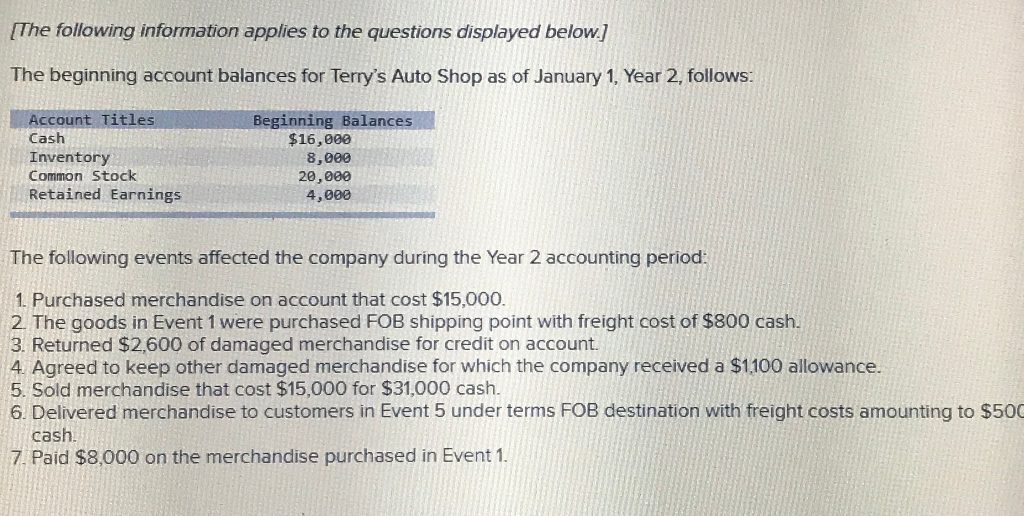

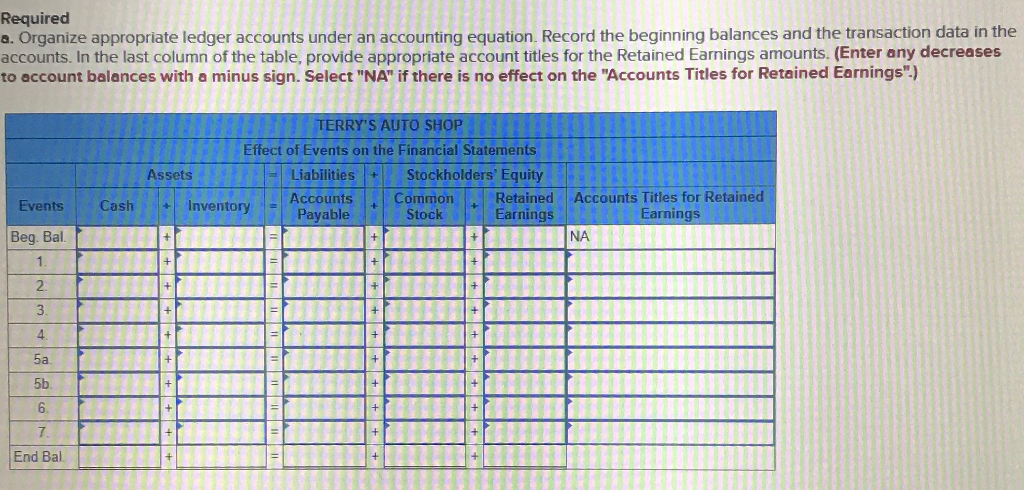

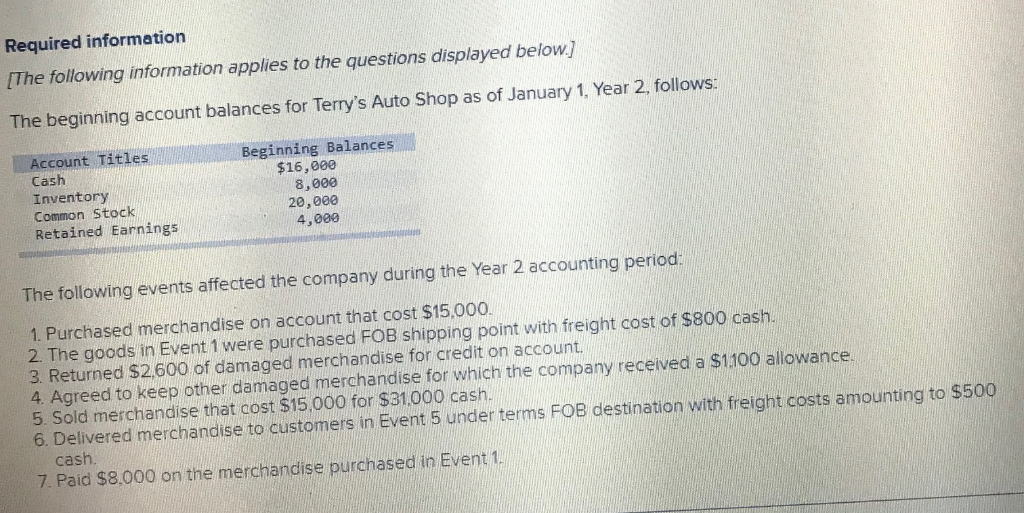

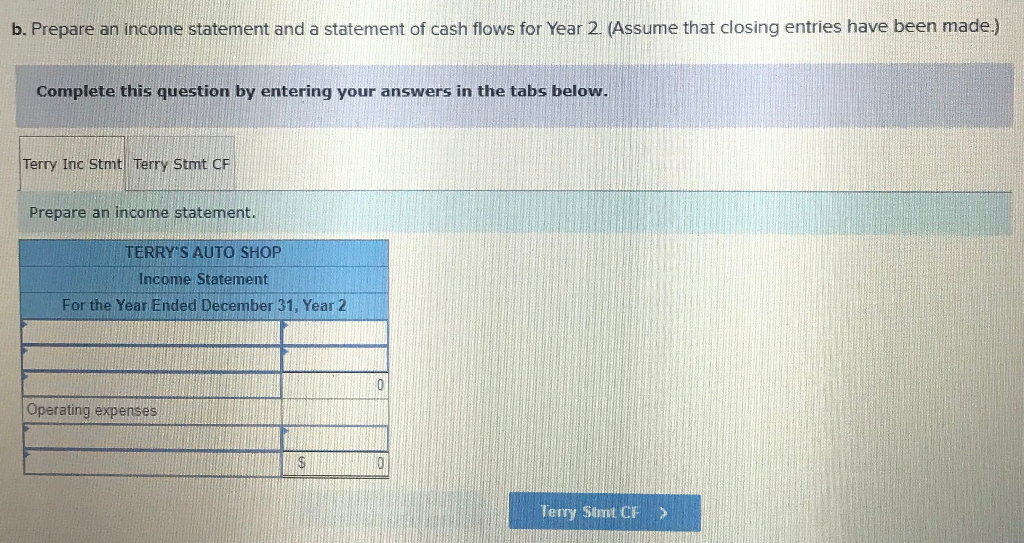

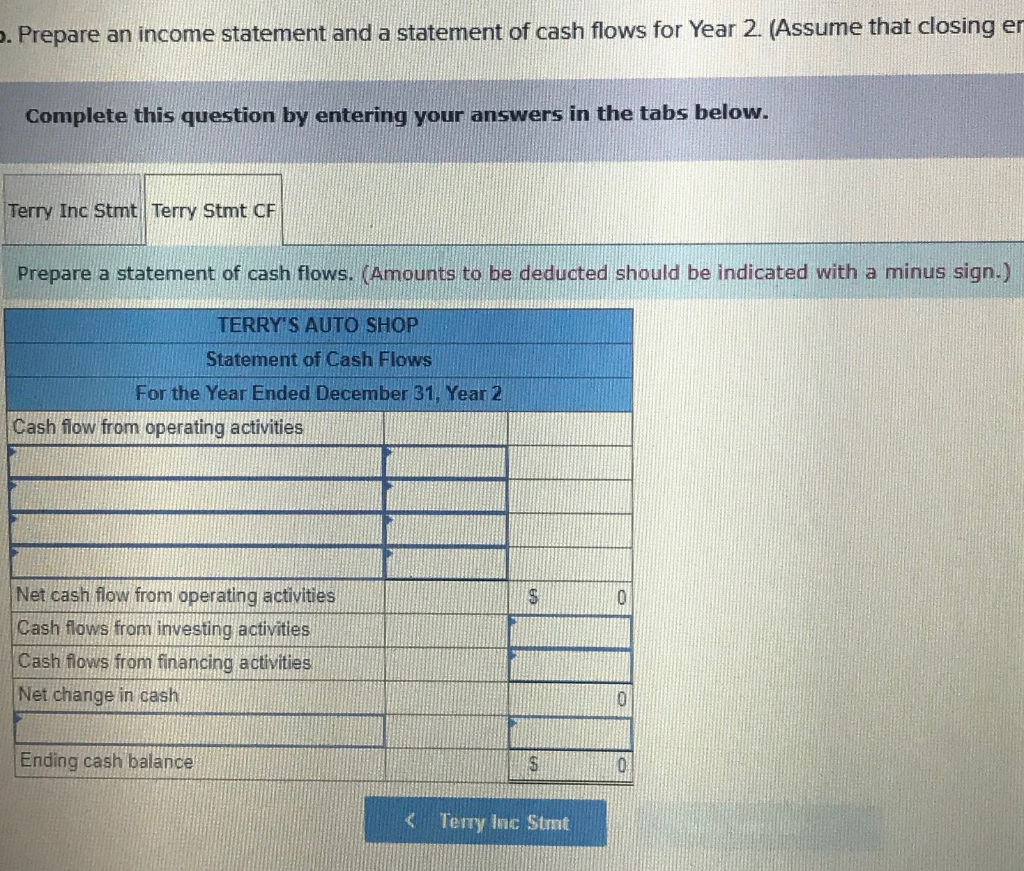

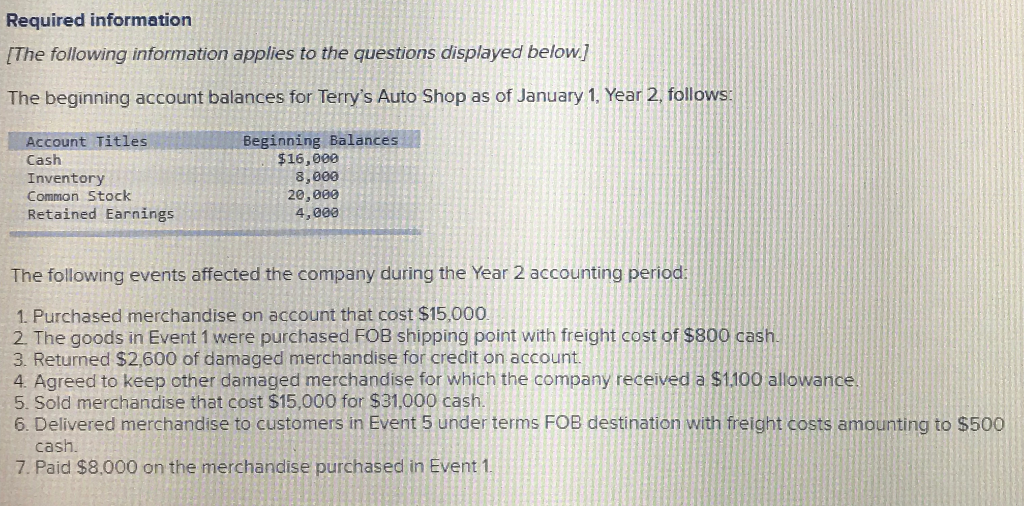

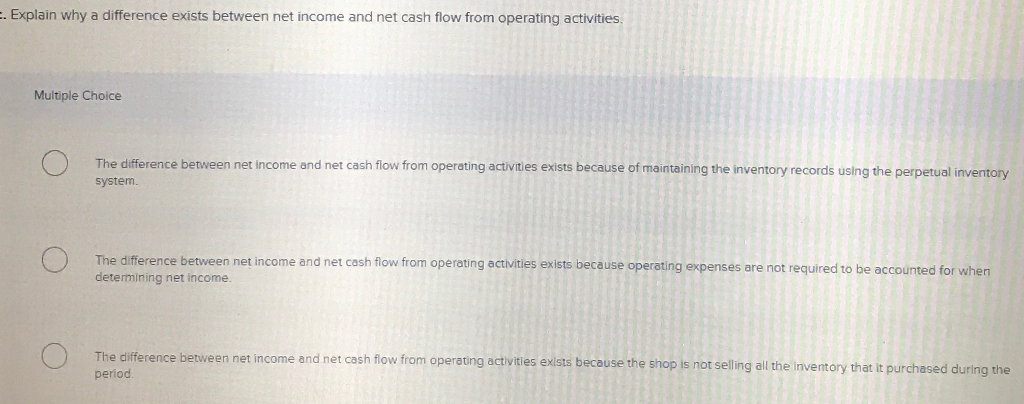

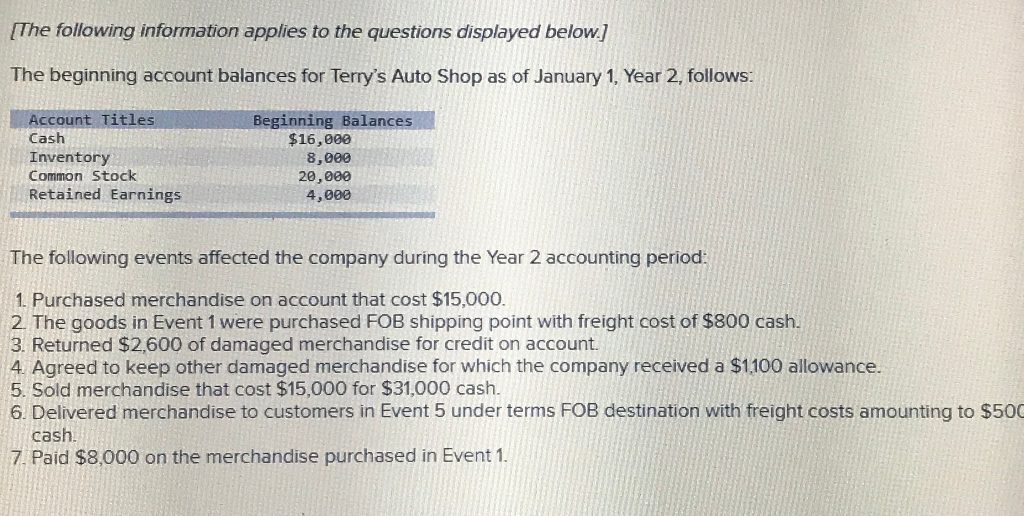

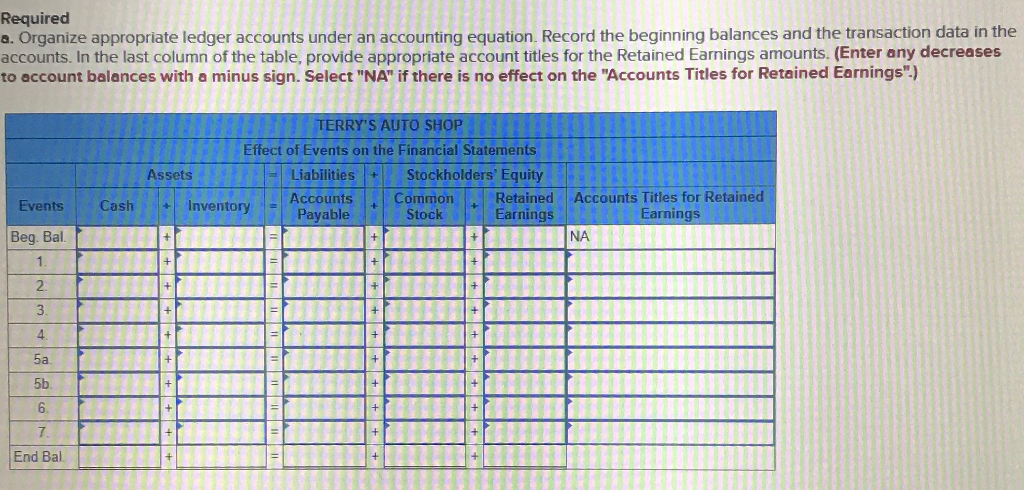

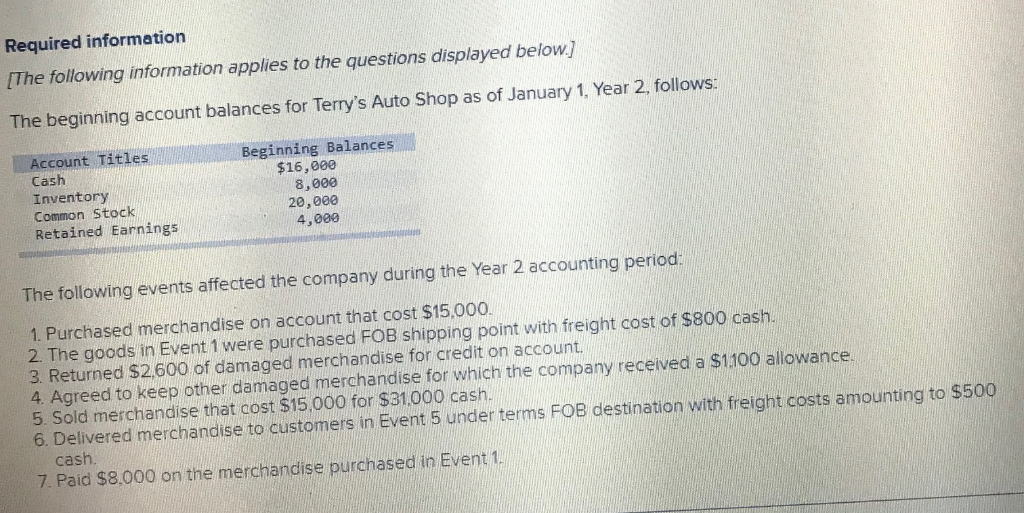

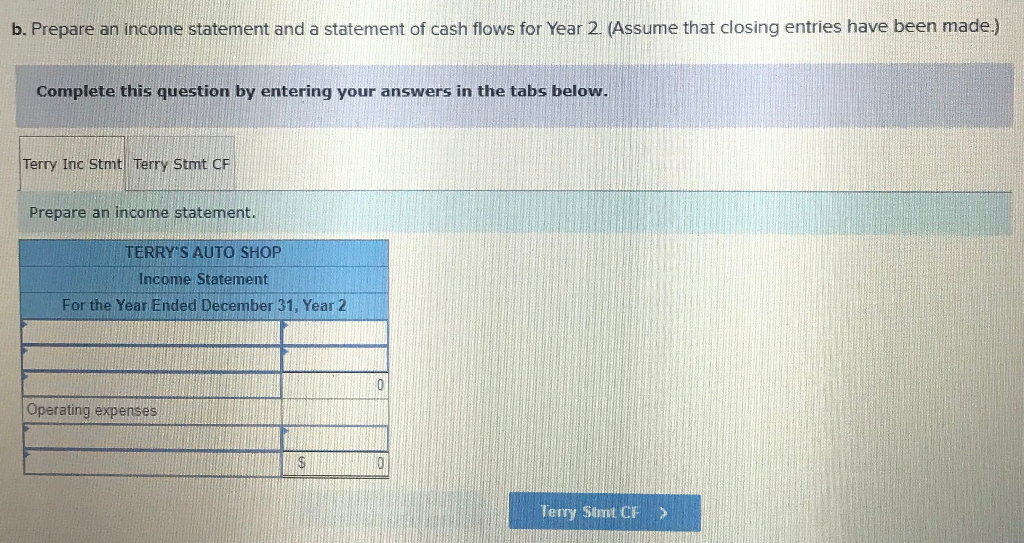

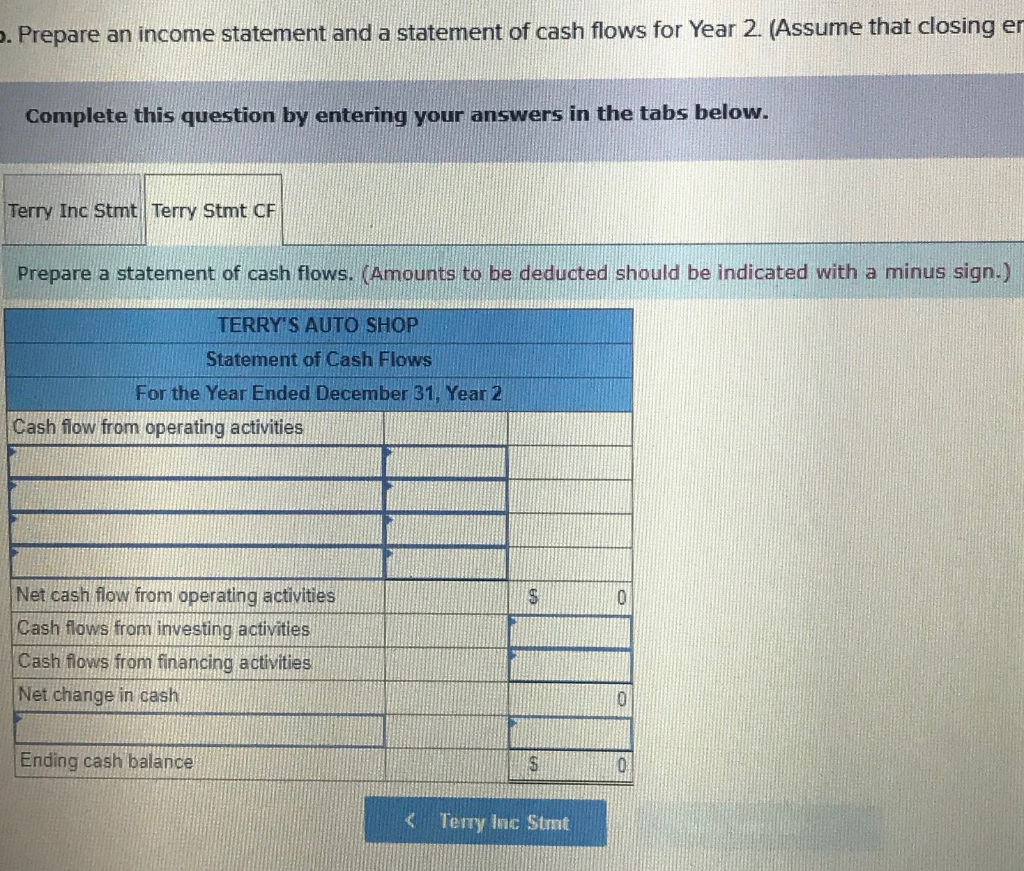

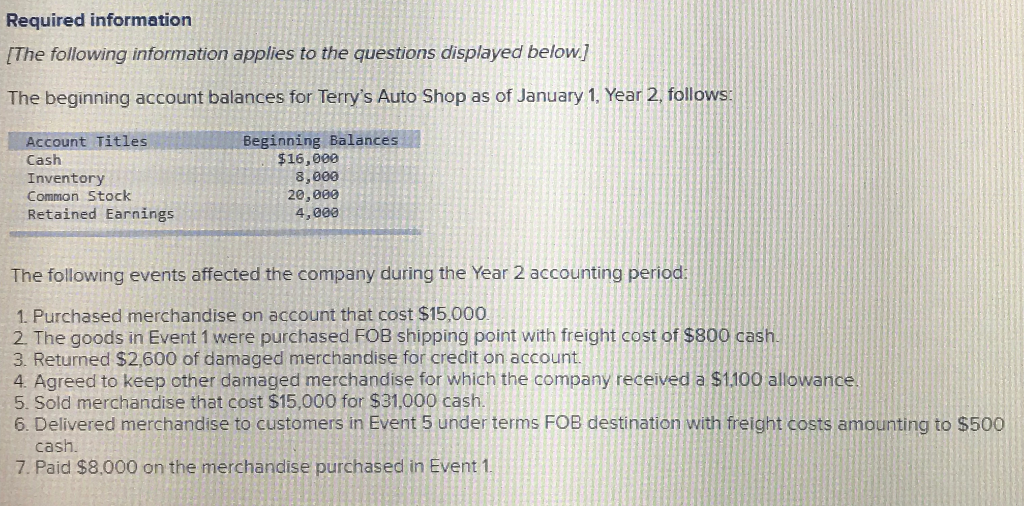

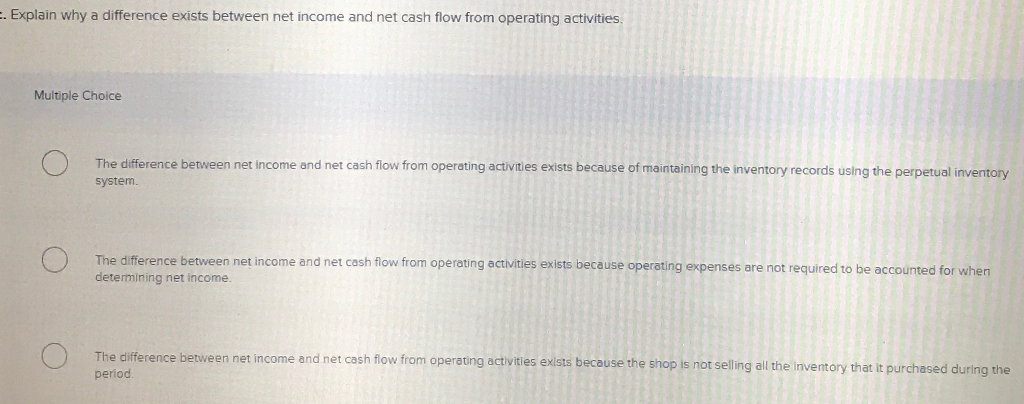

The following information applies to the questions displayed below] The beginning account balances for Terry's Auto Shop as of January 1, Year 2, follows: Account Titles Cash Inventory Common Stock Retained Earnings Beginning Balances $16,000 8,000 20,000 4,000 The following events affected the company during the Year 2 accounting period: 1 Purchased merchandise on account that cost $15,000. 2. The goods in Event 1 were purchased FOB shipping point with freight cost of $800 cash. 3. Returned $2,600 of damaged merchandise for credit on account. 4 Agreed to keep other damaged merchandise for which the company received a $1100 allowance. 5. Sold merchandise that cost $15,000 for $31,000 cash. 6. Delivered merchandise to customers in Event 5 under terms FOB destination with freight costs amounting to $500 cash 7. Paid $8,000 on the merchandise purchased in Event 1. Required a. Organize appropriate ledger accounts under an accounting equation. Record the beginning balances and the transaction data in the accounts. In the last column of the table, provide appropriate account titles for the Retained Earnings amounts. (Enter any decreases to account balances with a minus sign. Select "NA" if there is no effect on the "Accounts Titles for Retained Earnings" TERRY'S AUTO SHOP Effect of Events on the Financial Statements Assets LiabilitiesStockholders Equity Cash InventoryAccounts Payable Common Retained Accounts Titles for Retained Earnings Events Earnings Beg. Bal NA 2. 4 5a. 5b. 6. 7 End Bal Required information [The following information applies to the questions displayed below.] The beginning account balances for Terry's Auto Shop as of January 1, Year 2. follows: Account Titles Cash Inventory Common Stock Retained Earnings Beginning Balances $16,0es 8,000 20,000 4,000 The following events affected the company during the Year 2 accounting period: 1. Purchased merchandise on account that cost $15,000. 2 The goods in Event 1 were purchased FOB shipping point with freight cost of $800 cash. 3. Returned $2,600 of damaged merchandise for credit on account 4. Agreed to keep other damaged merchandise for which the company received a $1100 allowance. 5. Sold merchandise that cost $15 000 for $31,000 cash 6. Delivered merchandise to customers in Event 5 under terms FOB destination with freight costs amounting to $500 cash. 7. Paid $8.000 on the merchandise purchased in Event 1 b. Prepare an income statement and a statement of cash flows for Year 2 (Assume that closing entries have been made) Complete this question by entering your answers in the tabs below. Terry Inc Stmt Terry Stmt CF Prepare an income statement. ERRY'S AUTO SHOP Income Statement For the Year Ended December 31, Year 2 Operating expenses Terry Stmt CF> . Prepare an income statement and a statement of cash flows for Year 2. (Assume that closing er Complete this question by entering your answers in the tabs below. Terry Inc Stmt Terry Stmt CF Prepare a statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.) TERRY'S AUTO SHOP Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flow from operating activities Net cash flow from operating activities Cash flows from investing activities Cash fows from financing activities Net change in cash Ending cash balance KTerry Inc Stmt Required information [The following information applies to the questions displayed below The beginning account balances for Terry's Auto Shop as of January 1. Year 2 follows s: Account Title Cash Beginning Balances $16,000 8,000 20,000 4,000 Inventory Common Stock Retained Earnings The following events affected the company during the Year 2 accounting period: 1. Purchased merchandise on account that cost $15,000 2. The goods in Event 1 were purchased FOB shipping point with freight cost of $800 cash 3, Returned $2,600 of damaged merchandise for credit on account. 4. Agreed to keep other damaged merchandise for which the company received a $1100 allowance. 5. Sold merchandise that cost $15,000 for $31,000 cash. 6. Delivered merchandise to customers in Event 5 under terms FOB destination with freight costs amounting to $500 cash. 7. Paid $8.000 on the merchandise purchased in Event 1 . Explain why a difference exists between net income and net cash flow from operating activities Multiple Choice inventory records using the perpetual inventory system. The difference between net income and net cash flow from operating activities exists because o determining net income en net income and net cash flow from operating activities exists because the shop is not selling all the n period