Question

[The following information applies to the questions displayed below.] Rick Hall owns a card shop: Halls Cards. The following cash information is available for the

[The following information applies to the questions displayed below.] Rick Hall owns a card shop: Halls Cards. The following cash information is available for the month of August Year 1. As of August 31, the bank statement shows a balance of $11,050. The August 31 unadjusted balance in the Cash account of Halls Cards is $7,773. A review of the bank statement revealed the following information: A deposit of $1,760 on August 31, Year 1, does not appear on the August bank statement. It was discovered that a check to pay for baseball cards was correctly written and paid by the bank for $2,515 but was recorded on the books as $3,415. When

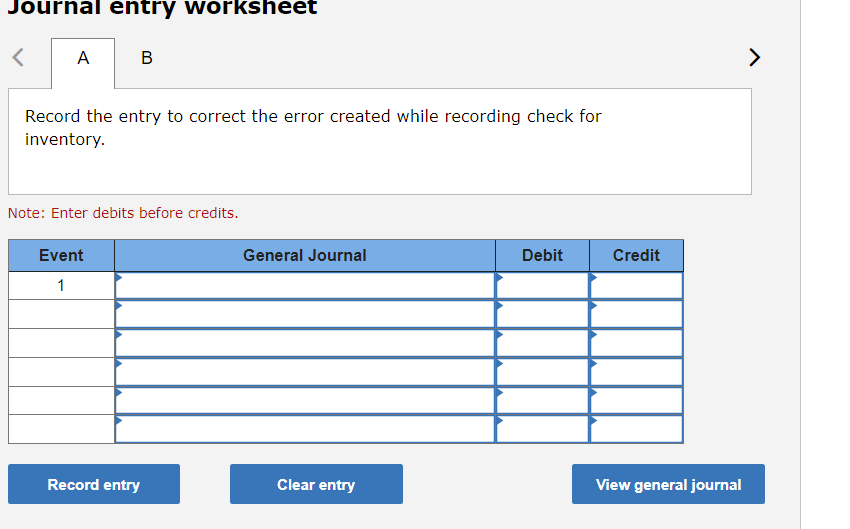

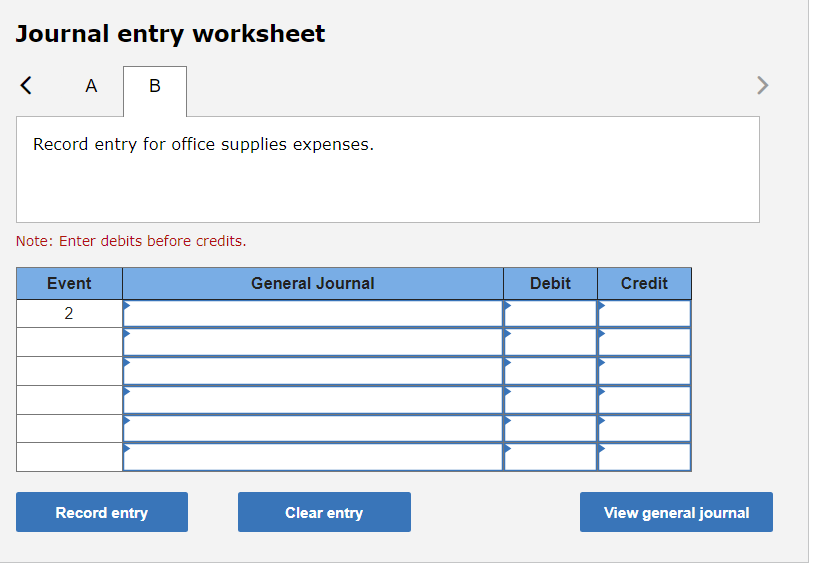

Record the entry to correct the error created while recording check for inventory. Note: Enter debits before credits. Journal entry worksheet Record entry for office supplies expenses. Note: Enter debits before credits. Record the entry to correct the error created while recording check for inventory. Note: Enter debits before credits. Journal entry worksheet Record entry for office supplies expenses. Note: Enter debits before credits

Record the entry to correct the error created while recording check for inventory. Note: Enter debits before credits. Journal entry worksheet Record entry for office supplies expenses. Note: Enter debits before credits. Record the entry to correct the error created while recording check for inventory. Note: Enter debits before credits. Journal entry worksheet Record entry for office supplies expenses. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started