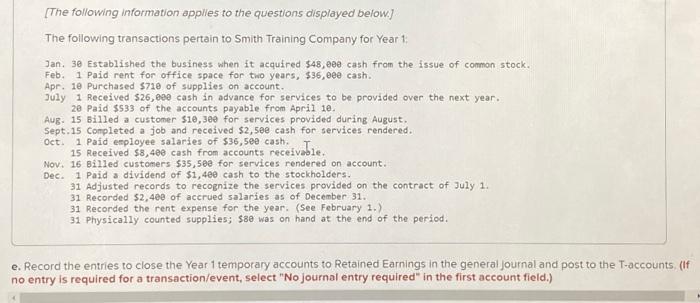

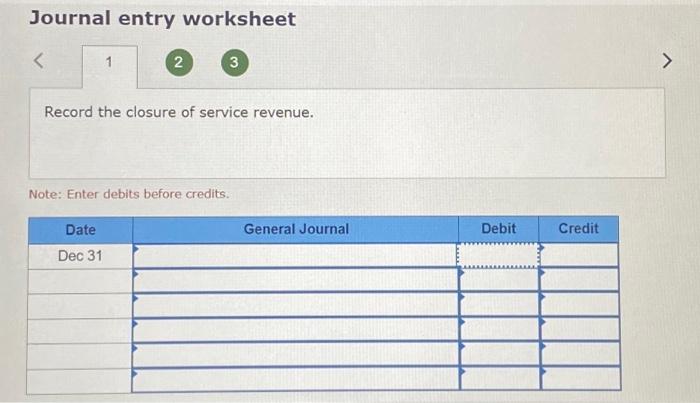

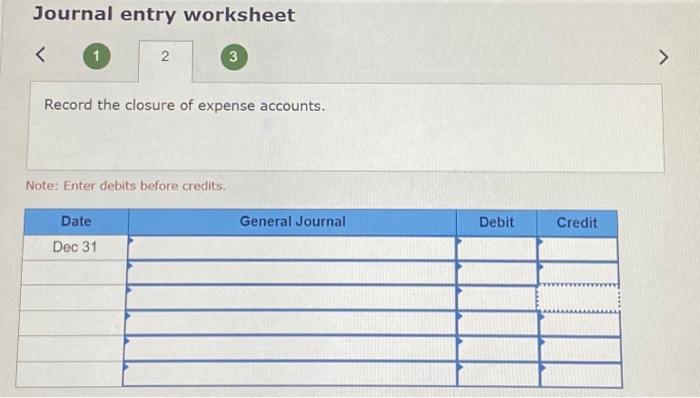

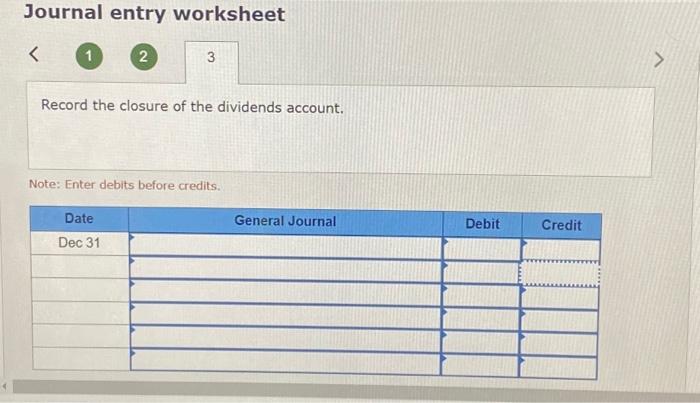

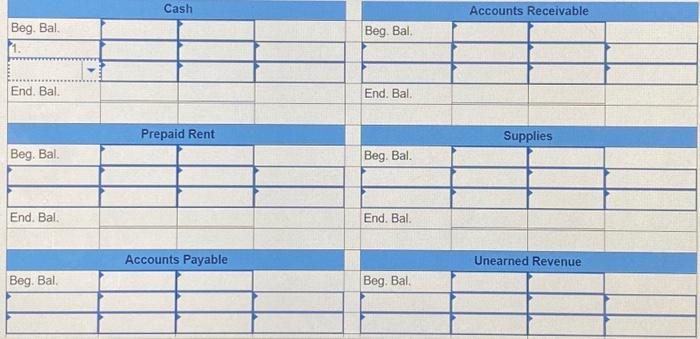

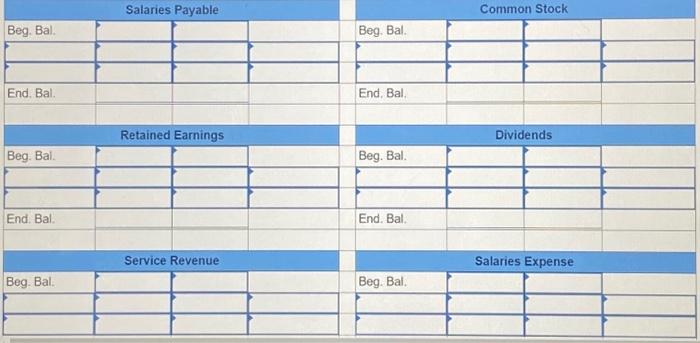

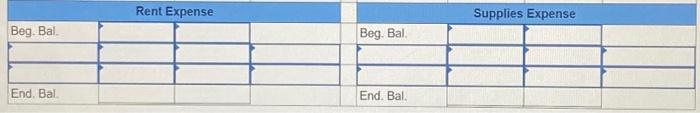

[The following information applies to the questions displayed below.] The following transactions pertain to Smith Training Company for Year 1: Jan. 30 Established the business when it acquired 548 , 00 cash from the issue of common stock. Feb. 1 Paid rent for office space for tio years, $36,0e0 cash. Apr. 10 Purchased $710 of supplies on account. July 1 Received $26, 00e cash in advance for services to be provided over the next year. 20 Paid $533 of the accounts payable from April 10 . Aug. 15 billed a customer 110,300 for services provided during August. Sept.15 completed a job and received $2,50e cash for services rendered. oct. 1 Paid exployee salaries of $36,59cash. 15 Received $8,400 cash from accounts receivable. Nov. 16 Billed customers 535,500 for services rendered on account. Dec. 1 Paid a dividend of $1,4e0 cash to the stockholders. 31 Adjusted records to recognize the services provided on the contract of July 1. 31 Recorded $2,4e of acerued salaries as of December 31. 31 Recorded the rent expense for the year. (See February 1.) 31 Physically counted supplies; $8 was on hand at the end of the period. e. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general Journal and post to the T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the closure of service revenue. Note: Enter debits before credits. Journal entry worksheet Record the closure of expense accounts. Note: Enter debits before credits. Journal entry worksheet Record the closure of the dividends account. Note: Enter debits before credits. \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Rent Expense } & \multicolumn{3}{c|}{ Supplies Expense } \\ \hline Beg. Bal. & & & Beg. Bal. & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & \\ \hline End. Bal. & & & End. Bal. & & & \\ \hline \end{tabular} [The following information applies to the questions displayed below.] The following transactions pertain to Smith Training Company for Year 1: Jan. 30 Established the business when it acquired 548 , 00 cash from the issue of common stock. Feb. 1 Paid rent for office space for tio years, $36,0e0 cash. Apr. 10 Purchased $710 of supplies on account. July 1 Received $26, 00e cash in advance for services to be provided over the next year. 20 Paid $533 of the accounts payable from April 10 . Aug. 15 billed a customer 110,300 for services provided during August. Sept.15 completed a job and received $2,50e cash for services rendered. oct. 1 Paid exployee salaries of $36,59cash. 15 Received $8,400 cash from accounts receivable. Nov. 16 Billed customers 535,500 for services rendered on account. Dec. 1 Paid a dividend of $1,4e0 cash to the stockholders. 31 Adjusted records to recognize the services provided on the contract of July 1. 31 Recorded $2,4e of acerued salaries as of December 31. 31 Recorded the rent expense for the year. (See February 1.) 31 Physically counted supplies; $8 was on hand at the end of the period. e. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general Journal and post to the T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the closure of service revenue. Note: Enter debits before credits. Journal entry worksheet Record the closure of expense accounts. Note: Enter debits before credits. Journal entry worksheet Record the closure of the dividends account. Note: Enter debits before credits. \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Rent Expense } & \multicolumn{3}{c|}{ Supplies Expense } \\ \hline Beg. Bal. & & & Beg. Bal. & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & \\ \hline End. Bal. & & & End. Bal. & & & \\ \hline \end{tabular}