Answered step by step

Verified Expert Solution

Question

1 Approved Answer

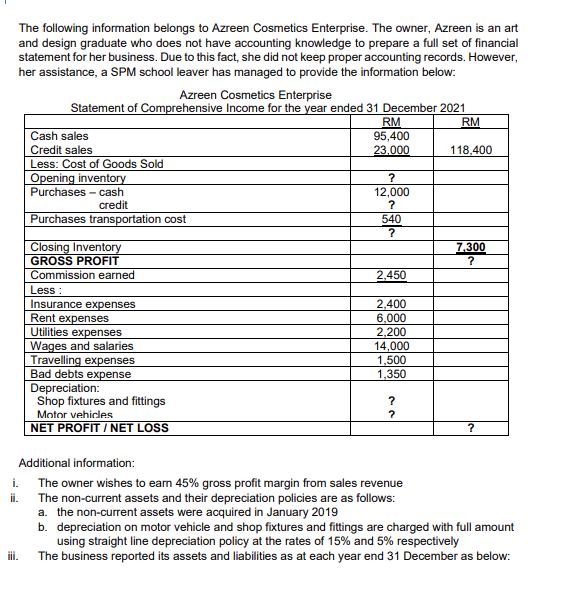

The following information belongs to Azreen Cosmetics Enterprise. The owner, Azreen is an art and design graduate who does not have accounting knowledge to

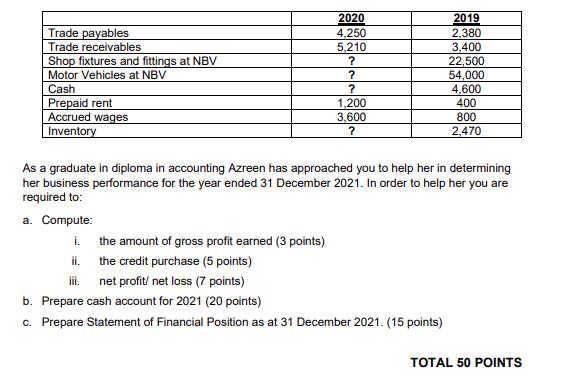

The following information belongs to Azreen Cosmetics Enterprise. The owner, Azreen is an art and design graduate who does not have accounting knowledge to prepare a full set of financial statement for her business. Due to this fact, she did not keep proper accounting records. However, her assistance, a SPM school leaver has managed to provide the information below: Azreen Cosmetics Enterprise Statement of Comprehensive Income for the year ended 31 December 2021 RM i. ii. Cash sales Credit sales Less: Cost of Goods Sold Opening inventory Purchases - cash credit Purchases transportation cost Closing Inventory GROSS PROFIT Commission earned Less : Insurance expenses Rent expenses Utilities expenses Wages and salaries Travelling expenses Bad debts expense Depreciation: Shop fixtures and fittings Motor vehicles NET PROFIT / NET LOSS RM 95,400 23,000 ? 12,000 ? 540 ? 2,450 2,400 6,000 2,200 14,000 1,500 1,350 ? ? Additional information: The owner wishes to earn 45% gross profit margin from sales revenue The non-current assets and their depreciation policies are as follows: a. the non-current assets were acquired in January 2019 118,400 7,300 ? ? b. depreciation on motor vehicle and shop fixtures and fittings are charged with full amount using straight line depreciation policy at the rates of 15% and 5% respectively The business reported its assets and liabilities as at each year end 31 December as below: Trade payables Trade receivables Shop fixtures and fittings at NBV Motor Vehicles at NBV Cash Prepaid rent Accrued wages Inventory 2020 4,250 5,210 ? ? ? 1,200 3,600 ? the amount of gross profit earned (3 points) the credit purchase (5 points) net profit/ net loss (7 points) 2019 2,380 3,400 22,500 54,000 4,600 400 As a graduate in diploma in accounting Azreen has approached you to help her in determining her business performance for the year ended 31 December 2021. In order to help her you are required to: a. Compute: i. ii. iii. b. Prepare cash account for 2021 (20 points) c. Prepare Statement of Financial Position as at 31 December 2021. (15 points) 800 2,470 TOTAL 50 POINTS

Step by Step Solution

★★★★★

3.59 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER A 1 calculation of gross profit earned Gross Profit 11840...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started