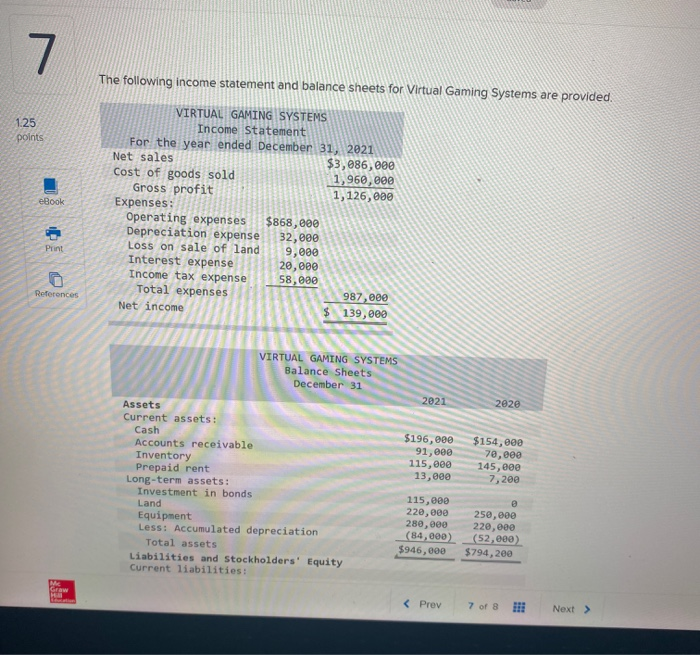

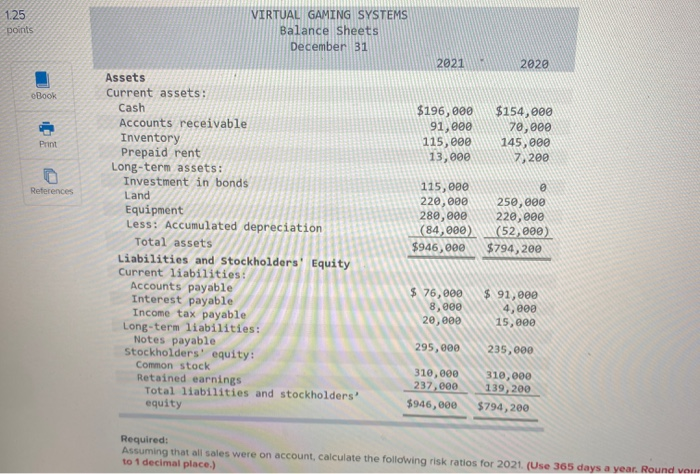

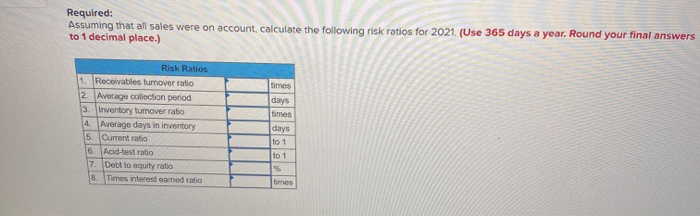

The following income statement and balance sheets for Virtual Gaming Systems are provided. 1.25 points VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31, 2021 Net sales $3,086, 000 Cost of goods sold 1,960,000 Gross profit 1,126,000 Expenses: Operating expenses $868,000 Depreciation expense 32,000 Loss on sale of land 9,000 Interest expense 20,000 Income tax expense 58,080 Total expenses 987 Net income References $ 139,000 VIRTUAL GAMING SYSTEMS Balance Sheets December 31 2021 2020 $196,000 91,000 115,000 13,000 $154, eee 70,000 145,000 7,200 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: 115,000 220, eee 280,000 (84,000) $946,000 250,000 220,000 (52,eee) $794,200 1.25 points RTUAL GAMING SYSTEMS Balance Sheets December 31 2021 2020 eBook $196,000 91,000 115,000 13,000 $154,000 70,000 145,000 7,200 Print References Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equi Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity 115,000 220,000 280,000 (84,000) $946,000 250,000 220,000 (52,000) $794,200 $ 76,000 8,000 20,000 $ 91,000 4,000 15,000 235,000 295,000 310,000 237,800 $946,000 310,000 139,209 $794,200 Required: Assuming that all sales were on account, calculate the following risk ratios for 2021. (Use 365 days a year. Round V to 1 decimal place.) . Required: Assuming that all sales were on account, calculate the following risk ratios for 2021. (Use 365 days a year. Round your final answers to 1 decimal place.) Risk Ratios 11. Receivables turnover ratio 2. Average collection period 3. Inventory tumover ratio 4. Average days in inventory 5. Current ratio 6. Acid-test ratio 7 Dect to quity ratio 8. Times interest earned ratio