Answered step by step

Verified Expert Solution

Question

1 Approved Answer

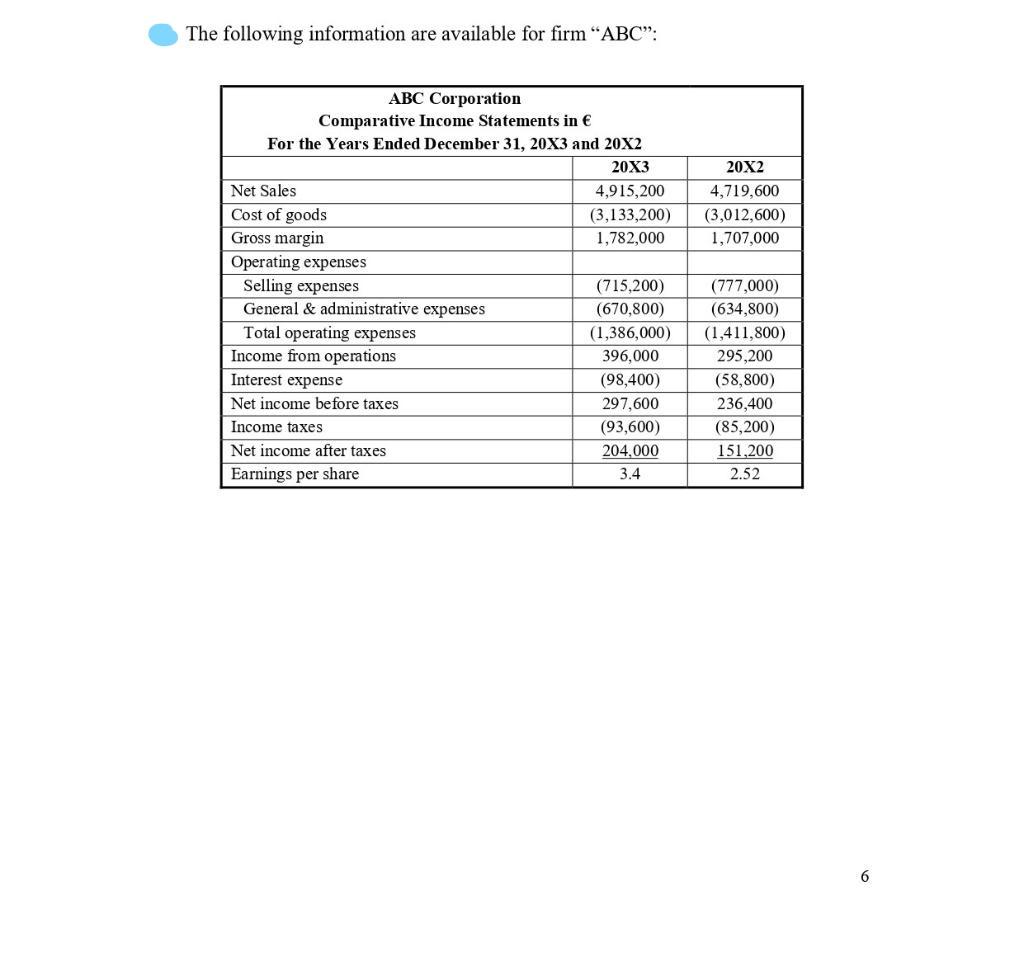

The following information are available for firm ABC: ABC Corporation Comparative Income Statements in For the Years Ended December 31, 20X3 and 20X2 20X3

The following information are available for firm "ABC": ABC Corporation Comparative Income Statements in For the Years Ended December 31, 20X3 and 20X2 20X3 20X2 4,915,200 4,719,600 (3,133,200) (3,012,600) 1,782,000 1,707,000 Net Sales Cost of goods Gross margin Operating expenses Selling expenses General & administrative expenses Total operating expenses Income from operations Interest expense Net income before taxes Income taxes Net income after taxes Earnings per share (715,200) (670,800) (1,386,000) 396,000 (98,400) 297,600 (93,600) 204,000 3.4 (777,000) (634,800) (1,411,800) 295,200 (58,800) 236,400 (85,200) 151,200 2.52 6 Assets Fixed assets: Property. plant and equipment (net) Total fixed assets Current assets: Inventory Accounts Receivable (net) Cash and cash equivalents Total current assets Total assets 20X3 1,687,500 1,125,000 862,200 353,400 121,800 1,337,400 2,462,400 ABC Corporation Comparative Balance Sheets in December 31, 20X3 and 20X2 Liabilities 20X2 1,080,000 1,080,000 892,200 343,800 61,200 1,297,200 2,377,200 Net Capital Expenditures Dividends Paid Common shares Outstanding Stock Price Stockholders' Equity Stockholders' equity: Common stock 10 par value Retained earnings Total equity Long-term liabilities: stockholders' Bonds payable Total long term liabilities Current liabilities: Notes payable Accounts payable Total current liabilities Total liabilities Total liabilities stockholders' equity 20X3 60,000 66,000 60,000 27 & 20X3 600,000 561,000 1,161,000 600,000 20X2 97,500 51,000 60,000 45 600,000 300,000 401,400 701,400 1,301,400 2,462,400 20X2 600,000 461,400 1,061,400 600,000 715,800 1,315,800 1,315,800 2,377,200 Required: 1. Prepare a long-term solvency analysis by calculating for each year the total liabilites-to-equity ratio and the interest coverage ratio. 2. Prepare a market strength analysis by calculating for each year the P/E ratio and the dividends yield. 7 The following information are available for firm "ABC": ABC Corporation Comparative Income Statements in For the Years Ended December 31, 20X3 and 20X2 20X3 20X2 4,915,200 4,719,600 (3,133,200) (3,012,600) 1,782,000 1,707,000 Net Sales Cost of goods Gross margin Operating expenses Selling expenses General & administrative expenses Total operating expenses Income from operations Interest expense Net income before taxes Income taxes Net income after taxes Earnings per share (715,200) (670,800) (1,386,000) 396,000 (98,400) 297,600 (93,600) 204,000 3.4 (777,000) (634,800) (1,411,800) 295,200 (58,800) 236,400 (85,200) 151,200 2.52 6 Assets Fixed assets: Property. plant and equipment (net) Total fixed assets Current assets: Inventory Accounts Receivable (net) Cash and cash equivalents Total current assets Total assets 20X3 1,687,500 1,125,000 862,200 353,400 121,800 1,337,400 2,462,400 ABC Corporation Comparative Balance Sheets in December 31, 20X3 and 20X2 Liabilities 20X2 1,080,000 1,080,000 892,200 343,800 61,200 1,297,200 2,377,200 Net Capital Expenditures Dividends Paid Common shares Outstanding Stock Price Stockholders' Equity Stockholders' equity: Common stock 10 par value Retained earnings Total equity Long-term liabilities: stockholders' Bonds payable Total long term liabilities Current liabilities: Notes payable Accounts payable Total current liabilities Total liabilities Total liabilities stockholders' equity 20X3 60,000 66,000 60,000 27 & 20X3 600,000 561,000 1,161,000 600,000 20X2 97,500 51,000 60,000 45 600,000 300,000 401,400 701,400 1,301,400 2,462,400 20X2 600,000 461,400 1,061,400 600,000 715,800 1,315,800 1,315,800 2,377,200 Required: 1. Prepare a long-term solvency analysis by calculating for each year the total liabilites-to-equity ratio and the interest coverage ratio. 2. Prepare a market strength analysis by calculating for each year the P/E ratio and the dividends yield. 7

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Longterm solvency analysis Solvency analysis examines the ability of ABC Corporation to meet its l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started