Answered step by step

Verified Expert Solution

Question

1 Approved Answer

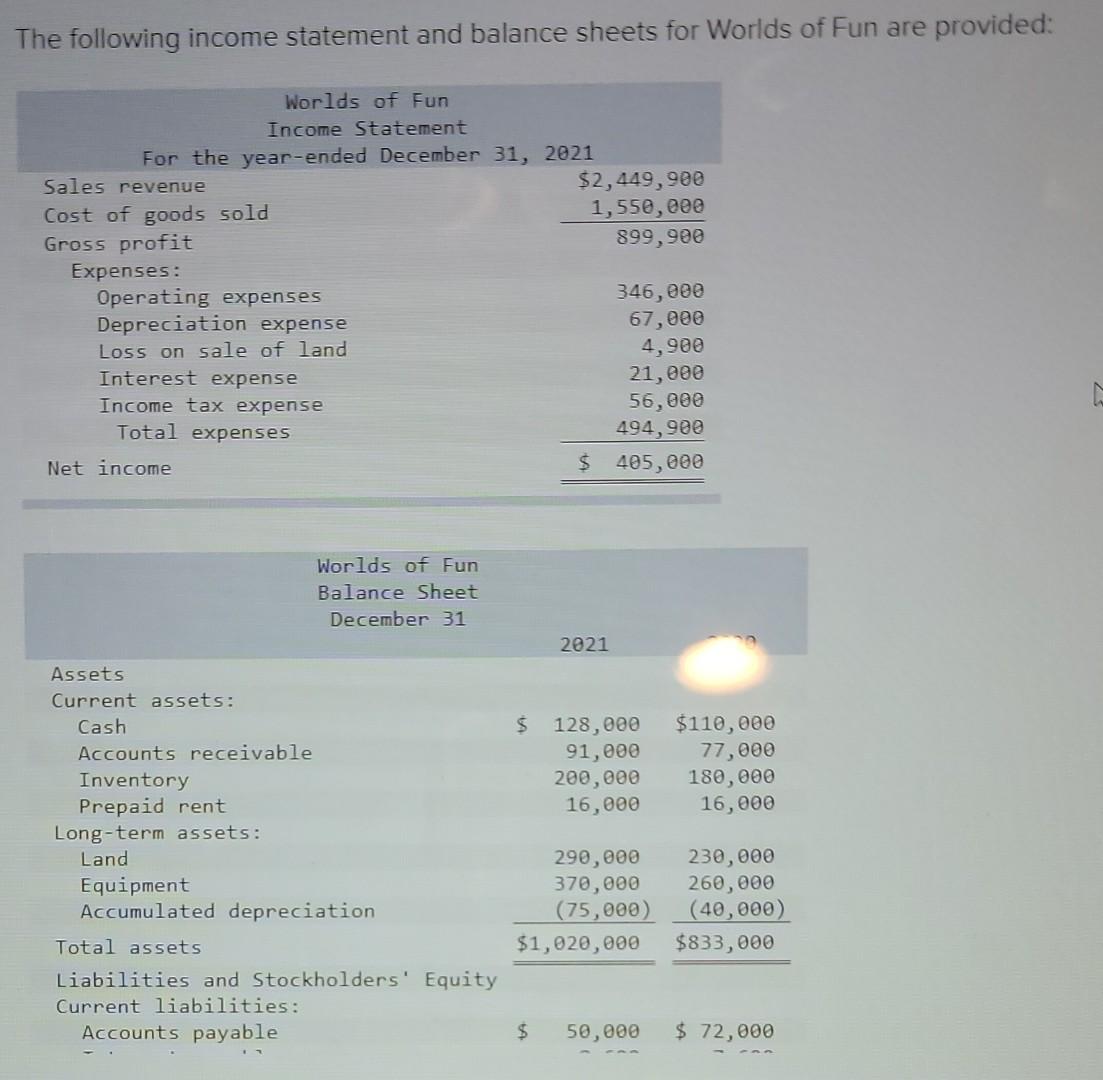

The following income statement and balance sheets for Worlds of Fun are provided: Worlds of Fun Income Statement For the year-ended December 31, 2021 Sales

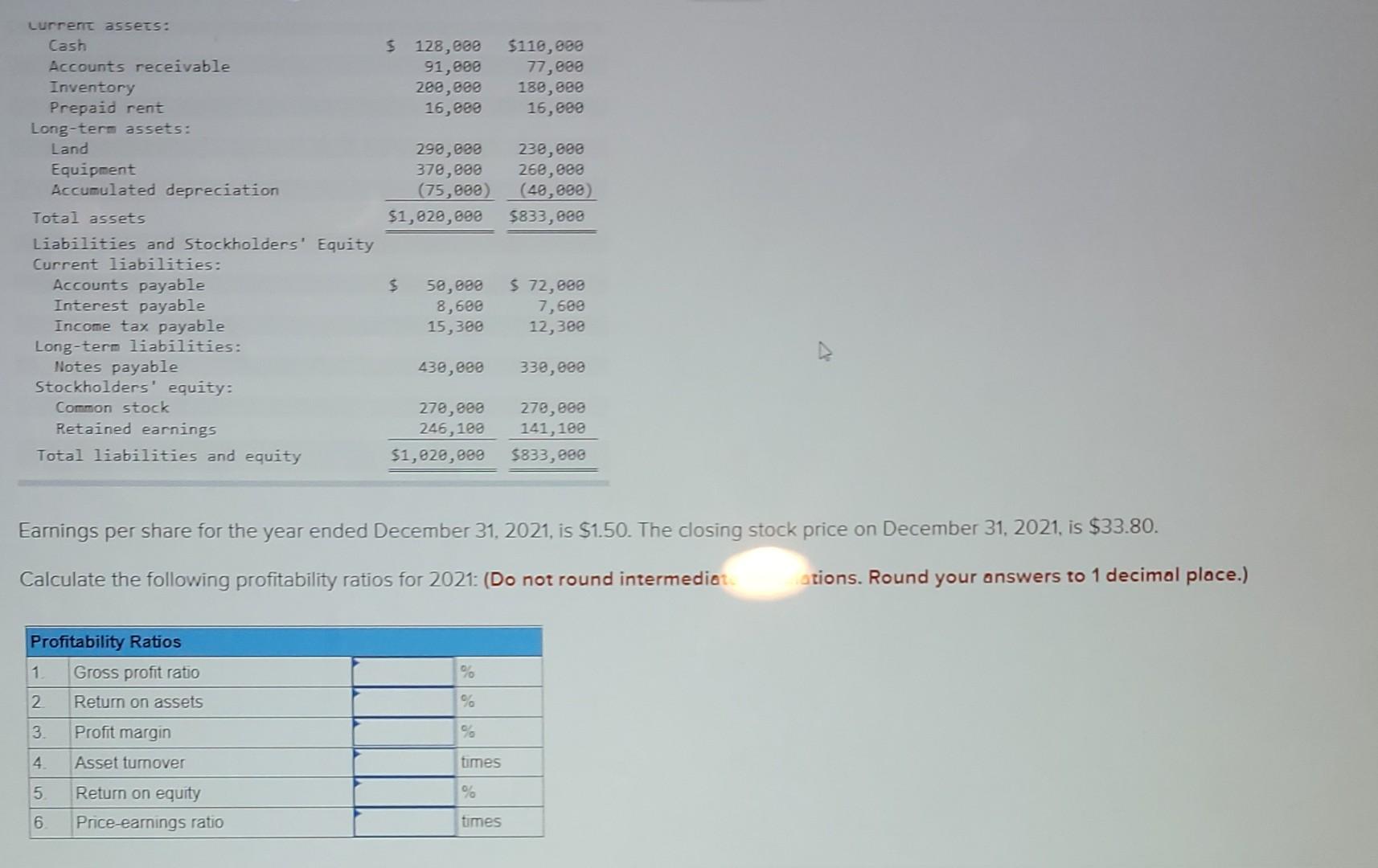

The following income statement and balance sheets for Worlds of Fun are provided: Worlds of Fun Income Statement For the year-ended December 31, 2021 Sales revenue $2,449,900 Cost of goods sold 1,550,000 Gross profit 899,900 Expenses: Operating expenses 346,000 Depreciation expense 67,000 Loss on sale of land 4,900 Interest expense 21,000 Income tax expense 56,000 Total expenses 494,900 Net income $ 405,000 Worlds of Fun Balance Sheet December 31 2021 $ 128,000 91,000 200,000 16,000 $110,000 77,000 180,000 16,000 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Land Equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable 290,000 370,000 (75,000) $1,020,000 230,000 260,000 (40,000) $833,000 $ 50,000 $ 72,000 $ 128,000 91,800 200, eee 16,000 $110,000 77,280 180,000 16,000 298,000 378,888 (75,000 $1,020,000 230,000 260, een (49,880) 5833, 080 Lurrent assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Land Equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and equity $ 50,000 8,600 15,300 $ 72,000 7,600 12,300 430, eee 330,000 270,000 246,109 $1,020,000 270,000 141,100 $833, 080 Earnings per share for the year ended December 31, 2021, is $1.50. The closing stock price on December 31, 2021, is $33.80. Calculate the following profitability ratios for 2021: (Do not round intermediat ations. Round your answers to 1 decimal place.) Profitability Ratios 1 Gross profit ratio % 2 Return on assets 3. Profit margin 4. Asset turnover times 5 % Return on equity Price earnings ratio 6 times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started