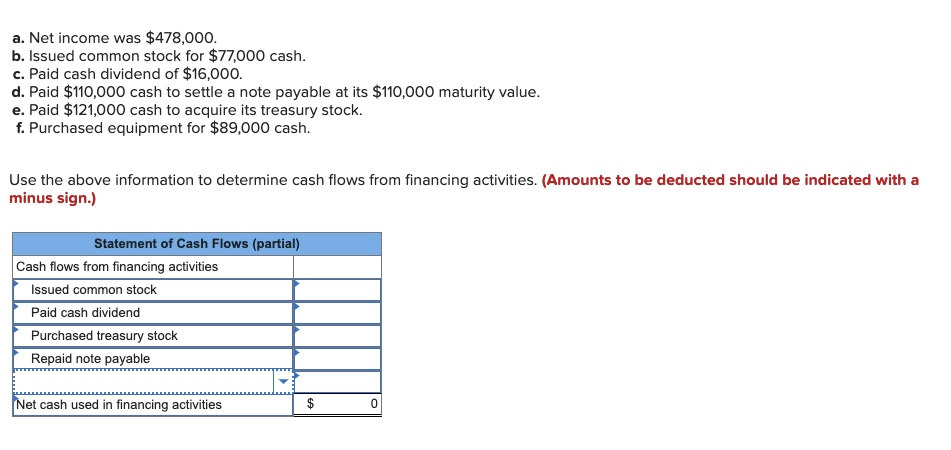

The following income statement and additional year-end information is provided. $ 2,203,000 1,079,470 1,123,530 SONAD COMPANY Income Statement For Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses Salaries expense $301, 811 Depreciation expense 52,872 Rent expense 59,481 Amortization expenses-Patents 6,609 Utilities expense 24,233 Gain on sale of equipment Net income 445,006 678,524 8,812 687,336 $ Accounts receivable Inventory $20,350 increase 17,400 increase Accounts payable Salaries payable $8,125 decrease 4,350 decrease Prepare the operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Amortization expense-Patents Depreciation expense Gain on sale of equipment Prepare the operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Amortization expense-Patents Depreciation expense Gain on sale of equipment Changes in current operating assets and liabilities Decrease in accounts payable Decrease in salaries payable Increase in accounts receivable Increase in inventory Net cash provided by operating activities $ 0 a. Equipment with a book value of $81,500 and an original cost of $162,000 was sold at a loss of $34,000. b. Paid $109,000 cash for a new truck. c. Sold land costing $315,000 for $415,000 cash, yielding a gain of $100,000. d. Long-term investments in stock were sold for $92,100 cash, yielding a gain of $14,000. Use the above information to determine cash flows from investing activities. (Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Cash flows from investing activities Cash paid for new truck Cash received from the sale of equipment Cash received from the sale of land Cash received from the sale of long-term stock investments Net cash provided by investing activities $ 0 a. Net income was $478,000. b. Issued common stock for $77,000 cash. c. Paid cash dividend of $16,000. d. Paid $110,000 cash to settle a note payable at its $110,000 maturity value. e. Paid $121,000 cash to acquire its treasury stock. f. Purchased equipment for $89,000 cash. Use the above information to determine cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Cash flows from financing activities Issued common stock Paid cash dividend Purchased treasury stock Repaid note payable Net cash used in financing activities $