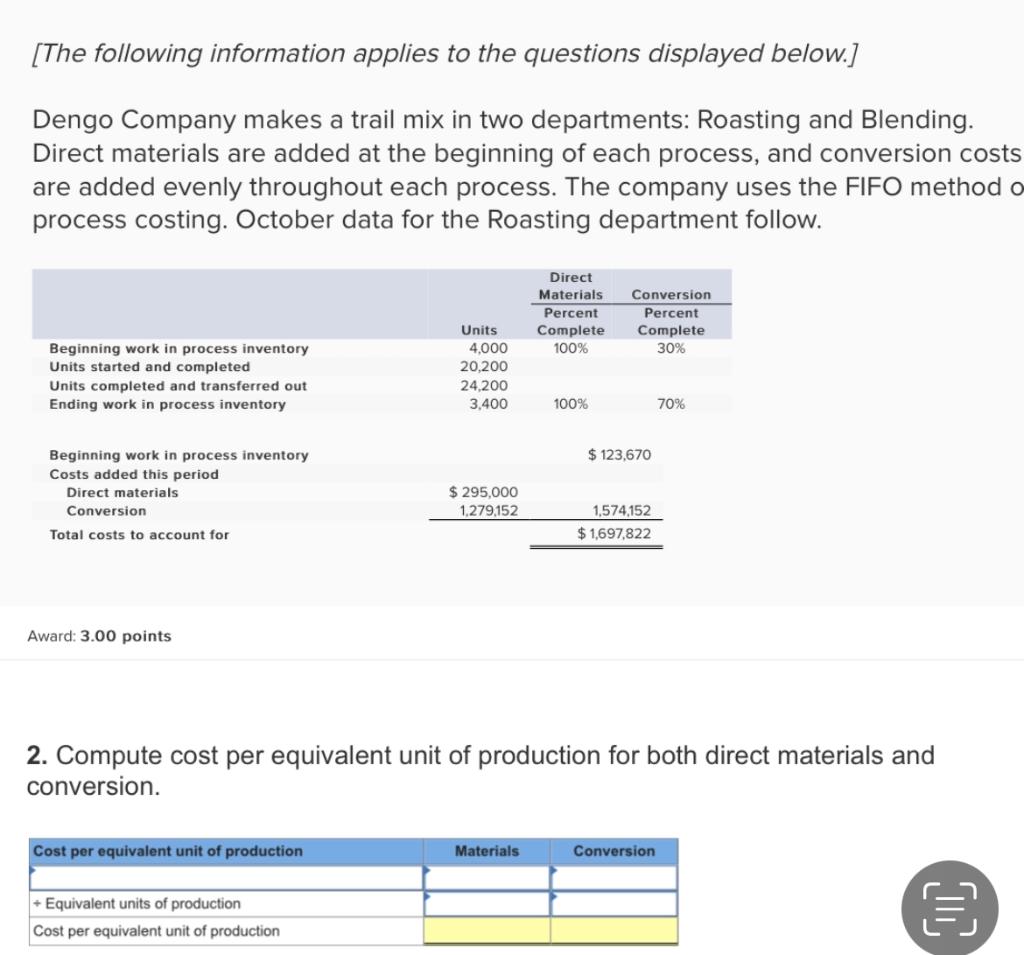

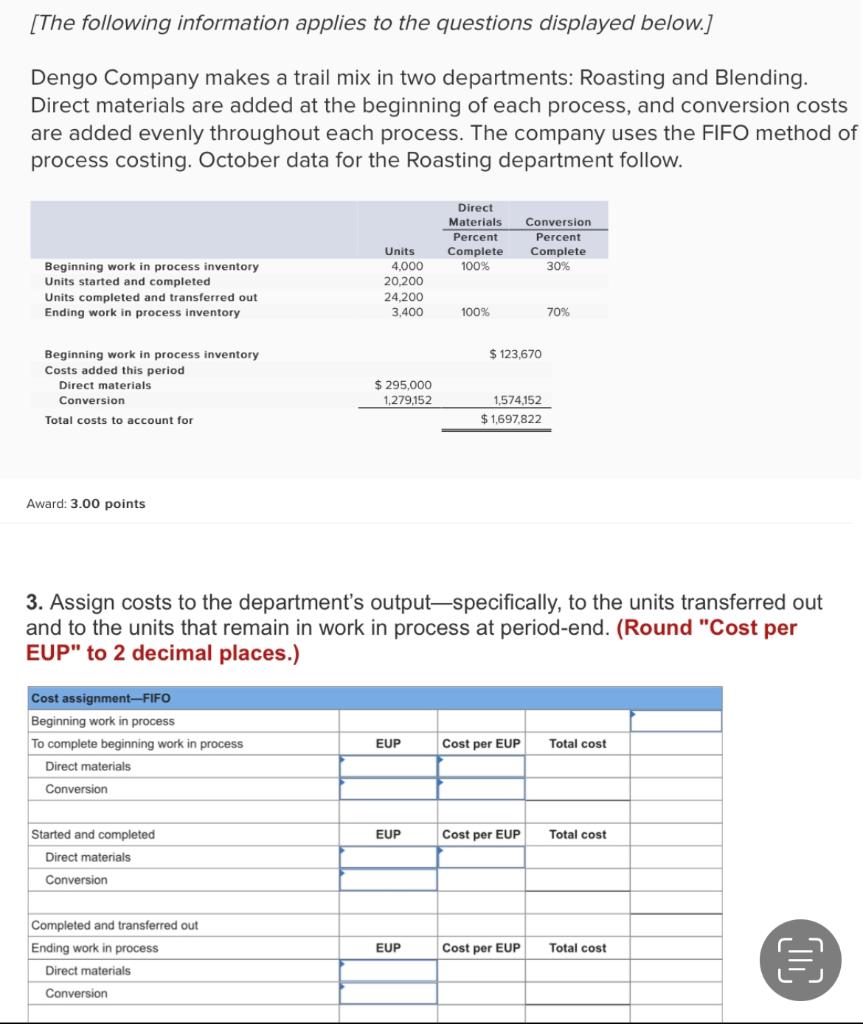

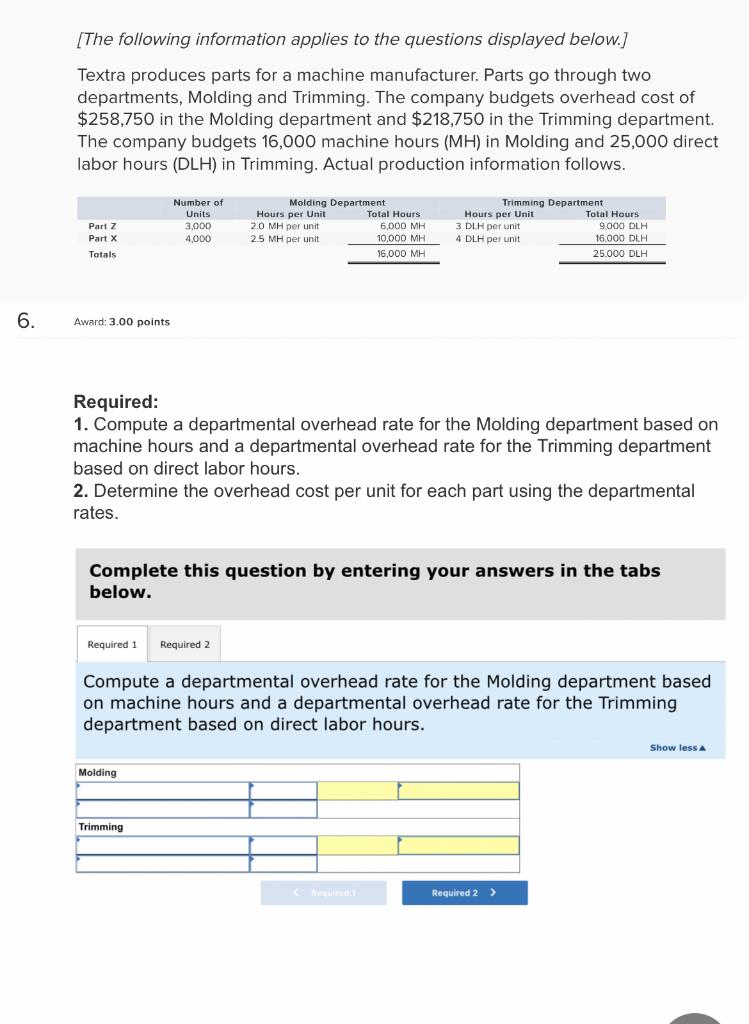

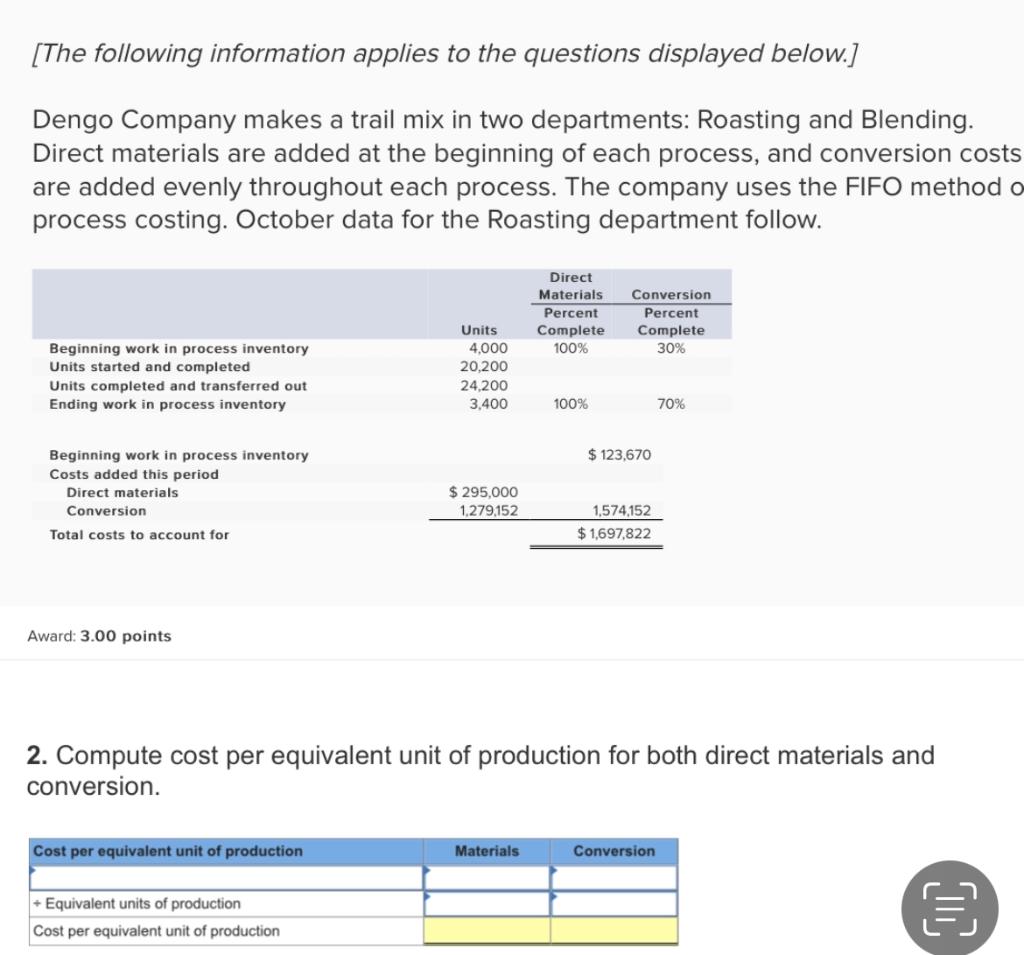

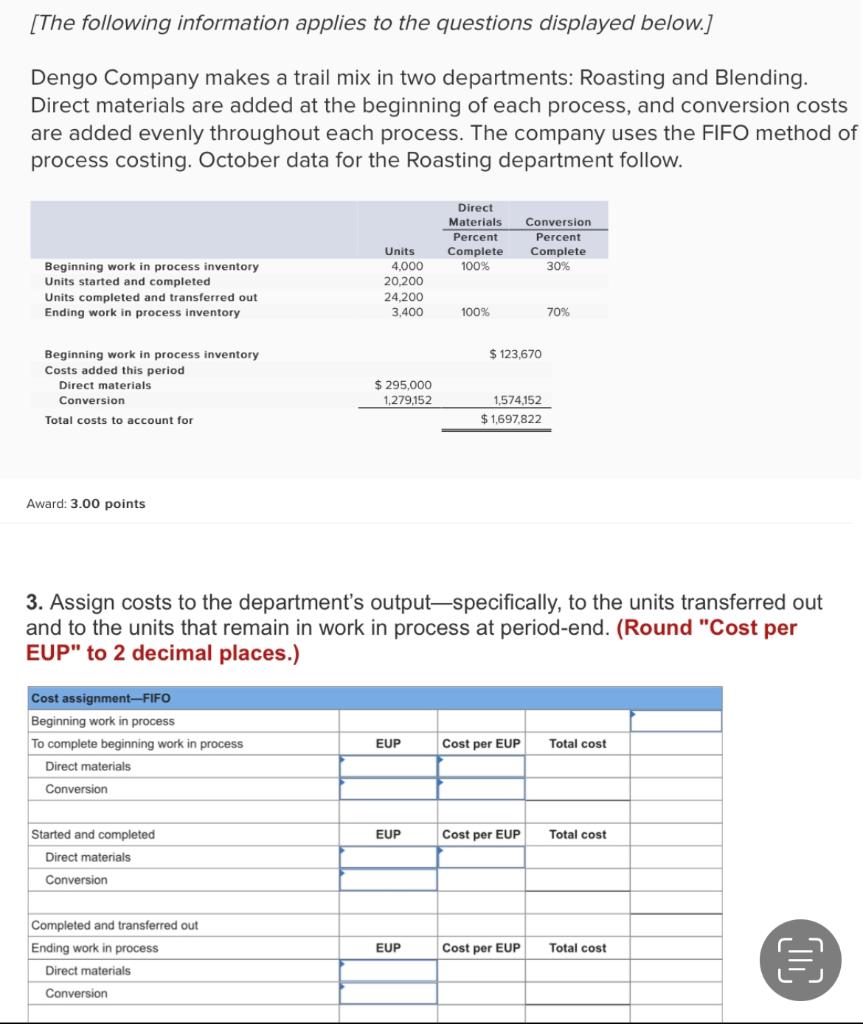

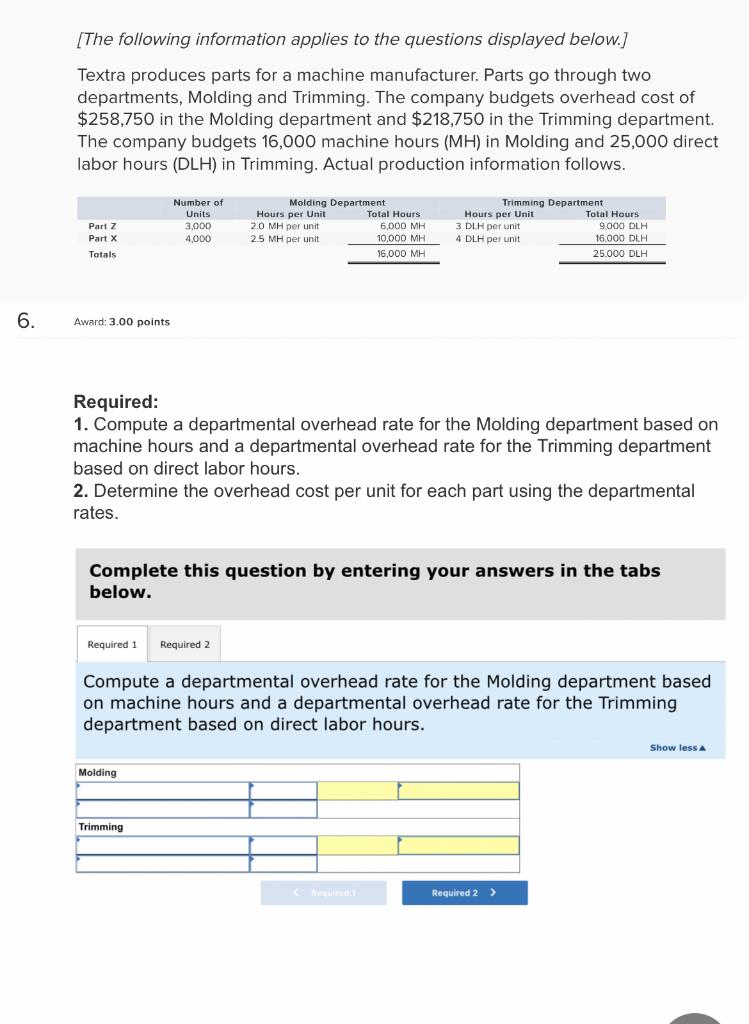

[The following information applies to the questions displayed below.] Dengo Company makes a trail mix in two departments: Roasting and Blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method o process costing. October data for the Roasting department follow. Direct Materials Percent Complete 100% Conversion Percent Complete 30% Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Units 4.000 20,200 24,200 3,400 100% 70% $ 123,670 Beginning work in process inventory Costs added this period Direct materials Conversion Total costs to account for $ 295,000 1,279.152 1,574,152 $1,697,822 Award: 3.00 points 2. Compute cost per equivalent unit of production for both direct materials and conversion. Cost per equivalent unit of production Materials Conversion + Equivalent units of production Cost per equivalent unit of production LLL [The following information applies to the questions displayed below.) Dengo Company makes a trail mix in two departments: Roasting and Blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. October data for the Roasting department follow. Direct Materials Percent Complete 100% Conversion Percent Complete 30% Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Units 4,000 20,200 24,200 3,400 100% 70% $ 123,670 Beginning work in process inventory Costs added this period Direct materials Conversion Total costs to account for $ 295,000 1,279,152 1,574,152 $ 1,697,822 Award: 3.00 points 3. Assign costs to the department's output-specifically, to the units transferred out and to the units that remain in work in process at period-end. (Round "Cost per EUP" to 2 decimal places.) Cost assignment--FIFO Beginning work in process To complete beginning work in process Direct materials Conversion EUP Cost per EUP Total cost EUP Cost per EUP Total cost Started and completed Direct materials Conversion EUP Cost per EUP Total cost Completed and transferred out Ending work in process Direct materials Conversion (The following information applies to the questions displayed below.) Textra produces parts for a machine manufacturer. Parts go through two departments, Molding and Trimming. The company budgets overhead cost of $258,750 in the Molding department and $218,750 in the Trimming department. The company budgets 16,000 machine hours (MH) in Molding and 25,000 direct labor hours (DLH) in Trimming. Actual production information follows. Part 2 Part X Totals Number of Units 3,000 4,000 Molding Department Hours per Unit Total Hours 2.0 MH per unit 6,000 MH 2.5 MH per unit 10,000 MH 16.000 MH Trimming Department Hours per Unit Total Hours 3 DLH per unit 9000 DLH 4 DLH per unit 16 000 DLH 25.000 DLH 6. Award: 3.00 points Required: 1. Compute a departmental overhead rate for the Molding department based on machine hours and a departmental overhead rate for the Trimming department based on direct labor hours. 2. Determine the overhead cost per unit for each part using the departmental rates. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute a departmental overhead rate for the Molding department based on machine hours and a departmental overhead rate for the Trimming department based on direct labor hours. Show less Molding Trimming Required 2 >