Answered step by step

Verified Expert Solution

Question

1 Approved Answer

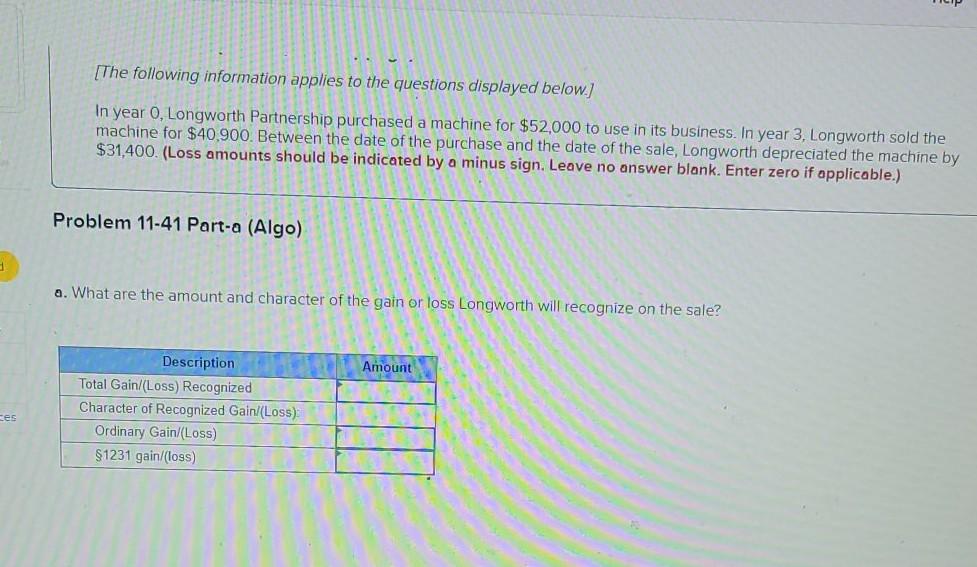

[The following information applies to the questions displayed below.) In year 0, Longworth Partnership purchased a machine for $52,000 to use in its business. In

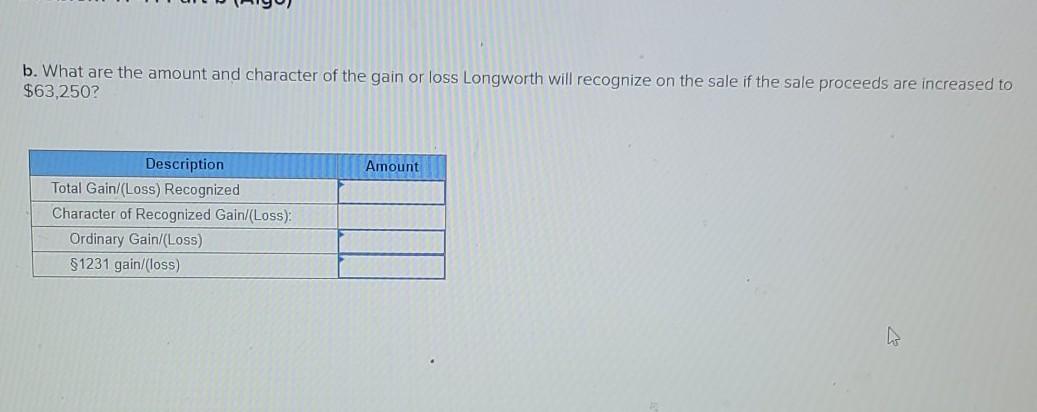

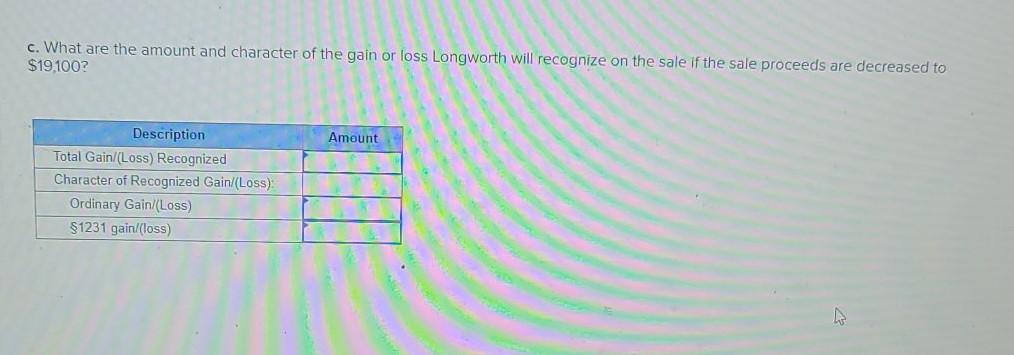

[The following information applies to the questions displayed below.) In year 0, Longworth Partnership purchased a machine for $52,000 to use in its business. In year 3, Longworth sold the machine for $40,900. Between the date of the purchase and the date of the sale, Longworth depreciated the machine by $31,400. (Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) Problem 11-41 Part-a (Algo) a. What are the amount and character of the gain or loss Longworth will recognize on the sale? Amount Description Total Gain/(Loss) Recognized Character of Recognized Gain!(Loss) Ordinary Gain/(Loss) $1231 gain/(109) ces b. What are the amount and character of the gain or loss Longworth will recognize on the sale if the sale proceeds are increased to $63,250? Amount Description Total Gain/(Loss) Recognized Character of Recognized Gain/(Loss): Ordinary Gain/(Loss) $1231 gain/loss) c. What are the amount and character of the gain or loss Longworth will recognize on the sale if the sale proceeds are decreased to $19,100? Amount Description Total Gain/(Loss) Recognized Character of Recognized Gain/(Loss) Ordinary Gain/(Loss) $1231 gain/loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started